When central bank breaches own rules

In an ominous sign, the central bank has flouted its own rules when it permitted Aviva Finance Ltd to open five more branches although the financial health of the non-bank financial institution has been in a bad shape.

16 November 2021, 18:00 PM

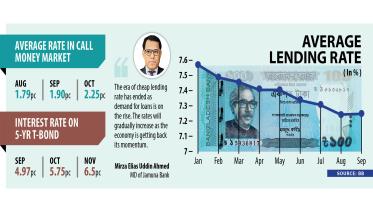

Are the days of cheap loans over?

Up until July this year, firms had been able to borrow at unprecedented lower interest rates as the cost of funds declined amid business slowdown.

13 November 2021, 18:00 PM

Forex reserve drops to $45b

The country’s foreign exchange reserve has declined to $45.06 billion, mainly due to high import payments and a downward trend of remittances.

11 November 2021, 18:00 PM

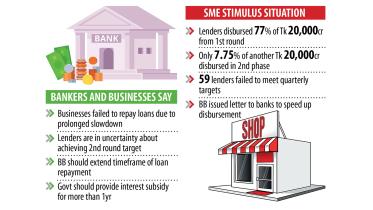

Lending dismal under second stimulus package

Banks in Bangladesh are less keen on giving out loans under the second round of stimulus packages as many clients are in trouble to pay off their current debts, a development that may hurt the economic recovery.

9 November 2021, 18:00 PM

Union Capital barred from giving loans over Tk 1cr

The Bangladesh Bank yesterday ordered Union Capital Ltd not to disburse any loans exceeding Tk 1 crore after the non-bank financial institution repeatedly failed to repay depositors despite their funds reaching maturity.

3 November 2021, 18:00 PM

Remittance flow shrinks further

The flow of remittance to Bangladesh shrank further in October as money transfers through informal channels such as hundi might have returned with the ease of pandemic restrictions.

1 November 2021, 18:00 PM

Remittance flow shrinks further

The flow of remittance to Bangladesh shrank further in October as money transfers through informal channels such as hundi might have returned with the ease of pandemic restrictions. Expatriate Bangladeshis sent $1.65 billion in October, down 4.6 per cent from one month earlier and 21.7 per cent year-on-year, according to data from Bangladesh Bank.

1 November 2021, 15:57 PM

Liquidity crunch looms as imports, credit demand on the rise

Banks will come under a liquidity crunch within three to six months due to an escalation of import financing and a rising demand for loans from businesses as the economy returns to normalcy, warned several top executives yesterday.

31 October 2021, 18:00 PM

Covid takes a toll on female employment rate in banks

The coronavirus pandemic has taken a toll on female employment rate in Bangladesh’s banking sector, causing it to fall alarmingly in the first half of this year.

30 October 2021, 18:00 PM

FDI inflow rises marginally

Foreign direct investment to Bangladesh rose 6 per cent year-on-year to $2.51 billion in the last fiscal year, continuing the recent trends whereas peer countries secured a higher level of investment from external investors.

24 October 2021, 18:00 PM

Small businesses struggle to repay stimulus loans

Lenders are failing to implement the second phase of the stimulus package for the CMSME sector as clients struggle to repay the loans secured under the first round.

23 October 2021, 18:00 PM

Farm loan disbursement rises in Jul-Sep

Farm loan disbursement grew 11 per cent year-on-year to Tk 5,210 crore in the first three months of this fiscal year as banks are now giving out funds to diversified arenas in the agriculture sector.

19 October 2021, 18:00 PM

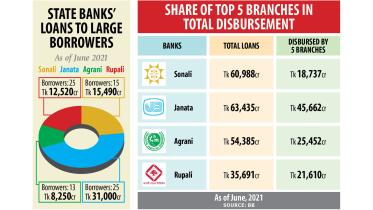

Banks hold on to a few borrowers despite risks

State banks in Bangladesh are maintaining an elevated level of loan concentration among a handful of clients, putting their own financial health and the interest of depositors at grave risk.

12 October 2021, 18:00 PM

IMF cuts growth forecast to 6.5pc

The International Monetary Fund yesterday cut the economic growth forecast for Bangladesh to 6.5 per cent for the current fiscal year from its April projection of 7.5 per cent.

12 October 2021, 18:00 PM

State banks far away from targets

The Bangladesh Bank yesterday ordered four state banks to speed up cash recovery from defaulters as their record in realising delinquent loans has remained dismal.

11 October 2021, 18:00 PM

Import bills surpass pre-pandemic levels

Import payments surged in Bangladesh in the first two months of the current fiscal year to go past the pre-pandemic levels, a sign of strong economic recovery in keeping with a sharp fall in coronavirus infections.

9 October 2021, 18:00 PM

Bangladesh Bank on dollar selling spree to keep taka steady

The foreign exchange regime has made an about-face in the last two months as the Bangladesh Bank continues to inject US dollars (USD) into the market to halt the depreciation of the local currency and meet the growing appetite of the economy.

5 October 2021, 18:00 PM

Nagad’s interim licence gets fourth extension

The Bangladesh Bank yesterday renewed the interim licence of Nagad for another six months as the Bangladesh Post Office (BPO) has failed to form a subsidiary to run the mobile financial service.

30 September 2021, 18:00 PM

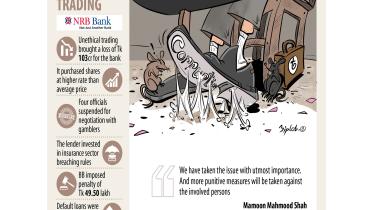

2 more banks fined for breaching stock investment rules

The Bangladesh Bank yesterday fined two more banks and warned four others for investing in the stock market breaching rules.

30 September 2021, 18:00 PM

NRB Bank deliberately loses Tk 103cr to favour stock gamblers

NRB Bank has incurred a loss of Tk 103 crore as it intentionally became involved in unethical trading practices in the stock market to favour gamblers, which weakened the financial health of the lender and put depositors’ money at risk.

28 September 2021, 18:00 PM