Banks’ capital base weaker than regional peers

The capital base of the banking industry in Bangladesh is much weaker than its peer countries in South Asia, which indicates their fragile financial health and poor brand image in the outside world.

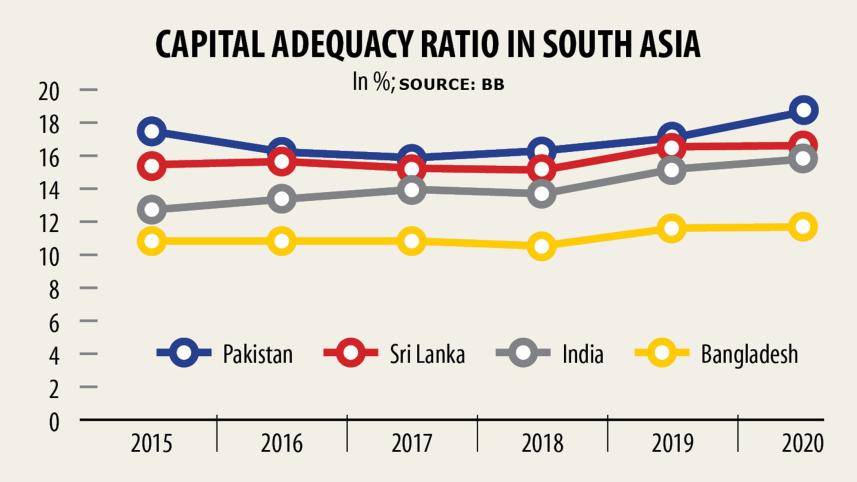

Banks maintained a capital adequacy ratio (CAR) of 11.60 per cent last year, way less than 18.6 per cent in Pakistan, 16.5 per cent in Sri Lanka, and 15.8 per cent in India.

This means the financial health of local banks is weaker than the lenders in the South Asian nations.

The CAR, also known as the capital to risk-weighted assets ratio, measures a bank's financial strength by using its capital and assets. It is used to protect depositors and promote the stability and efficiency of financial systems around the world.

It also reflects the ratio of defaulted loans, the capability to keep provisioning against regular and classified loans, and the actual corporate governance situation.

A Bangladesh Bank official says that the banking sector is going through a difficult time due to the ongoing business slowdown. So, the local banks need to fortify their capital base to minimise the downside risks.

The CAR reflects the overall financial health of lenders and is the topmost component of the CAMELS rating for banks, said Salehuddin Ahmed, a former governor of the central bank.

CAMELS, which stands for capital adequacy, asset quality, management, earnings, liquidity and sensitivity, is a recognised international rating system used to scale financial institutions using the six indicators represented by its acronym.

"The weak capital base points to the weak financial health of banks," Ahmed said.

In the past, only state-run banks used to experience a lower capital position. But the problem has recently spread to private banks due to a lack of corporate governance and poor management.

"Some 10-12 banks now perform well. But other banks are facing various problems," Ahmed said.

He blamed the high volume of defaulted loans for the lower CAR.

The NPLs in the banking sector stood at Tk 95,085 crore as of March, up 7.1 per cent from three months earlier and 2.8 per cent year-on-year.

Banks have to set aside a large amount of provisioning against the defaulted loans that ultimately hit the capital base.

This has also tarnished the sector's image and external lenders will show reluctance in doing business with local banks as well, according to Ahmed.

For instance, many local banks cannot open letters of credit (LCs) directly with banks in other countries due to their poor health. First, they have to secure an additional guarantee, known as "add confirmation", from other banks having a global presence.

So, local banks have to pay a hefty amount in charges and commissions to the confirming banks, adversely impacting the LC issuers' banks, Ahmed said.

In order to strengthen the capital base, the BB took initiatives to implement the Basel III guidelines by 2019.

Basel III is an internationally agreed set of measures developed by the Basel Committee on Banking Supervision in response to the global financial crisis of 2007-09 to improve regulations, supervisions and risk management within the banking sector.

As per a roadmap unveiled by the BB in 2014, banks were supposed to push up the minimum CAR to 12.5 per cent by December 2019 from 10 per cent then. But, the sector is far away from the benchmark.

"The global community does not know about the financial sector of Bangladesh. It usually knows the banks with large business volumes. Besides, the lower CAR has given a negative signal to them," said Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh.

He said local banks had not been able to expand their services to keep up with the changing time. Instead, their financial health had deteriorated.

Mansur, also a former official of the International Monetary fund, said the central bank had allowed some new banks to commence operation, and their capital base was still small.

"Corruption is another reason for the lower capital base."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments