Capital shortfall at banks widens

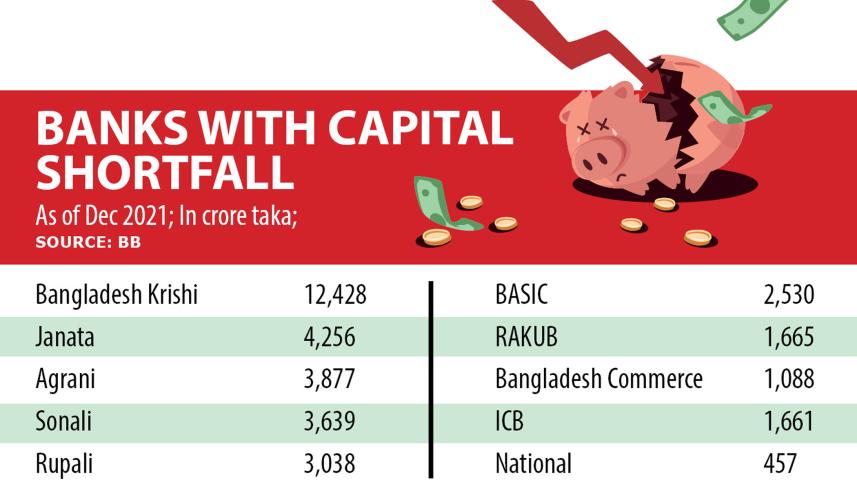

Ten banks in Bangladesh collectively faced a capital shortfall of Tk 34,639 crore in December, which highlighted their fragile health caused by years of irregularities.

The banks are Bangladesh Krishi, Janata, Agrani, Sonali, Rupali, BASIC, Rajshahi Krishi Unnayan, Bangladesh Commerce, ICB Islamic and National Bank.

Irregularities perpetrated at the banks are mainly responsible for the large capital deficit.

Bangladesh Krishi Bank had the highest capital shortfall of Tk 12,428 crore in December, up 15 per cent from a year ago, data from the Bangladesh Bank showed.

Sonali's shortfall widened to Tk 3,640 crore from Tk 3,063 crore during the period.

This led experts to call on the central bank to take immediate measures to address the problem as such a situation sends a negative signal to the international community and local businesspeople that the banking sector is weakening.

Foreign businesses usually look at the capital base and non-performing loans of banks before making any investment decisions. This level of the capital shortfall puts foreign investors at bay, they said.

The volume of the overall surplus capital in the banking sector decreased to Tk 10,843 crore in December, a decline of 32 per cent year-on-year.

The amount of default loans at banks rose last year, bringing a negative impact to the capital base in the sector.

Default loans at 60 banks operating in Bangladesh surged 16.38 per cent year-on-year to Tk 103,274 crore in 2021.

Banks have to set aside a large amount of provisioning against the defaulted loans that ultimately hit their capital base.

The capital adequacy ratio (CAR) also reduced to 11.08 per cent last year in contrast to 11.64 per cent the year prior, due to the reduction of capital.

The CAR, also known as the capital to risk-weighted assets ratio, measures a bank's financial strength by using its capital and assets. It is used to protect depositors and promote the stability and efficiency of financial systems around the world.

The capital base of the banking industry in Bangladesh is much weaker than its peer countries in South Asia, according to the financial stability report of the BB.

The CAR stood at 18.6 per cent in Pakistan, 16.5 per cent in Sri Lanka, and 15.8 per cent in India in 2020.

A BB official said says many local banks can't open letters of credit (LCs) directly with banks in other countries due to their poor health.

As a result, they have to first secure an additional guarantee, known as "add confirmation", from other banks having a global presence. This means local banks have to pay a hefty amount in charges and commissions to the confirming banks, adversely impacting the LC issuers' banks.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments