BRAC Bank logged 35% higher profit in 2023

BRAC Bank logged a 35 percent higher consolidated net profit after tax in 2023 amid challenging market conditions.

The bank's consolidated financials, which include all of its subsidiaries, showed a net profit after tax of Tk 828 crore in 2023, a significant increase from the Tk 614 crore reported in 2022, said a press release.

Its standalone net profit after tax was Tk 730 crore, representing an increase of 27 percent compared with that of the previous year.

Despite the stressed industry conditions, the bank delivered strong balance sheet growth, with deposits growing by 34 percent and loans and advances increasing by 26 percent.

In the first quarter of 2024, the bank's consolidated net profit after tax stood at Tk 318 crore, after an incredible 91 percent year-on-year growth.

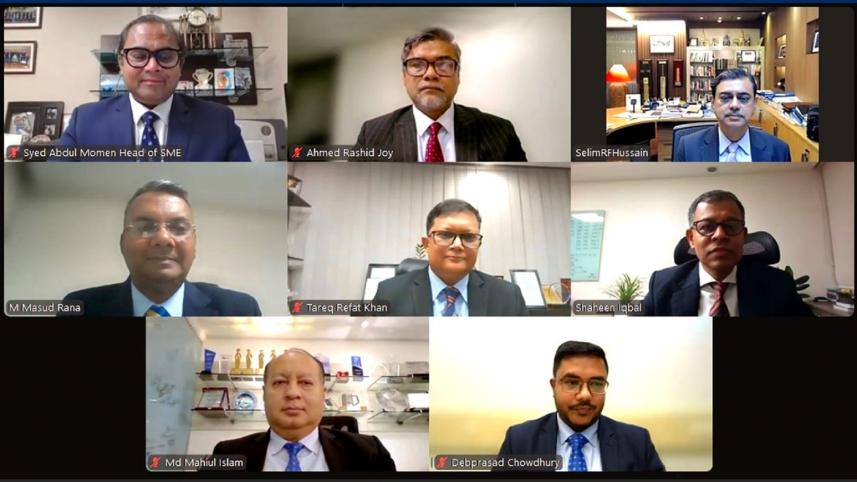

The lender's financial and operational accomplishments for FY 2023 and Q1 2024 earnings were unveiled at an earnings disclosure event, which was held virtually recently.

BRAC Bank's earnings per share increased to Tk 4.73 in 2023 from Tk 3.75 in 2022.

The bank's consolidated net asset value per share rose to Tk 41.36 from Tk 38.03 compared to the year prior.

The lender's loan portfolio grew by 26 percent year-on-year compared to average industry growth of 10.6 percent.

Its deposits grew 34 percent year-on-year despite average industry growth of 11.1 percent.

The bank's non-performing loans improved to 3.38 percent in 2023 from 3.72 percent in 2022 driven by prudent underwriting, monitoring and recovery initiatives.

Highlights of the bank's performance in Q1 2024 include that its consolidated earnings per share increased to Tk 1.70 while it was Tk 0.89 in the corresponding period of 2023.

Regarding the bank's financial results, Selim RF Hussain, managing director and CEO, said that the bank has achieved strong growth in line with its medium-term strategy.

"The bank's growth in deposits and loans is well above the industry average, and this is a testament to the customer's trust in the bank and its long-term sustainability," he said.

The bank has significantly upgraded its services and customer propositions in the last year through digital technology and customised products.

"We plan to continue this momentum and double our business by 2025," Hussain added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments