Who appoints CEO at Nagad now?

Govt asks postal department to take responsibility of the MFS provider

15 May 2025, 18:30 PM

BB to adopt more flexible exchange rate to meet IMF conditions

The central bank is likely to issue a circular in this regard today.

13 May 2025, 18:00 PM

New powers, old questions: Can BB clean up the banking sector?

In what is seen as a landmark step toward restoring financial discipline, Bangladesh's interim government recently granted the central bank sweeping new powers to intervene in the troubled banking sector.

12 May 2025, 18:30 PM

Globe Group to sell edible oil unit to repay bank loans

Globe Pharmaceuticals Group of Companies is set to sell its edible oil unit, Globe Edible Oil Ltd, to adjust bank liabilities.

11 May 2025, 18:00 PM

Premier Bank paid Iqbal Tk 10cr for unused office spaces

Premier Bank paid Tk 10 crore to HBM Iqbal, the former chairman of the bank, for office space in one of his buildings that the private commercial lender did not use or rent.

8 May 2025, 20:01 PM

Some banks hit by capital squeeze

State-owned, Islamic Shariah-based, and specialised banks have seen deeper deterioration in their financial positions, whereas private commercial banks and foreign banks remain on firmer ground.

4 May 2025, 18:01 PM

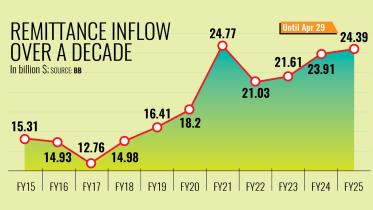

Remittance in ten months surpasses FY24 total

Remittance inflows in the first ten months of the current fiscal year have already exceeded the total receipts of FY 2023-24

3 May 2025, 18:00 PM

Is merger of Islamic banks a viable solution?

Ahsan H Mansur stated that the country's Islamic banking sector would be completely restructured as most of the existing Islamic banks are currently in trouble.

26 April 2025, 18:00 PM

Commercial banks’ lending to govt jumps 60%

With the central bank halting direct financing by printing new notes, the government also has no option but to turn to commercial banks to meet its fiscal needs.

21 April 2025, 18:00 PM

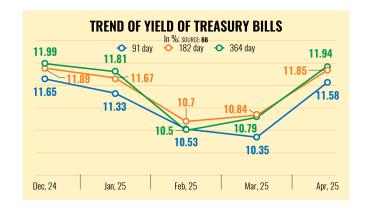

T-bill yields rise as govt turns to banks for funding

Interest rates on government treasury bills rose again this month, reversing a brief downward trend and signalling a continued liquidity crunch in the banking sector.

20 April 2025, 18:00 PM

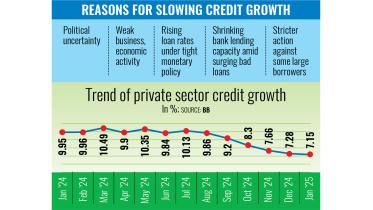

Why is credit demand so low?

Credit demand in the private sector of Bangladesh has virtually ground to a halt, hitting its lowest level since at least 2004, indicating a distressed business and investment situation.

12 April 2025, 18:00 PM

Remittance up as rates stabilise

Steady growth in remittance inflow has helped the interim government arrest the decline in foreign currency reserves, leading many to wonder why the remitters are sending more and more money back home.

29 March 2025, 20:17 PM

Forex market steadies as dollar inflows go up

The country’s foreign exchange market is stabilising thanks to a surge in US dollar (USD) inflows, driven by higher remittances, stronger export earnings and tighter oversight by the central bank.

26 March 2025, 18:00 PM

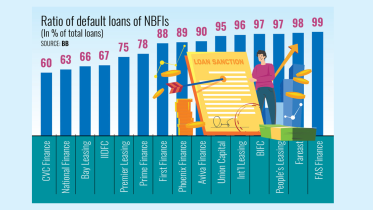

Banks get remedies but what about ailing NBFIs?

Of the 35 NBFIs in the country, a dozen are currently struggling to repay depositors due to an acute liquidity crisis

23 March 2025, 18:00 PM

Depositors to get max Tk 2 lakh on bank liquidation

The Bangladesh Bank (BB) has drafted a Deposit Protection Ordinance, proposing a maximum payout of Tk 2 lakh per depositor if a bank undergoes liquidation. The limit will be reviewed every three years.

22 March 2025, 18:00 PM

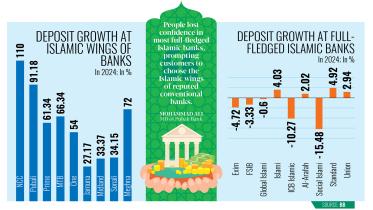

Islamic banks witness deposit shift

Islamic wings of conventional banks have become the preferred choice for religiously inclined depositors as many full-fledged Shariah-based banks struggle with a crisis of trust.

19 March 2025, 18:00 PM

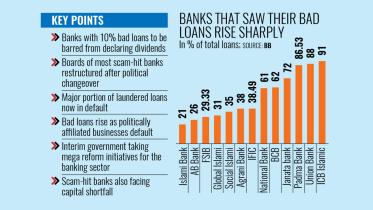

Bad loans at scam-hit banks surge after political changeover

At the end of last year, defaulted loans in the banking sector stood at Tk 345,765 crore, with those state-run and private commercial banks holding the majority.

18 March 2025, 18:00 PM

Shady firm took Tk 950cr from Islami Bank

It happened in just two days. A Nabil Group employee and a relative of its chairman own the firm.

15 March 2025, 20:54 PM

BB reconstitutes board of three private banks

The Bangladesh Bank (BB) today reconstituted the board of directors of three private commercial banks.

12 March 2025, 13:52 PM

Private sector credit growth hits decade-low

Credit appetite of the local private firms continues to fizzle out as the ongoing battle against inflation makes bank borrowing more expensive amid a volatile political climate after the August political changeover.

9 March 2025, 18:00 PM