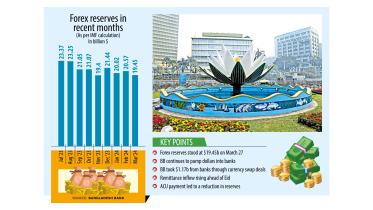

Forex reserves keep eroding despite currency swap

Under the currency swap agreements introduced last month, the banking regulator took $1.17 billion from commercial banks and injected around Tk 20,000 crore in the form of local currencies into the banking system, according to several central bankers.

29 March 2024, 00:11 AM

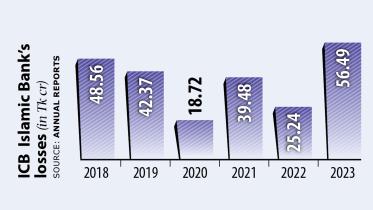

ICB Islamic Bank in dire straits

After Padma Bank, ICB Islamic Bank appears to be the next in line to be absorbed by a stronger bank under the central bank’s roadmap to clean up the banking sector and bring in corporate governance.

28 March 2024, 18:00 PM

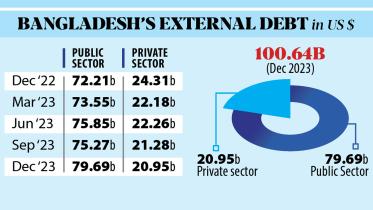

External debt crosses $100b for first time

Bangladesh’s external debt has crossed the $100 billion mark for the first time, indicating a challenging future amid foreign exchange shortage.

21 March 2024, 18:00 PM

NBFIs lose 17% of deposit accounts

Deposits at non-bank financial institutions (NBFIs) have slightly increased on an interest rate hike but the number of deposit accounts have dropped sharply, indicating a lack of trust.

20 March 2024, 00:09 AM

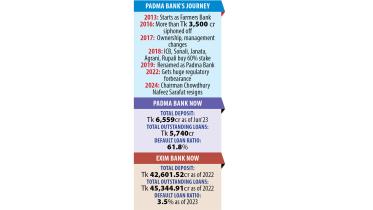

Exim-Padma Bank merger to take at least 18 months

The planned merger of Shariah-based Exim Bank and struggling Padma Bank is likely to take between 18 months to two-and-a-half years to complete, according to central bank officials.

18 March 2024, 18:00 PM

Forex market liquidity rising for US dollar inflow

Liquidity in the foreign exchange market is increasing due to a rise in the inflow of US dollars, riding on growing remittance, export earnings and currency swap deals.

18 March 2024, 00:29 AM

Forex market liquidity rising for US dollar inflow

Liquidity in the foreign exchange market is increasing due to a rise in the inflow of US dollars, riding on growing remittance, export earnings and currency swap deals

17 March 2024, 15:26 PM

Can mergers heal banking sector’s wounds?

The news that Shariah-based Exim Bank is going to merge with troubled commercial lender Padma Bank has taken the financial sector of Bangladesh by surprise.

17 March 2024, 00:25 AM

Exim Bank to take over troubled Padma Bank

Struggling Padma Bank is set to be taken over by Shariah-based Exim Bank as part of the Bangladesh Bank plan to rein in the runaway defaulted loans to a reasonable level and bring good governance to the banking sector.

14 March 2024, 18:00 PM

Padma Bank to merge with EXIM Bank: official

Padma Bank, which has been struggling with the burden of toxic loans for years, will merge with EXIM Bank. It will be the first bank merger in Bangladesh

14 March 2024, 07:40 AM

BB introduces counter-trade to ease forex pressure

The Bangladesh Bank has unveiled the counter-trade policy, an arrangement that promotes direct exchanges of goods and services without cash, with a view to reducing pressure on dwindling foreign currency reserves.

11 March 2024, 00:19 AM

Nine banks in ‘red zone’

Nine banks, including four state-run ones, have fragile financial health, says a recent report of the Bangladesh Bank.

10 March 2024, 18:00 PM

Nine banks were in BB ‘red zone’

Nine banks, including four state-run ones, were in the “red zone”, meaning their financial health was fragile,

10 March 2024, 11:41 AM

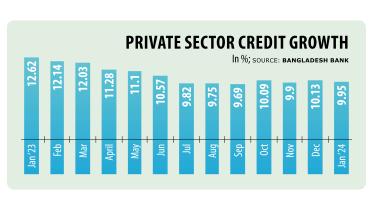

Private credit growth slows for contractionary monetary policy

Private sector credit growth slowed in January this year as the lending rate went up due to the central bank’s contractionary monetary policy, according to experts and analysts.

7 March 2024, 16:03 PM

BB now mulls merger of non-banks

Bangladesh Bank is planning to initiate mergers and acquisitions among weak non-bank financial institutions (NBFIs) if a similar initiative in the banking industry sees success.

6 March 2024, 00:52 AM

BB's repo facility to be weekly, not daily

The scope for banks to avail Bangladesh Bank’s (BB) repo facility is set to narrow as relevant auctions will be held weekly instead of daily from upcoming July.

4 March 2024, 19:00 PM

Currency swap pushes forex reserves above $20b

Bangladesh's foreign currency reserves have gone past the $20-billion mark after nearly a month thanks to the currency swap initiated by the central bank.

23 February 2024, 00:12 AM

A third of NBFIs running without MDs

Twelve non-bank financial institutions (NBFIs) in Bangladesh are running without a regular managing director or chief executive officer and a majority of them have had their top post vacant for more than three months in a clear breach of laws.

22 February 2024, 00:15 AM

Roadmap for banking reforms: Implementation is key

Although the roadmap drawn up to reform the banking industry of Bangladesh may seem attractive on the surface, there are questions regarding its efficacy in ensuring good governance in the scam-hit sector.

18 February 2024, 00:13 AM

Defaulted loans soar 20.7pc in 2023

The banking sector’s defaulted loans soared 20.7 percent to Tk 145,633 crore in 2023 as both governance and accountability continue to get looser.

12 February 2024, 18:00 PM