Bad loans

Banks’ CSR spending drops as bad loans surge

Corporate social responsibility (CSR) spending by Bangladesh’s banks nearly halved in the first half of 2025 amid rising bad loans, according to Bangladesh Bank’s (BB) half-yearly report on CSR activities of scheduled banks and non-bank financial institutions.

17 September 2025, 18:00 PM

Distressed loans surge to Tk 7.56 lakh cr

Banking sector's asset quality declines as distressed loans balloon to Tk 7.56 lakh crore

19 August 2025, 18:11 PM

Audits expose hidden bad loans at 6 Islamic banks

The reviews, initiated in January with backing from the ADB, expose deep-seated financial mismanagement at those banks

20 July 2025, 18:16 PM

21 banks bucked rising bad loan trend in 2024

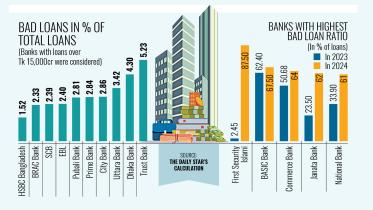

Twenty-one banks managed to keep their bad loan ratios under 5 percent of their total lending, even amid turbulence last year that rattled the sector and eventually pushed up the industry average of bad loans to 16.8 percent.

3 July 2025, 19:51 PM

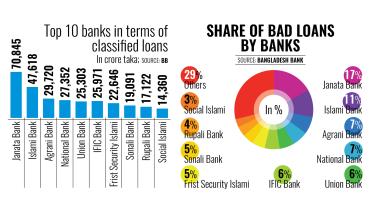

Ten banks hold 71% of total bad loans

Just ten banks, both state-owned and private, account for 71 percent of all non-performing loans (NPLs) in the country’s banking sector.

17 June 2025, 18:00 PM

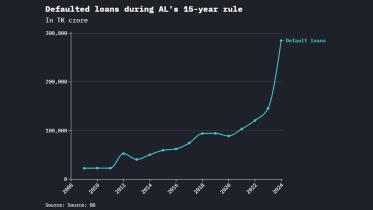

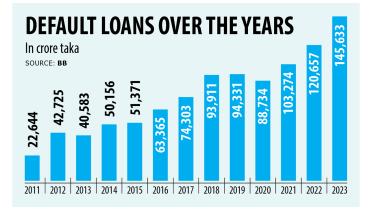

A staggering increase in default loans

Central bank must strive to improve banking sector’s health

17 June 2025, 10:00 AM

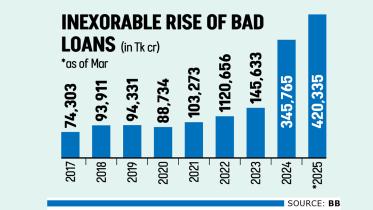

Bad loans hit record Tk 420,355cr

Bad loans in Bangladesh’s banking sector hit a record Tk 420,335 crore at the end of March as a clearer picture of the toxic loan is coming to light following the political changeover in August last year.

15 June 2025, 18:10 PM

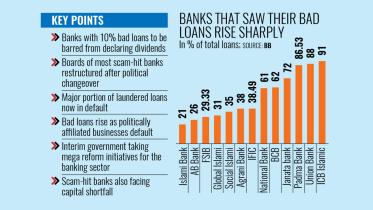

Bad loans at scam-hit banks surge after political changeover

At the end of last year, defaulted loans in the banking sector stood at Tk 345,765 crore, with those state-run and private commercial banks holding the majority.

18 March 2025, 18:00 PM

What does high default loan mean for the economy?

At the end of 2024, one-fifth of the total loans in the banking sector turned sour, mainly as the true extent of embezzlement by willful defaulters is now coming to light.

1 March 2025, 18:00 PM

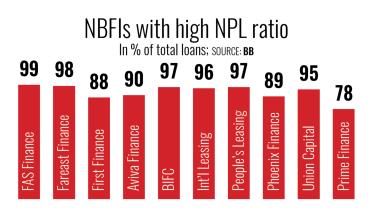

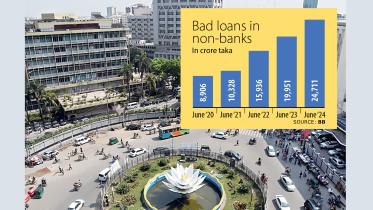

NBFIs’ bad loans surge to record Tk 26,163cr

Defaulted loans at the country’s non-bank financial institutions (NBFIs) reached a record 36 percent of all loans disbursed by them as of September 2024, a level that sector people described as a reflection of “massive irregularities and scams” seven to eight years ago.

