Banks should be setting interest rates, not others

Banks should be the only ones setting the interest rates as they offer loans at rates that are based on factors like cost of funds, credit worthiness of a customer and the prevailing market condition, said AKM Shaheed Reza, chairman of Mercantile Bank.

1 June 2019, 18:00 PM

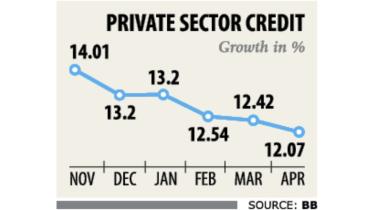

Credit growth sinks to 56-month low

Private sector credit growth sank to a 56-month low of 12.07 percent in April on the back of the ongoing liquidity crunch in the banking sector, in an ominous development that stands to slow down the economy’s tremendous growth momentum.

1 June 2019, 18:00 PM

BB steps in to ease Eid liquidity crunch

The central bank yesterday injected Tk 2,300 crore into the money market to ease liquidity crunch in the banking sector amid the cash withdrawal spree in the lead up to Eid.

30 May 2019, 18:00 PM

City Bank embracing digital innovations with gusto

People do not need banks but they need banking, Microsoft founder Bill Gates said 30 years ago. And it appears he was on to

27 May 2019, 18:00 PM

Stay alert about dubious transactions

The Bangladesh Financial Intelligence Unit (BFIU) yesterday instructed mobile financial service (MFS) providers to inform it of suspicious transactions with a view to reining in “digital hundi” ahead of Eid-ul-Fitr.

23 May 2019, 18:00 PM

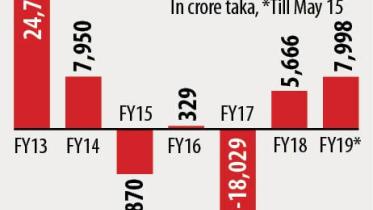

Govt’s bank borrowing hits six-year high

The government has all on a sudden stepped up its borrowing from the banking system from this month as its revenue collection fell short of expectations, sending the cash-strapped banks into a state of panic.

Until the end of April, the government did not borrow from banks

22 May 2019, 18:00 PM

Cash use costs Bangladesh Tk 9,000cr every year

The country has to count more than Tk 9,000 crore a year because of its heavy dependence on cash, necessity to move towards a cashless society. The maintenance cost of the printed money is nearly 0.50 percent of the country’s GDP, Central bank report styled ‘Reducing the Cash Transaction’.

15 May 2019, 18:00 PM

Suspicious transactions go up 64pc

Banks and financial organisations sent a record number of suspicious transaction and activities reports to the Bangladesh Financial

14 May 2019, 18:00 PM

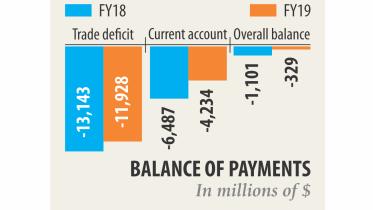

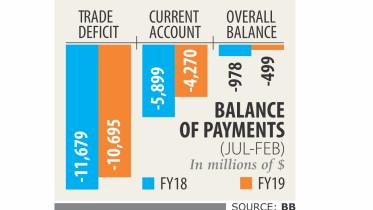

Trade deficit narrows 9pc

Trade deficit fell 9.24 percent year-on-year to $11.92 billion in the first nine months of the current fiscal year, giving some breathing

13 May 2019, 18:00 PM

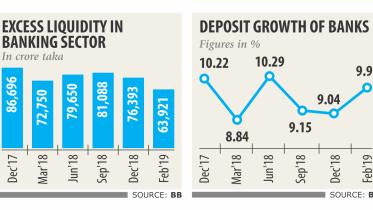

Liquidity crunch intensifying

Liquidity crunch in the banking sector is deepening due to slow growth of deposits and a lethargic recovery of loans.

12 May 2019, 18:00 PM

IPDC on a roll

When a majority of financial institutions are struggling with default loans and a lack of corporate governance, IPDC Finance Ltd has achieved stellar success by rolling out a raft of successful business models.

11 May 2019, 18:00 PM

A cashless society a distant dream

Bangladesh has a long way to go to become a cashless society as only six percent of the total transactions are now settled through the electronic mode.

5 May 2019, 18:00 PM

BB remains strict about offshore banking operations

The central bank has turned down banks’ request to grant them waiver on maintaining statutory liquidity ratio and cash reserve ratio for offshore banking operations as it remains steadfast in its intent to impose discipline on this elusive branch.

25 April 2019, 18:00 PM

Loans against movable assets on the cards

People can soon get loans from banks by keeping their movable assets with banks as collateral, in a development that will expand the

22 April 2019, 18:00 PM

Move to rid banks of NPL burden

The central bank has moved to form an asset management company to deal with the growing non-performing loans (NPLs) of banks, as part of its efforts to perk up the ailing sector.

15 April 2019, 18:00 PM

Banks plagued by liquidity crunch

Banks are now offering double-digit interest rates for deposits in a desperate attempt to prop up their liquidity base amid high default

10 April 2019, 18:00 PM

Trade deficit narrows

Trade deficit squeezed by 8.42 percent in the first eight months of 2018-19 thanks to the steady growth of exports and a slowdown

8 April 2019, 18:00 PM

Defaulters to get another lifeline

The country's loan classification rules, which were tightened in 2012 to comply with global standards, are set to be relaxed by the

6 April 2019, 18:00 PM

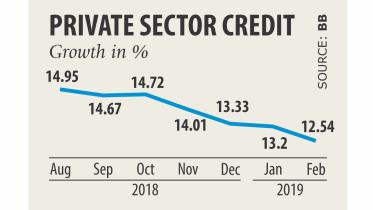

Private credit growth hits 53-month low

Private sector credit growth hit a 53-month low in February thanks to the ongoing liquidity crunch brought about by the rising default

2 April 2019, 18:00 PM

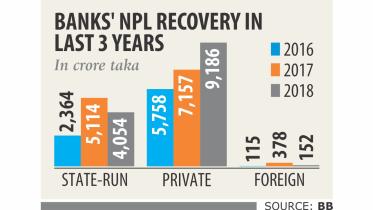

Recovery fails to keep pace with default loan spike

The pace of recovery of banks' nonperforming loans (NPL) was much lower than the rate at which their NPL increased last year -- an ominous development for the sector.

30 March 2019, 18:00 PM