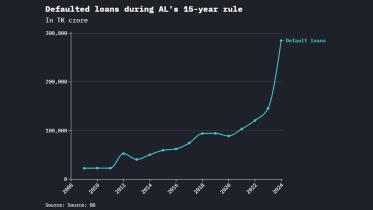

Defaulted loans may double next year

The defaulted loan figure is set to double as the Bangladesh Bank is set to tighten the classification rules for all types of loans by March next year to meet the International Monetary Fund’s loan conditions.

19 November 2024, 18:00 PM

Bad loans hit alarming record

Awami League-affiliated businesses had already put the country’s banking sector in trouble with huge bad debts, but the loans disbursed through irregularities to these companies turned sour even at a more alarming pace after the party’s ouster.

17 November 2024, 18:40 PM

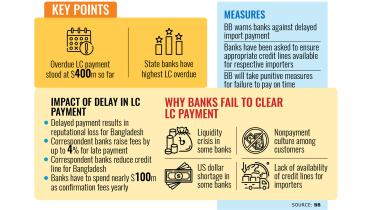

Import payment delay a reputational loss for Bangladesh: BB

Despite an overall improvement in foreign currency stocks, some state-run banks and Shariah-based lenders are not making import payments on time, prompting the central bank to issue a notice and warn of punitive actions against bank officials.

12 November 2024, 18:00 PM

Islamic banking to be off limits to regular banks

A bank will not be able to do Islamic banking business along with conventional banking at the same time, according to the draft ‘Islami Bank Company Act-2024’, as the central bank looks to level the playing field for Shariah-based banks.

9 November 2024, 18:18 PM

Private credit growth slows to three-year low

Private sector credit growth decelerated to the slowest pace in three years in September due to uncertainty in the investment environment following the recent political changeover.

7 November 2024, 18:00 PM

Rising remittance provides a breather amid forex crisis

Remittance inflow has continued to rise for the past few months, providing a breather for a country facing multiple challenges, including external payment pressures amid dwindling foreign exchange reserves.

3 November 2024, 18:00 PM

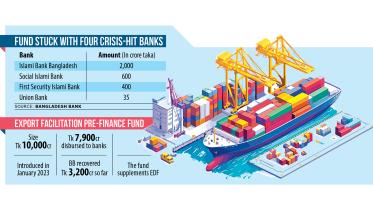

Tk 3,000cr export fund held up in four troubled banks

A large chunk of a Tk 10,000 crore central bank fund, meant for financing raw material imports for export orders, remains stuck with four crisis-hit banks, according to Bangladesh Bank officials.

31 October 2024, 18:00 PM

BB probe into Union Bank: ‘S Alam staffer’ took Tk 118cr sans approval

A “staffer of S Alam Group” took out Tk 118 crore from Union Bank without any approval or following any banking norms, indicating how the controversial business conglomerate used the bank.

28 October 2024, 20:33 PM

Pubali Bank’s journey to the top

While more than a dozen banks in Bangladesh are struggling to stay afloat, Pubali Bank, which has emerged as one of the leading private commercial lenders, stands as a glowing example of how to traverse difficult times.

26 October 2024, 18:00 PM

Cash outside banks keeps rising

The volume of cash outside the banking sector of Bangladesh has been increasing since the start of the year due to persistent inflation, the loss of consumer confidence in the sector due to the presence of ailing lenders, and the prevailing situation following the recent political changeover.

16 October 2024, 18:00 PM

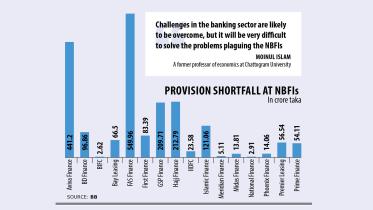

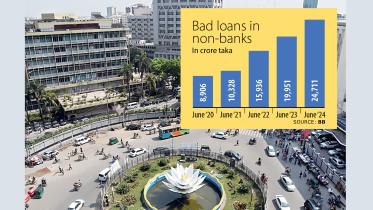

16 NBFIs face total provision shortfall of Tk 1,954cr

Sixteen non-bank financial institutions (NBFIs) faced a combined provision shortfall of Tk 1,954 crore till June this year, reflecting that their financial health had worsened.

13 October 2024, 18:00 PM

Crisis-hit banks repaying depositors for emergencies, basic needs

As crisis-hit lenders have started getting liquidity support from the inter-bank money market, they are now repaying depositors for specific purposes, such as medical emergencies, and in the case of salary disbursement or remittance encashment.

10 October 2024, 18:00 PM

EkPay offering payment services without licence

EkPay, an e-payment system of the Aspire to Innovate (a2i) programme of the government, has been offering all types of payment services without obtaining a licence from the Bangladesh Bank (BB), which is in clear violation of the Payment and Settlement System Act-2024.

8 October 2024, 18:00 PM

Non-banks’ default loans hit record high

Non-bank financial institutions (NBFIs) in the past fiscal year saw their defaulted loans reach a record 33.15 percent of all disbursed loans, according to the central bank, indicating a fragile situation in the sector thanks to widespread loan irregularities and scams.

6 October 2024, 18:00 PM

$800m repayment to Russia in limbo

About $809 million has piled up in a Bangladesh Bank escrow account to repay loans and interest for the Russia-funded Rooppur Nuclear Power Plant.

5 October 2024, 18:00 PM

S Alam took out 86pc of Global Islami Bank’s loans

S Alam Group and its linked companies account for more than 86 percent of the disbursed loans of Global Islami Bank (GIB), one of the six Shariah-based lenders that were controlled by the Chattogram-based business giant.

30 September 2024, 01:00 AM

Globe Edible Oil Ltd: S Alam’s backdoor takeover attempt

S Alam Group’s takeover of the Islami Bank to drain the healthiest bank of the country had left investors and customers in shock. It did not stop there.

25 September 2024, 01:00 AM

Five crisis-hit banks secure BB guarantee for liquidity

Five crisis-hit banks have obtained a Bangladesh Bank (BB) guarantee to avail liquidity support from the inter-bank money market, according to central bank officials.

22 September 2024, 18:00 PM

Overseas assets: Singapore FIU seeks info on S Alam Group

The Financial Intelligence Unit (FIU) of Singapore has requested details about the Chattogram-based conglomerate S Alam Group and its owners, including information on their domestic and foreign assets, from Bangladesh’s Financial Intelligence Unit (BFIU).

19 September 2024, 18:00 PM

Singapore’s Financial Intelligence Unit seeks info on S Alam Group

The overseas assets of S Alam Group, including those in Singapore, came under scrutiny following recent media reports.

19 September 2024, 08:09 AM