MFS providers see surge in utility payments

Utility bill payments through mobile financial service (MFS) providers crossed the Tk 2,000-crore mark in June, underscoring the growing preference among users to make payments from the comfort of their homes.

Electricity, water, gas and other service payments through MFS soared to Tk 2,059 crore in June, up 41.11 per cent from Tk 1,459.1 crore during the same month last year, according to the latest data of the Bangladesh Bank.

On a month-on-month basis, utility payments through MFS rose 17.28 per cent from May to June.

The upsurge in payments of this segment is mainly due to the various perks of using MFS.

For example, Kawsar Ahmed, who lives in Mirpur, says he previously had to go through a great deal of trouble to pay utility bills.

"But it is now super easy to pay them through MFS as I can download my bill statement whenever I want from the app."

According to a recently published World Bank study, titled "The Global Findex Database 2021", about 25 per cent of adults in Bangladesh directly pay their utilities from either a bank or MFS account – the highest share in the South Asian region.

Around 11 per cent of adults in the region pay utilities directly from an account.

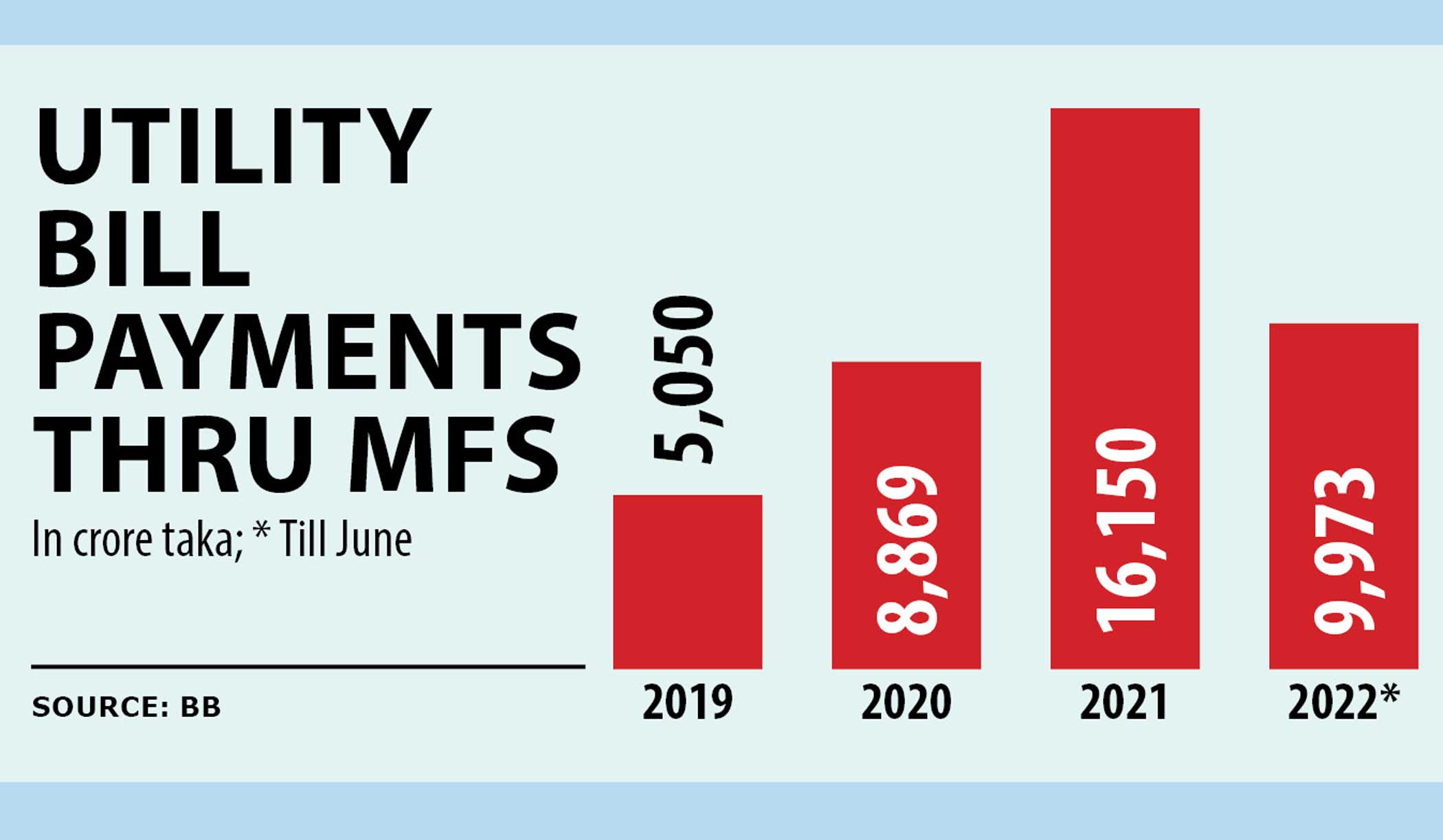

Covid-19 has greatly boosted bank and MFS account usage for paying utility bills in Bangladesh, where transactions in the segment were below Tk 500 crore per month in the pre-pandemic era.

Industry people say the volume of such transactions has been increasing rapidly over the years due to the growing number of customers who rely on MFS for everything from fund transfers to bill payments.

In addition to traditional utility bills, customers are also paying for internet, telephone and cable services through MFS.

BKash, the country's top MFS company, registered phenomenal growth in the utility bill segment in recent times. As such, more than one crore utility bill payments are being made each month through bKash.

"Users can save all their billing information on the bKash app, making future bill payments more convenient," said Ali Ahmmed, chief commercial officer of bKash.

"Users can also check their bills through bKash and eco-friendly digital receipts can be downloaded after payment. Receipts of all bill payments of the last one year are also available on the respective customer's bKash app."

In addition, the MFS provider's 6.3 crore registered users can seamlessly "Add Money" to their bKash account from an account with any of 37 commercial banks in the country.

"After receiving money in their bKash account, customers can do almost all day-to-day financial transactions, including utility bill payments, through bKash Wallet," said Ahmmed.

Muhammad Zahidul Islam, head of communication at Nagad Ltd, said the company has promoted utility bill payments through its app by facilitating such transactions without charges.

"We believe we have played an important role in this segment and other players are now also starting to offer free of cost utility bill payments following our policy," he added.

Nagad had about 6.4 crore active customers with a daily average transaction of more than Tk 700 crore in June.

Zahedul Islam, head of corporate communications and external affairs at Upay, another MFS provider, said they have inked deals with several electricity and gas companies to facilitate payments.

In Bangladesh, 13 platforms currently provide the service to 17.86 crore customers. However, industry people said the number of active customers is far less.

Overall transactions through MFS increased by 19.89 per cent year-on-year to Tk 94,293 crore in June while the growth was 23 per cent month-on-month.

In the month, MFS customers also carried out about Tk 27,419 crore worth of cash-in transactions, Tk 26,692 crore cash-out transactions, Tk 24,520 crore person-to-person transactions, Tk 3,126 crore merchant payments, Tk 3,508 crore government-to-person transactions, Tk 3,264 crore salary disbursements, and Tk 797.5 crore talk time purchases.

"MFS transactions usually see an upward trend during festivals. Besides, the Bangladesh Bank earlier relaxed the transaction limit for MFS and that may have had an impact on the rising transaction volume," Zahedul said.

Zahidul of Nagad said they are now focusing on boosting payments through MFS as they are providing cash-back and discounts.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.