Yunus’ economic gambit paying off

Two months ago, as Professor Muhammad Yunus waded into Bangladesh’s unprecedented political turmoil, he inherited economic chaos by default.

7 October 2024, 18:00 PM

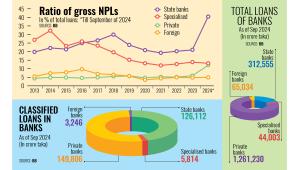

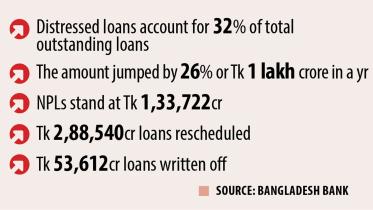

Distressed loans soar to a record Tk 4.75 lakh cr

Distressed loans at banks totalled over Tk 4.75 lakh crore at the end of 2023 – a revelation that makes for a sobering read of the actual health of this vital sector of the economy.

30 September 2024, 01:00 AM

Minimum 2% shareholding for board membership a reason behind banking sector ills

Referring to the legal provision requiring a 2 percent shareholding in a commercial bank to become a director, Abdul Mannan, chairman of First Security Islami Bank (FSIB), said this has driven away seasoned banking leadership from boardrooms and allowed infamous individuals like S Alam into banking leadership roles.

28 September 2024, 18:00 PM

Beximco seeks extension of loan tenure by 10 years

Beximco has sought support from the government to extend the repayment period of its liabilities to Janata Bank over the next 10 years, including a two-year moratorium.

22 September 2024, 18:05 PM

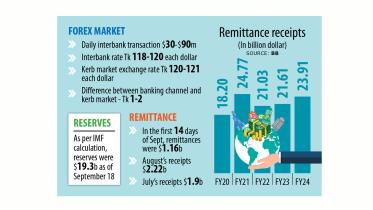

Forex market on the mend as remittances rebound

After a prolonged period of crisis, the foreign exchange market in Bangladesh, especially the interbank forex market, is showing signs of recovery, driven by a rebound in remittance receipts and key policy interventions by the central bank.

21 September 2024, 18:00 PM

Salman loses grip on IFIC Bank

The Bangladesh Bank yesterday constituted a new board of directors at IFIC Bank after dissolving the previous board, effectively bringing an end to Salman F Rahman’s grip on the private commercial bank.

4 September 2024, 18:00 PM

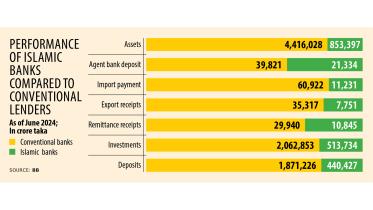

Islamic bank deposits grow despite irregularities

The country’s Islamic banking sector registered growth in deposits in June although several Shariah-based lenders are facing widespread scams and irregularities.

3 September 2024, 18:00 PM

Remittances jumped 39% in August

Remittances sent by Bangladeshis living abroad soared nearly 39 percent year-on-year to $2.2 billion in August, which is likely to ease pressure on the foreign exchange reserves to some extent.

1 September 2024, 18:00 PM

Orion Pharma’s Tk 132cr loan rescheduled with special approval

Orion Pharma Ltd, a pharmaceutical company of Orion Group, has been provided a rescheduling facility on a forced/demand loan by state-run Agrani Bank with special approval from the Bangladesh Bank.

26 August 2024, 18:00 PM

BB appoints administrator at Nagad

The Bangladesh Bank yesterday appointed an administrator to Nagad after one too many allegations of irregularities in the mobile financial service provider’s operations and dealings.

21 August 2024, 18:00 PM

Need favourable legal framework to recover NPLs

A favourable legal framework for facilitating the recovery of non-performing loans (NPLs) should be formed in consultation with the attorney general and legal experts, according to Selim RF Hussain, chairman of the Association of Bankers, Bangladesh (ABB)..Hussain, also managing director a

20 August 2024, 18:47 PM

S Alam group, associates: Tk 95,000cr loans taken from 6 banks

S Alam Group and its associate companies took out Tk 95,331 crore between 2017 and June this year from six banks, with 79 percent of the sum coming from Islami Bank.

19 August 2024, 18:00 PM

S Alam drains Janata branch dry

As much as 90 percent of the loans disbursed by a branch of state-run Janata Bank was for S Alam Group, in yet another instance of how the Chattogram-based business giant exerted its influence on the country’s banking sector.

17 August 2024, 18:00 PM

Prioritise immediate economic concerns

The interim government should prepare a white paper on the economy and identify sectors that require immediate attention, according to Dr Debapriya Bhattacharya, an eminent economist and public policy analyst.

13 August 2024, 18:00 PM

$600m loans from EDF turn sour

Loans amounting to nearly $600 million, or Tk 7,000 crore, disbursed from the Export Development Fund (EDF), which was formed based on the country’s foreign exchange reserves, have been defaulted, according to a Bangladesh Bank (BB) document.

13 August 2024, 18:00 PM

Businesses hit by drought of cash supply

Businesses in Bangladesh, especially those that mostly deal with cash transactions, yesterday said they are contending with a liquidity crunch as the country’s central bank has placed a limit on daily cash withdrawals from banks.

11 August 2024, 18:00 PM

Cash crunch intensifies as ATMs run dry

People’s sufferings due to cash shortages have intensified as most ATM booths started running dry nearly a week ago in Bangladesh.

10 August 2024, 18:00 PM

BB loses Tk 55cr in forex deals with Islami Bank

The Bangladesh Bank has incurred a loss of Tk 55 crore from its foreign exchange deal with Islami Bank centring the introduction of the crawling peg exchange rate system.

10 August 2024, 18:00 PM

ATMs out of cash as money supply disrupted

Nasir Hossain, a resident of the capital’s Dhanmondi area, had to urgently buy daily necessities as he had not gone to the market for the past few days in the wake of the deadly protests that forced Sheikh Hasina to resign from her post as prime minister.

7 August 2024, 18:00 PM

Absence of security affects banking services

Although banks reopened yesterday, a day after prime minister Sheikh Hasina handed in her resignation, overall activities including financial transactions were affected due to security concerns among lenders and clients.

6 August 2024, 18:00 PM