Current account posts $3.53b surplus amid downturn

The country’s current account balance posted a surplus of $3.53 billion in the first quarter of the fiscal year on the back of a sharp decline in the trade deficit.

2 November 2020, 18:00 PM

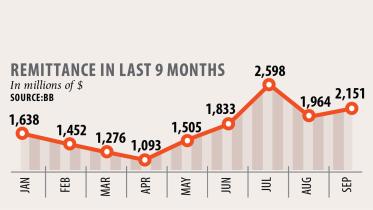

Remittance on a roll

Bangladesh received 28.62 per cent more remittance in October as the money sent by the country’s migrant workers toiling abroad kept its scintillating growth defying grim predictions.

1 November 2020, 18:00 PM

Another Tk 7,000cr for large industries, services sector

The central bank yesterday expanded the size of the stimulus package for large industries and services sector firms to make the low-cost funds available for the factories located in the economic zones.

29 October 2020, 18:00 PM

Target forex reserve

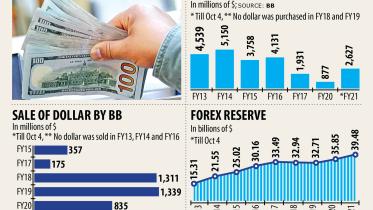

The burgeoning forex reserve, now hovering around $40 billion, is turning a lot of heads, alarmingly though, as big borrowers shift their eyes from exhausted public banks to the secured coffers.

27 October 2020, 18:00 PM

Defaulted loans at NBFIs soar amid irregularities

Defaulted loans at non-bank financial institutions (NBFI) escalated 26.51 per cent in the first half of 2020 because of a lack of corporate governance in absence of the central bank’s proper supervision.

26 October 2020, 18:00 PM

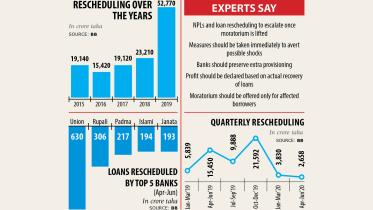

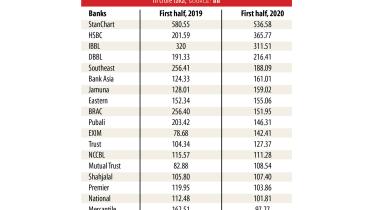

BB should steer clear of regulatory forbearance

Bangladesh Bank should take strict measures to avoid further regulatory forbearance in order to strengthen the financial health of the country’s banking sector, said Rahul Anand, the Bangladesh mission chief of the International Monetary fund.

25 October 2020, 18:00 PM

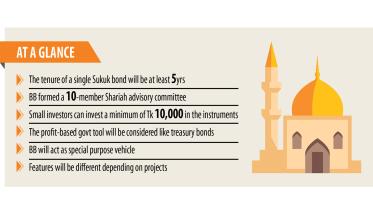

Shariah-compliant bonds by Dec

The government plans to issue Shariah-compliant bonds, commonly known as sukuk, from December as part of its effort to implement infrastructure projects smoothly.

21 October 2020, 18:00 PM

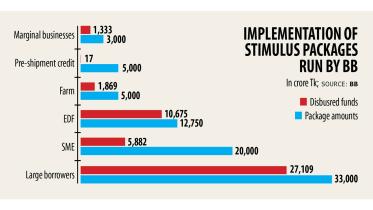

Big borrowers gain, SMEs still in pain

They were the hardest hit when the coronavirus pandemic struck the country in March, but the implementation of the stimulus packages the government unveiled for small and medium enterprises (SMEs), farmers and low-income groups more than six months ago has been slow because of the reluctance of banks.

19 October 2020, 18:00 PM

State lenders disregard marginal farmers, micro-enterprises

Seven state-run banks have not disbursed any fund from the central bank’s stimulus fund of Tk 3,000 crore for low-income professionals, marginal farmers and micro-enterprises.

15 October 2020, 18:00 PM

IMF lowers GDP growth forecast to 4.4pc

The International Monetary Fund yesterday lowered its economic growth forecast for Bangladesh to 4.4 per cent for the current fiscal year as the country is still struggling to pull itself out of the wreckage caused by the coronavirus pandemic.

13 October 2020, 18:00 PM

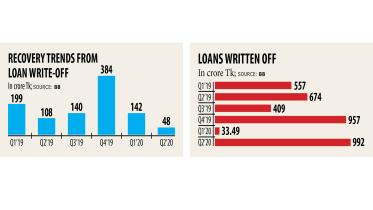

Recovery from loan write-off plummets

Recovery from loan write-offs plunged to at least a 66-month low in the second quarter of 2020 as banks faced troubles in realising the delinquent loans because of the countrywide shutdown.

13 October 2020, 18:00 PM

Govt to use forex reserves for development projects

The government has decided to use the country’s ballooning foreign exchange reserves to implement development projects.

11 October 2020, 18:00 PM

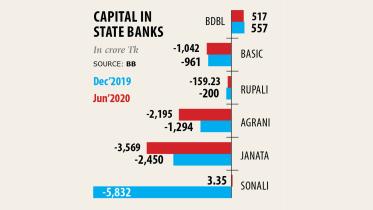

All efforts fail to reduce NPLs at state banks

In the late nineties, the key financial indicators of the state-owned commercial banks deteriorated alarmingly. Non-performing loans (NPLs) rose to 45.6 per cent because of poor corporate governance.

10 October 2020, 18:00 PM

Strengthen audit for better compliance

The central bank yesterday asked four state-run commercial banks to strengthen their audit function to bolster internal control and compliance.

8 October 2020, 18:00 PM

Mighty taka puts Bangladesh Bank in a bind

For exporters desperately trying to keep up the latest robust run of merchandise sales abroad and cement the recovery from the coronavirus pandemic, an old problem has raised its head: a rising taka against a falling US dollar.

7 October 2020, 18:00 PM

Loan rescheduling urge ebbs further amid payment holiday

Loan rescheduling in the banking sector declined further in the second quarter of the year on the back of the ongoing loan moratorium facility introduced to help borrowers weather the fallouts of the coronavirus pandemic.

3 October 2020, 18:00 PM

Remittance inflow defies grim forecast

Despite grim predictions, remittance inflow stayed strong for the fourth straight month as expatriates sent home $2.15 billion last month, giving the country’s economy some relief amid the pandemic.

1 October 2020, 18:00 PM

Banks’ profit soars, on paper

Net profit in the banking sector soared 33.60 per cent year-on-year to Tk 2,424 crore in the first half of 2020 despite a collapse in business and a feeble recovery of loans due to the onslaught of the coronavirus pandemic.

30 September 2020, 18:00 PM

Another breather for borrowers

Bangladesh Bank yesterday extended the deadline for loan status classification by banks further to December 31, as it now forecasts the economy would be enshrouded by the coronavirus-induced gloom for longer than it had imagined earlier.

28 September 2020, 18:00 PM

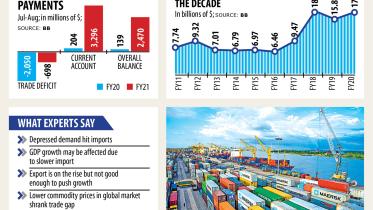

Narrowing trade deficit not wholly good

Trade deficit narrowed heavily in the first two months of the fiscal year in the wake of falling imports because of the ongoing economic slowdown, a sign of depressed demand and consumption.

28 September 2020, 18:00 PM