Loan write-off declines

Loans written off by banks in Bangladesh declined in the first half of 2022 despite the upward trend of default loans.

7 October 2022, 02:10 AM

Three factors holding back economy

The interest rate cap on loans, the frequent changes to the exchange rate regime and a relaxed attitude to enforcing austerity measures are the major challenges facing Bangladesh in restoring stability in the economy.

4 October 2022, 02:20 AM

September brings no cheer for economy

The economy of Bangladesh has continued to suffer from foreign exchange-related stress as both exports and remittances declined in September whereas import payments were almost unchanged.

3 October 2022, 03:00 AM

Remittance lowest in seven months

Despite a surge in the outflow of migrant workers, remittances to Bangladesh declined 11 percent year-on-year to $1.54 billion in September, the lowest in seven months.

3 October 2022, 02:10 AM

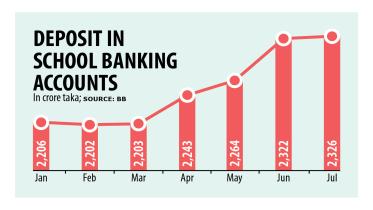

School banking gaining traction

School banking is increasingly gaining popularity among students, exemplified by total deposits in such accounts surpassing Tk 2,300 crore in July despite ongoing economic hurdles such as rising inflation.

2 October 2022, 02:40 AM

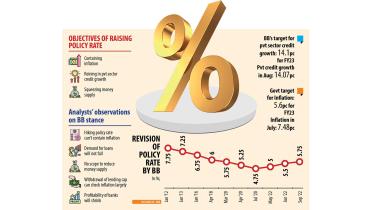

BB hikes key interest rate by 25 basis points

The Bangladesh Bank yesterday raised its benchmark interest rate by 25 basis points to 5.75 per cent as it stepped up its fight against inflation, which is running at a multi-year high.

30 September 2022, 02:10 AM

Economic growth momentum at risk for global volatility: BB

The economy faces multidimensional challenges as the volatile global scenario threatens to create an adverse situation for the growth momentum of Bangladesh, the central bank warned yesterday.

29 September 2022, 02:10 AM

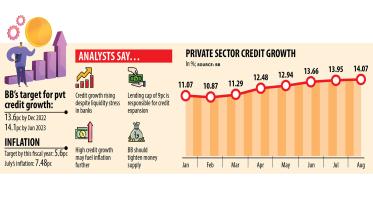

Private credit growth surges, nears Bangladesh Bank target

Bangladesh’s private sector credit growth surged to 14.07 per cent in August, almost touching the central bank’s target for the entire fiscal year, an ominous sign for the economy since it may stoke inflationary pressures.

28 September 2022, 02:10 AM

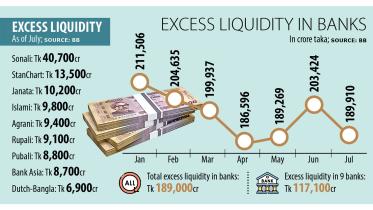

9 banks hold over 60% of excess liquidity

Sixty-two per cent of the excess fund in the banking sector in Bangladesh is concentrated in nine banks, highlighting the liquidity pressure facing other lenders.

27 September 2022, 07:05 AM

Banks prefer govt bonds to private sector lending

Banks with surplus funds in Bangladesh are increasingly preferring government securities to lending to the private sector as the former gives higher yields amid the continued interest rate cap.

27 September 2022, 02:20 AM

Transactions thru cards for int’l payment keep rising

Foreign currency transactions through cards maintained an upward trend in July, surging 274 per cent year-on-year at a time when the country is trying to stop the depletion of its forex reserves.

26 September 2022, 02:30 AM

Stabilising forex market: BB actions contradict aim

Bangladesh Bank recently took a set of initiatives to bring about an effective floating exchange rate, meaning that which will rise or fall based on supply and demand, to bring back stability in the foreign exchange market.

25 September 2022, 02:40 AM

From bottomless basket to a role model

Bangladesh’s economy has gone from a basket case to being a model case study for economic development across the globe.

24 September 2022, 18:00 PM

Forex market: Six banks apologise for making excessive profits

The central bank yesterday ordered six banks to spend 50 per cent of the profits they had earned from their foreign exchange businesses unethically between May and June for corporate social responsibility (CSR) programmes.

23 September 2022, 02:40 AM

Bangladesh Bank platform eases local trade in foreign currency

A new digital platform rolled out by the Bangladesh Bank has opened a new horizon for local businesses to do trade with foreign currencies on a real-time basis.

23 September 2022, 02:20 AM

Six banks asked to spend forex business profits for CSR

The six banks are Standard Chartered Bangladesh, Brac Bank, Dutch-Bangla Bank, The City Bank, Southeast Bank and Prime Bank.

22 September 2022, 14:36 PM

Trade with India in rupee not feasible

Businesses will not be able to use the Indian rupee for trading with India as the Bangladesh Bank has not enlisted the currency for the settlement of bills for exports and imports.

22 September 2022, 02:10 AM

Uttara Finance urges ACC to bar former MD’s travel abroad

Uttara Finance and Investment has requested Anti-Corruption Commission (ACC) to prevent its former managing director, SM Shamsul Arefin, from leaving Bangladesh over his alleged involvement in scams.

21 September 2022, 02:40 AM

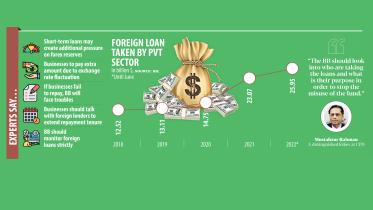

New headache: Private firms’ foreign loans jump to $26b

The amount of foreign loans availed by the private sector in Bangladesh has been swelling fast since 2020, creating a major headache for the country’s economy at a time when its foreign exchange reserves are plummeting.

19 September 2022, 02:10 AM

Bar on ex-MD of FAS Finance from leaving country

The immigration service of Bangladesh Police has imposed an embargo on Pritish Kumar Sarker, a former managing director of the FAS Finance and Investment, from leaving Bangladesh over his alleged involvement in financial scams.

16 September 2022, 03:05 AM