Drawing strength from values

Although the banking sector in Bangladesh is facing multiple challenges, including an alarming amount of bad loans, Brac Bank has been able to strengthen its financial health by keeping its values at the core of every activity.

7 November 2023, 18:00 PM

Current account balance turns positive

The country’s current account balance stood in positive territory in the first quarter of the current fiscal year due to a sharp slowdown in imports.

3 November 2023, 03:58 AM

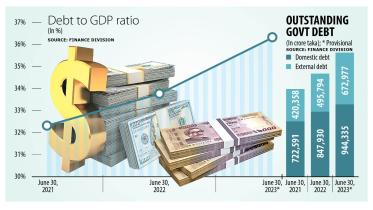

Govt’s interest expenses jump

The government's expenses on interest payments rose 22.14 percent year-on-year to Tk 92,538 crore in the last fiscal year due mainly to a higher cost of borrowing.

1 November 2023, 02:03 AM

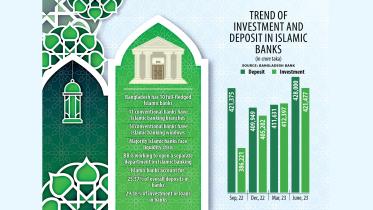

Bankers, directors to be kept out of Shariah board

No bankers and directors will be able to hold any post in the Shariah supervisory committee of banks as the Bangladesh Bank changes rules to make lenders more compliant and curb irregularities.

29 October 2023, 18:00 PM

Premier Bank eyes digital expansion

Premier Bank PLC is investing in building a robust digital infrastructure to make all financial services available at the fingertips of customers, said M Reazul Karim, managing director of the private commercial bank.

28 October 2023, 18:00 PM

Nagad, Kori get go-ahead for digital bank

Bangladesh Bank yesterday issued letters of intent to Nagad Digital Bank and Kori Digital Bank, in a development that can substantially enhance people’s access to finance.

22 October 2023, 18:00 PM

BB nod likely today for setting up digital banks

Bangladesh Bank is likely to give primary approval today for the formation of digital banks in the country.

22 October 2023, 01:30 AM

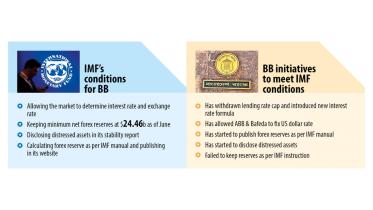

$4.7B loan from IMF: Next tranche of $681m expected in Dec

Bangladesh is hopeful of receiving the second tranche of the IMF’s $4.7 billion loan programme in December as the authorities agreed to further monetary policy tightening, tighter fiscal policy and greater exchange rate flexibility.

19 October 2023, 18:00 PM

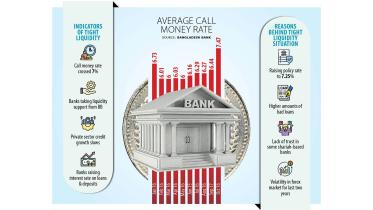

Banks suffering for growing liquidity stress

A majority of banks in Bangladesh, including some Shariah-based ones, are facing difficulties to run their activities due to a liquidity crisis, according to industry people.

17 October 2023, 01:30 AM

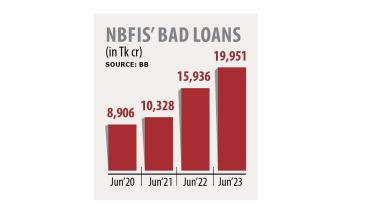

NBFIs’ bad loans at all-time high

After banks, it is now the non-bank financial institutions (NBFI) sector that has logged in a record volume of defaulted loans, in yet another data point that informs of the alarming state of the country’s overall financial sector.

12 October 2023, 18:00 PM

Lending, exchange rates still not market-driven: IMF

Bangladesh Bank introduced a new formula in June to determine the lending interest rate and brought about a single exchange rate recently but both are yet to be determined by the open market, the International Monetary Fund (IMF) has said.

12 October 2023, 02:58 AM

25 banks keep NPLs below 5%

With the high rate of non-performing loans (NPLs) being a major challenge for the banking sector, just 25 of the 61 commercial banks in Bangladesh are managing to keep their NPL rates below 5 percent.

11 October 2023, 00:30 AM

Capital Shortfall in Q2: 15 banks fall short of Tk 33,744cr

A record 15 banks, including seven state-run lenders, faced capital shortfall in the second quarter of 2023, in yet another indication of the worrying state of the financial sector.

8 October 2023, 18:00 PM

Big rise in 10 banks’ bad loans

The defaulted loans in 10 banks, including four state-run lenders, increased at an alarming rate in fiscal 2022-23, indicating their worsening financial health.

7 October 2023, 18:00 PM

BB raises policy rate at sharpest pace in a decade

Amid criticisms over the delay in squeezing money supply, the Bangladesh Bank yesterday made borrowing costlier as it raised the policy rate by 75 basis points to 7.25 percent to step up its fight against inflation..This is the sharpest pace of rate increase in at least a decade, said a ce

5 October 2023, 00:38 AM

Private credit growth continues to drop

Private sector credit growth in Bangladesh has continued to dip in recent months, with banks and borrowers adopting a go-slow strategy amidst the stress on the economy and growing apprehensions of a political crisis centring the upcoming parliamentary elections.

4 October 2023, 01:47 AM

Default loans hit an all-time high

Non-performing loans (NPLs) in Bangladesh’s banking sector hit a new record in June as withdrawal of a relaxed central bank policy, slowdown in business sales and deliberate non-payments pushed up the volume of bad loans to Tk 1,56,039 crore, central bank data showed.

2 October 2023, 00:00 AM

Default loans reach record Tk 1.56 lakh crore

The bad loans rose by Tk 24,419 crore in the last three months to June

1 October 2023, 14:20 PM

‘Wide gap in exchange rates hurts remittance’

Beneficiaries of wage earner remitters receive a 2.50 percent cash incentive on top of the market-determined exchange rate for any amount of remittance inflow.

1 October 2023, 04:51 AM

Will Bangladesh benefit from trade in rouble?

Russia has included Bangladesh on its list of friendly and neutral countries, a development that would allow its local banks and brokers to settle trade transactions in the rouble.

25 September 2023, 02:00 AM