non-performing loans (NPLs) in Bangladesh

Why are IMF policies failing to stabilise our economy?

Why does macroeconomic instability continue to plague Bangladesh even after partnering with the IMF?

27 May 2024, 05:00 AM

Will merger help solve the weaker banks’ problems?

Merger takes place when two or more companies combine together to strengthen capital base and asset size.

12 February 2024, 02:00 AM

Six private banks’ bad loans soar 55pc in nine months

Bad loans in six private banks increased by about 55 percent in the first nine months of the year, raising further alarms about the health of the banking sector.

22 November 2023, 18:00 PM

Bad loans rise in private banks, but drop in state banks

Overall, banking sector's non-performing loans fall slightly

21 November 2023, 14:56 PM

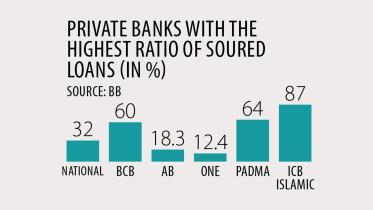

25 banks keep NPLs below 5%

With the high rate of non-performing loans (NPLs) being a major challenge for the banking sector, just 25 of the 61 commercial banks in Bangladesh are managing to keep their NPL rates below 5 percent.

11 October 2023, 00:30 AM

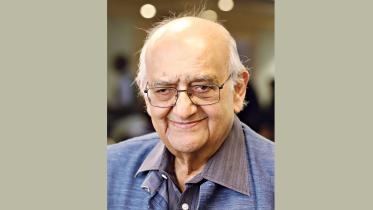

Falling reserve, rising bad loans worrying

The falling foreign exchange reserves and the ever-rising defaulted loans are very concerning for the economy, and the government should respond fast to avoid a looming crisis, eminent economist Prof Rehman Sobhan said yesterday.

9 October 2023, 18:00 PM

Big rise in 10 banks’ bad loans

The defaulted loans in 10 banks, including four state-run lenders, increased at an alarming rate in fiscal 2022-23, indicating their worsening financial health.

7 October 2023, 18:00 PM

Default loans hit an all-time high

Non-performing loans (NPLs) in Bangladesh’s banking sector hit a new record in June as withdrawal of a relaxed central bank policy, slowdown in business sales and deliberate non-payments pushed up the volume of bad loans to Tk 1,56,039 crore, central bank data showed.

2 October 2023, 00:00 AM

Default loans reach record Tk 1.56 lakh crore

The bad loans rose by Tk 24,419 crore in the last three months to June

1 October 2023, 14:20 PM

Banking sector reform can no longer be delayed

To better understand corporate default risks, generate more data and produce greater information

10 September 2023, 00:00 AM