6 January 2025, 18:00 PM

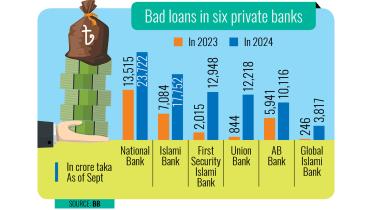

Six private banks see bad loans nearly triple in a year

Defaulted loans at six private commercial banks nearly tripled in one year till September 2024, according to central bank data, which bankers term “alarming”.

17 December 2024, 18:00 PM

State sponsored dis-equalising factors

The state itself had deepened inequality as it “sponsored dis-equalising factors”, exempting corporations from taxes and helping banks with liquidity for years on end only to benefit the elite, said Prof Rehman Sobhan, chairman of the Centre for Policy Dialogue, yesterday.

7 December 2024, 19:28 PM

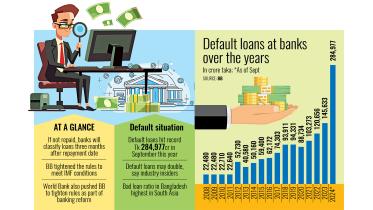

BB tightens loan classification rules to meet IMF conditions

Payment failure for three months or 90 days after the due date will now lead to classification of loans regardless of type, according to new rules announced by the central bank yesterday, aligning with international best practices prescribed by the International Monetary Fund (IMF).

27 November 2024, 18:00 PM

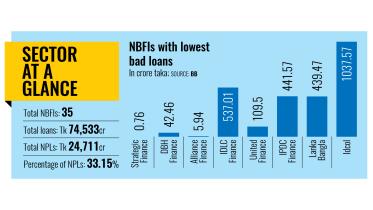

How some non-banks tamed bad loans

When most non-bank financial institutions (NBFIs) in Bangladesh are in hot water with high ratios of non-performing loan (NPL), a handful have been successfully able to keep the rate low.

20 November 2024, 18:00 PM

Bad loans hit alarming record

Awami League-affiliated businesses had already put the country’s banking sector in trouble with huge bad debts, but the loans disbursed through irregularities to these companies turned sour even at a more alarming pace after the party’s ouster.

17 November 2024, 18:40 PM

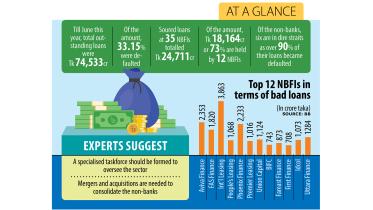

A third of NBFIs hold over 73% of bad loans

Twelve non-bank financial institutions (NBFIs) out of a total 35 are holding nearly 73.5 percent of the sector’s bad loans, according to Bangladesh Bank data, reflecting a precarious situation at those entities.

5 November 2024, 18:00 PM

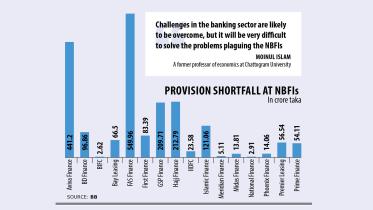

16 NBFIs face total provision shortfall of Tk 1,954cr

Sixteen non-bank financial institutions (NBFIs) faced a combined provision shortfall of Tk 1,954 crore till June this year, reflecting that their financial health had worsened.

13 October 2024, 18:00 PM

Non-banks’ default loans hit record high

Non-bank financial institutions (NBFIs) in the past fiscal year saw their defaulted loans reach a record 33.15 percent of all disbursed loans, according to the central bank, indicating a fragile situation in the sector thanks to widespread loan irregularities and scams.

6 October 2024, 18:00 PM

Politically-motivated lending causing bad loans to spiral: WB

The amount of bad loans has been spiralling in Bangladesh owing to rampant politically-motivated lending and inadequate credit risk management, according to a World Bank report.

29 July 2024, 18:00 PM

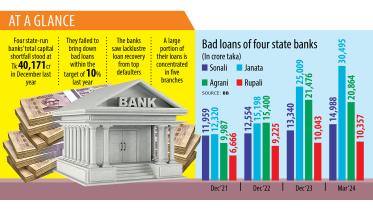

State banks nowhere near target to retrieve funds from top defaulters

Four state-run banks in Bangladesh are finding it difficult to recoup loans from their top 20 defaulters, a failure that has worsened their financial health and squeezed their capacity further to lend.

9 July 2024, 18:00 PM