NPLs

‘Recovery of NPLs overseas will strengthen Bangladesh’s banking sector’

Wieger Wielinga, managing director of Omni Bridgeway, speaks with The Daily Star breaking down the concept of litigation funding.

5 June 2025, 04:00 AM

What to expect from Bangladesh economy in 2024

The year 2023 was indeed one of the most difficult ones in the recent history of Bangladesh in terms of economic performance.

1 January 2024, 02:02 AM

What’s really causing our non-performing loans to skyrocket?

It is alleged that a group of politically-connected people took out large loans from state-owned commercial banks (SOCBs) and intentionally defaulted on them.

17 October 2023, 02:00 AM

Banking sector reform can no longer be delayed

To better understand corporate default risks, generate more data and produce greater information

10 September 2023, 00:00 AM

Non-performing loans: Are we aware of the real picture?

It is necessary to get an appropriate estimate of NPLs so that the actual performance of the banking sector can be understood.

28 August 2023, 02:00 AM

Banks’ profits hit by lower income from forex market

The combined profits of 35 listed banks in Bangladesh dropped 9 percent year-on-year to Tk 4,160 crore during the first half of 2023 as volatility in the country’s foreign exchange market has curbed their commissions from forex dealings.

6 August 2023, 00:00 AM

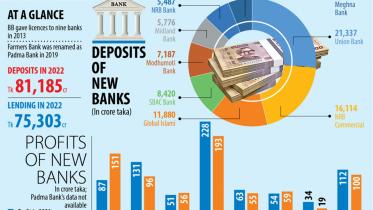

How new banks are faring after a decade

The government awarded licences to set up new nine banks in 2013 despite criticism from analysts and economists and initial reservations from the central bank since the number of lenders was already high in Bangladesh and approvals were largely given on political consideration.

20 July 2023, 01:00 AM

Will it do more harm than good?

It seems there exists a nexus among the policymakers, bank directors, and defaulters which facilitates the process of swindling depositors’ money.

10 July 2023, 17:00 PM

Banking sector holding the economy hostage

Comprehensive reforms needed to boost investment, sustain growth

30 September 2022, 11:29 AM

Default loan rescheduling falls to 7-year low

Rescheduling of default loans fell to a seven-year low in 2021, riding on a moratorium extended by the Bangladesh Bank to protect borrowers from the economic shocks arising from the coronavirus pandemic.

25 April 2022, 18:00 PM