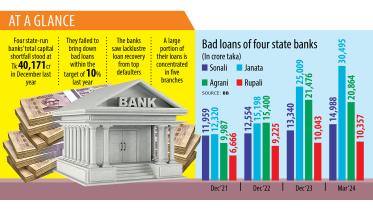

State banks nowhere near target to retrieve funds from top defaulters

Four state-run banks in Bangladesh are finding it difficult to recoup loans from their top 20 defaulters, a failure that has worsened their financial health and squeezed their capacity further to lend.

9 July 2024, 18:00 PM

Old political issue has evolved from financial to structural problem

A longstanding political issue has now evolved from a financial concern to a structural problem in Bangladesh, according to noted economist Prof Rehman Sobhan.

8 July 2024, 18:00 PM

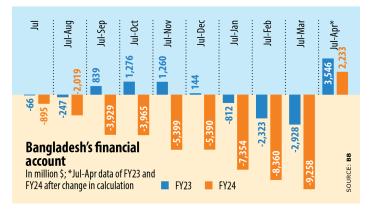

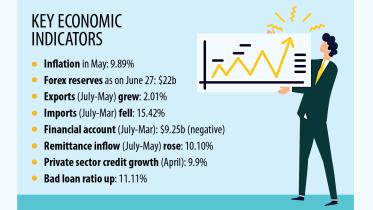

Financial account turns positive. It’s more about $14b export data correction

The financial account has turned positive after more than a year, yet it might not be good news for Bangladesh since it is the result of the revision of national data in line with IMF prescription and does not indicate improvement in the health of the economy.

3 July 2024, 18:00 PM

BB injected $12.79b into banks in FY24

The Bangladesh Bank injected $12.79 billion into banks from its reserves in the just-concluded 2023-24 fiscal year as banks combatted a severe US dollar crisis which hampered import payments.

2 July 2024, 18:00 PM

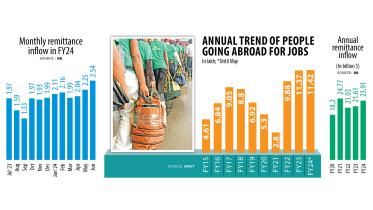

Remittance hit $24b in FY24, highest in three years

After hovering around the $21-billion mark for the previous two fiscal years, total remittances sent home by Bangladesh’s migrant workers reached nearly $24 billion in the just concluded fiscal year of 2023-24, providing some breathing space amid the forex crunch.

1 July 2024, 18:00 PM

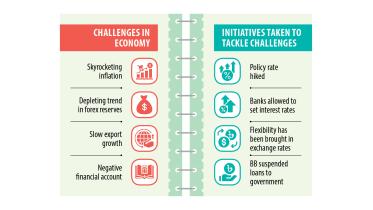

Economy in FY25: Is there any light at the end of the tunnel?

There is hope that the major challenges Bangladesh is facing due to high inflation and the foreign reserve crisis will stabilise gradually in fiscal year 2024-25, but consistency in maintaining a strict policy stance will be imperative to that end.

30 June 2024, 18:00 PM

FY24: one of the gloomiest years for economy

At the beginning of fiscal year 2023-24, there was an expectation that the country’s economy would recover from the shocks of the Covid-19 pandemic and other external pressures.

29 June 2024, 18:00 PM

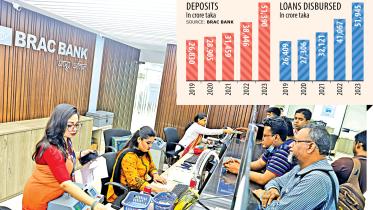

BRAC Bank thrives on SMEs that many consider a no-go

Small and medium enterprises (SMEs) are considered risky clients by most formal sector lenders since their financial health is weak and they are not good at managing risks and are expensive to lend. However, BRAC Bank has a different story to tell.

22 June 2024, 18:00 PM

Banks’ surging investments in bills, bonds shrink loanable funds

Banks in Bangladesh are increasing their investments in Treasury bills and bonds to net higher profits from the rising interest rate, a development that has squeezed the availability of loans for borrowers.

16 June 2024, 01:20 AM

Forex reserves to get $2b boost

Bangladesh’s foreign currency reserves are set to receive as high as $2 billion this month, which may send the total to nearly $21 billion, handing a much-needed relief to the US dollar supply.

14 June 2024, 01:10 AM

Bangladesh Bank’s digital efforts off to a slow start

The services have received lukewarm responses from the targeted customers because they were launched hastily and lack user-friendly features and campaigns were not run to make them popular. Besides, there is no incentive and banks are unwilling, industry insiders said.

12 June 2024, 03:18 AM

BB allows new entities to assess credit worthiness of borrowers

These credit bureaus will work to determine credit standards by analysing borrower data before sharing it with banks, which will help financial institutions make informed decisions, said the central bank guidelines on the licencing, operating and regulating of credit bureaus.

10 June 2024, 01:02 AM

Why have loan defaults risen sharply?

However, NPLs rose 38.5 percent year-on-year to Tk 1,82,295 crore by the end of March, accounting for 11.11 percent of the total loans disbursed in the banking system, according to central bank data.

8 June 2024, 21:24 PM

Bad loans hit historic high

Default loans in the banking sector of Bangladesh hit an all-time high of Tk 182,295 crore, but no reform programme to reduce it has been announced in the budget for the upcoming fiscal year.

6 June 2024, 18:00 PM

Default loans hit historic high of Tk 1,82,295 crore

Bad loans rose by Tk 36,367 crore in just three months

6 June 2024, 10:51 AM

Banking reforms remain a pipe dream

As new finance minister Abul Hassan Mahmood Ali gears up to place his first budget for FY25, the lack of good governance in the banking sector remains a widely discussed issue.

6 June 2024, 00:42 AM

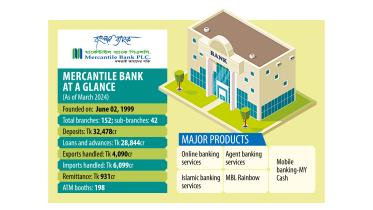

Mercantile Bank redirects focus to SME, retail lending

Mercantile Bank PLC used to emphasise corporate lending but now the private commercial lender plans to redirect the focus in order to bring the unbanked people under the financial system by providing more loans to small and medium enterprises, retail and agriculture, said its top executive.

1 June 2024, 18:06 PM

Janata Bank’s 57pc bad loans taken by 7 firms

Seven large borrowers, including AnonTex, Crescent, Ratanpur, and S Alam groups, account for 57 percent of the total default loans at Janata Bank, highlighting the risks lenders face if a handful of firms eat up most of the credit.

30 May 2024, 18:00 PM

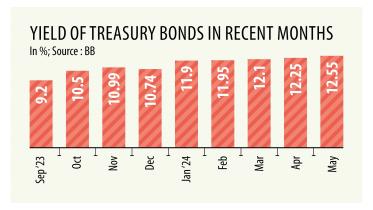

Treasury bond yields climb to 15-year high

The interest rate of treasury bonds recently jumped to a 15-year high of 12.75 percent, indicating that government borrowing will become costlier in the months ahead.

30 May 2024, 01:00 AM

BB bypasses own rules in appointing IFIC Bank adviser

The Bangladesh Bank has bypassed its own rules by approving the appointment of Mohammad Shah Alam Sarwar as the strategic adviser of IFIC Bank PLC.

29 May 2024, 03:32 AM