Loan default

RMG, textile: Top export sectors among major loan defaulters

Bangladesh Bank report shows RMG and textiles as major loan defaulters; small firms suffer

23 September 2025, 18:00 PM

We need a bank commission that can drive radical reforms

But its objectives must be clearly defined and regularly scrutinised

20 August 2024, 15:00 PM

Sonali Bank asked to show Orion’s loan as defaulted

The Bangladesh Bank instructed state-run Sonali Bank to classify the Tk 106 crore loans taken by Orion Infrastructure Ltd as defaulted since the client repeatedly failed to repay on time.

18 August 2024, 18:00 PM

$600m loans from EDF turn sour

Loans amounting to nearly $600 million, or Tk 7,000 crore, disbursed from the Export Development Fund (EDF), which was formed based on the country’s foreign exchange reserves, have been defaulted, according to a Bangladesh Bank (BB) document.

13 August 2024, 18:00 PM

$600 million taken in loans from Export Development Fund defaulted

Dhaka-based firms defaulted most of the amount at $558.7 million and Chattogram-based ones $29.7 million

13 August 2024, 08:26 AM

We must kickstart economic revival

There are many hurdles to overcome in the coming days

7 August 2024, 06:00 AM

Regulators responsible for the ailing banks

Punish wilful defaulters before banks’ health further deteriorates

11 March 2024, 18:01 PM

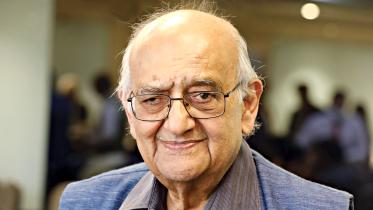

Loan default now part of business model

Defaulting on loans is progressively becoming part of the business model to stay competitive, said Rehman Sobhan, chairman of the Centre for Policy Dialogue.

24 February 2024, 18:00 PM

Government must choose citizens over oligarchs

Otherwise, banking sector health will continue to deteriorate

24 December 2023, 10:52 AM

The Bangladeshi model of dealing with bank crises

The growth of bad loans is mainly due to the business-politics nexus, lack of corporate governance, and weak judicial system

3 October 2023, 14:00 PM

Don’t fall for quick fixes in bank sector

Relaxing loan repayment is unlikely to work if habitual defaulters continue to be tolerated

21 June 2023, 12:10 PM

Overflow of non-performing loans

Time for govt to change its policy towards habitual defaulters

14 May 2023, 12:00 PM

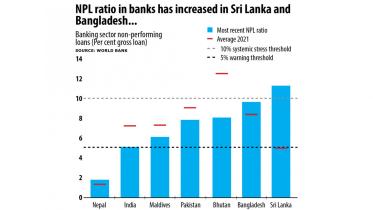

Bangladesh 2nd in South Asia in bad loan ratio

Bangladesh’s banking sector has the second-highest ratio of non-performing loans (NPL) among the countries in South Asia as lenders continue to face multiple challenges emanating from scams, a lack of corporate governance and borrowers’ growing reluctance to make instalments regularly.

13 May 2023, 18:00 PM

The ongoing economic peril and our plundered future

'Lunthito Bhabishyat: Bangladesher Arthanoitik Shonkoter Chalchitra' gives an overview of Bangladesh's current economic crisis.

9 March 2023, 14:00 PM

We got less than what we borrowed

Several farmers, accused of defaulting on loans in Pabna, have said they became victims of fraudulent activities when they took the loans from Bangladesh Samabaya Bank.

6 December 2022, 01:20 AM

Destroying the economy to save the thieves

An unholy nexus of powerful people are protecting those who've stolen thousands of crores.

4 December 2022, 15:00 PM

Taking loans v tackling laundering: Which serves our long-term interests best?

Fighting tax evasion, preventing trade-based illicit financial outflows and ending the culture of money laundering and loan defaults is a much more sustainable solution to adding to foreign exchange reserves than taking foreign loans on interest.

3 August 2022, 15:00 PM

Bangladesh Bank revises post import financing policy

The Bangladesh Bank today revised its policy for post import financing (PIF) in order to give clarification to banks as importers have faced complexities to get fund properly.

26 April 2022, 14:03 PM

Curbing Loan Default: ‘Match-fixing’ in govt measures

The government seems to lack the will to arrest bad loans and restore corporate governance in the banking sector with the habitual defaulters working the system, analysts said.

12 October 2019, 18:00 PM

Bad loans put Janata in trouble

State-run Janata Bank’s provisioning shortfall has hit a whopping Tk 8,256 crore, the highest-ever deficit for any bank in the country, putting depositors’ money at risk.

23 July 2019, 18:00 PM