NPL

Default loan reaches record high of Tk 2.85 lakh crore

This accounts for around 17 percent of total outstanding loans.

17 November 2024, 10:24 AM

Politically-motivated lending must stop

Despite repeated warnings, no effective measures have been taken to rectify the poor governance.

31 July 2024, 05:00 AM

High bad loans a 'big threat' to financial sector: BB

The central bank said in quarterly review on money and exchange rate

28 March 2024, 14:30 PM

Bad loan ratio rises to 9% in 2023

The default loan ratio in the banking sector of Bangladesh rose to 9 percent in 2023 from 8.16 percent a year ago

12 February 2024, 11:23 AM

Which banks have lowest non-performing loans in Bangladesh?

13 have NPL below 3%, much lower than the sectoral ratio of 8%

10 July 2023, 15:33 PM

Don’t fall for quick fixes in bank sector

Relaxing loan repayment is unlikely to work if habitual defaulters continue to be tolerated

21 June 2023, 12:10 PM

How DBH managed to keep its NPLs so low

While a number of banks and non-bank financial institutions (NBFIs) are struggling to rein in their non-performing loans (NPL), DBH Finance PLC has continued to maintain the lowest NPL to loan ratio in the industry for years.

24 May 2023, 02:30 AM

Overflow of non-performing loans

Time for govt to change its policy towards habitual defaulters

14 May 2023, 12:00 PM

Interest cap, NPLs did more damage than Covid, war

The business sector in Bangladesh has been going through severe challenges for the past four years, which, for many, have been the toughest period in decades, with the coronavirus pandemic being the dominant factor in the early part before the Russia-Ukraine war broke out. Today, we are running the second report of a series to present how various sectors fared in the face of the two unprecedented shocks.

10 April 2023, 02:00 AM

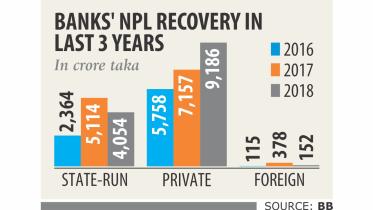

Recovery fails to keep pace with default loan spike

The pace of recovery of banks' nonperforming loans (NPL) was much lower than the rate at which their NPL increased last year -- an ominous development for the sector.

30 March 2019, 18:00 PM