One Year Of Ukraine War: Undoing of Bangladesh economy

In the end, it was a war that began some 5,800 kilometres away a year ago that laid bare the longstanding weaknesses of the Bangladesh economy.

24 February 2023, 01:00 AM

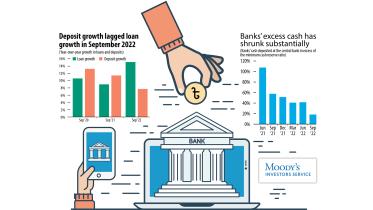

Spike in funding costs to hurt banks’ profitability

Weak banks in Bangladesh with small holdings of government securities, which are used to mobilise funds either from the central bank or peers, may become more vulnerable in the days to come, Moody’s Investors Service warned yesterday.

23 February 2023, 02:00 AM

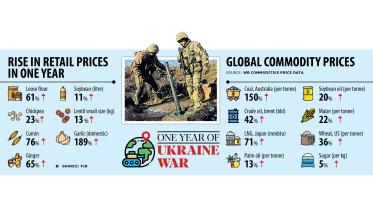

Economy bleeds while reality only getting harsher for people

Russia’s war in Ukraine might be taking place 5,800 kilometres away from Bangladesh and the country is not involved militarily in the dragging conflict in any way, but its economy and people have been paying heavy prices.

22 February 2023, 02:00 AM

Eight banks face provision shortfall of Tk 19,048cr

Eight banks in Bangladesh faced a collective provisioning shortfall of Tk 19,048 crore in 2022, creating a risk for their depositors.

21 February 2023, 02:00 AM

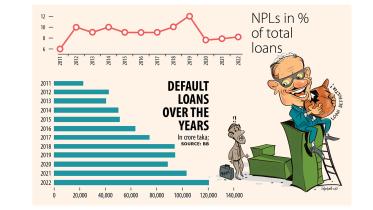

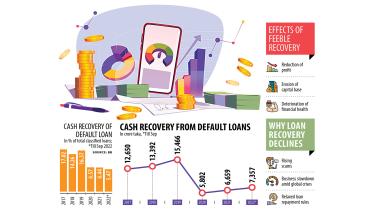

Relaxed rules can’t tame default loans

Default loans in Bangladesh’s banking sector jumped 17 per cent year-on-year to Tk 120,656 crore last year owing to a lack of corporate governance and the ongoing business slowdown.

20 February 2023, 02:00 AM

Default loans rises nearly 17%

Habitual defaulters' reluctance to repay the funds fuelled the amount to reach Tk 120,656 crore

19 February 2023, 11:29 AM

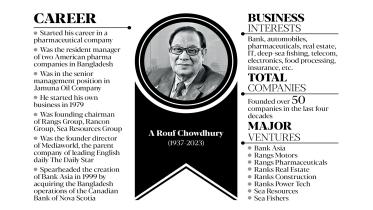

A Rouf Chowdhury: a dreamer and a trailblazer

Bangladesh’s banking sector has long been going through a difficult time as a majority of banks are plagued by challenges stemming from a lack of corporate governance. But Bank Asia Ltd stands out thanks to its unwavering focus on following rules strictly under the leadership of a strong board of directors led by A Rouf Chowdhury.

19 February 2023, 02:00 AM

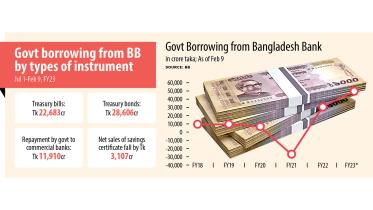

Govt’s higher borrowing from BB stokes inflation risk

The government has kept borrowing from the Bangladesh Bank as commercial banks can’t come up with much-needed funds owing to the liquidity crunch.

15 February 2023, 02:00 AM

‘Rules on compulsory diploma discriminatory’

It will be very tough for bankers to pass the exam smoothly if the existing curriculum is retained.

12 February 2023, 03:30 AM

BB injects $330m into market since IMF loan

The Bangladesh Bank has injected $330 million into the country’s foreign exchange market since February 1 when the International Monetary Fund disbursed $476.27 million to Bangladesh as the first installment of a $4.7 billion loan.

10 February 2023, 02:00 AM

BB to offer new tool for cash support to Islamic banks

Bangladesh Bank will introduce another tool to provide liquidity support to cash-strapped Shariah-based banks in order to safeguard their ailing financial health.

5 February 2023, 18:00 PM

IMF releases $476.27 million as first loan instalment for Bangladesh

The International Monetary Fund (IMF) has disbursed $476.27 million to Bangladesh as the first instalments of $4.7 billion loan it approved early this week.

2 February 2023, 13:01 PM

Relaxed rules failed to speed up default loan recovery

The recovery of default loans is still weak in Bangladesh despite offering relaxed repayment policies for three consecutive years to 2022 as delinquent borrowers are not paying back funds on time, hitting banks’ income and cash flow.

1 February 2023, 02:00 AM

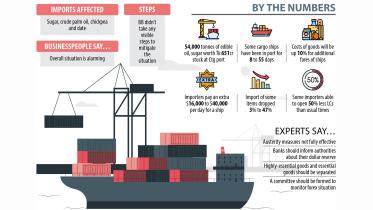

No visible step from BB to ease importers’ woes

The Bangladesh Bank is yet to take any visible measure in line with a commerce ministry directive aimed at asking banks to earmark a portion of their foreign currency holdings to open letters of credit to import essentials ahead of Ramadan.

19 January 2023, 02:00 AM

Pilot kicks off for digital payment with QR code

The Bangladesh Bank will commence a campaign tomorrow to popularise an interoperable QR code across the capital city in a move to bring millions of small businesses such as street vendors and lower-income groups under the digital transaction system.

17 January 2023, 16:13 PM

Feeble monetary policy against challenges

Bangladesh Bank yesterday unveiled a wishy-washy monetary policy for the next six months that will prove to be ineffective in tackling the headwinds passing through the economy.

16 January 2023, 01:00 AM

Monetary policy won’t work if interest rate cap stays

By retaining the interest rate cap on lending and fixed exchange rate, the upcoming monetary policy for the second half of this fiscal year will not play any role in containing inflation, economists said.

15 January 2023, 02:20 AM

Lanka gets 6 more months to repay BB’s $200m

Bangladesh Bank yesterday granted Sri Lanka’s request to be given six more months to repay a $200 million loan due to the prolonging of its economic crisis.

13 January 2023, 03:00 AM

Nagad Finance inches closer to running MFS operation

The Bangladesh Bank yesterday decided in principle to allow Nagad Finance PLC, a proposed non-bank financial institution (NBFI), to run mobile financial services.

13 January 2023, 02:30 AM

Sri Lanka given 6 more months to repay Bangladesh’s $200m loan

Bangladesh Bank today granted Sri Lanka six more months to repay the $200 million loan after the Island nation requested to extend the repayment period due to its prolonged economic crisis.

12 January 2023, 14:18 PM