Pubali Bank steps up efforts to grow digitally

The presence of vibrant corporate governance and adoption of technology-driven means have helped Pubali Bank go from strength to strength in widening its banking operations.

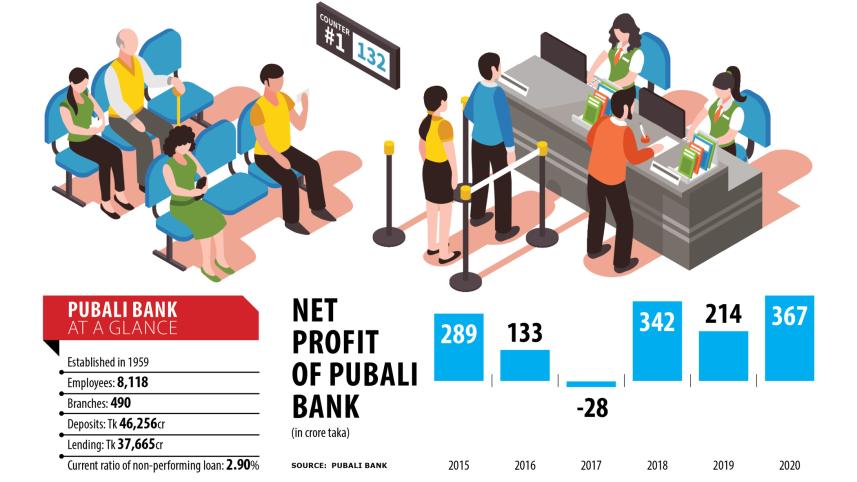

Established in 1959, the lender has turned itself into a model for the country's banking sector.

It is now running both physical and digital operations to reach out to general people across the country.

"We have been carrying out banking operations for 64 years. Yet, we are moving forward in an expansionary mode," said Pubali Bank Managing Director Safiul Alam Khan Chowdhury in an interview with The Daily Star recently.

A long journey ensuring good governance year after year is rare in the country's banking sector, but the lender has done it in an efficient manner.

The ratio of default loans, one of the major indicators of the financial strength of a bank, stands at 2.90 per cent for Pubali Bank, way lower than the industry average of 8.12 per cent.

"We have an unparalleled and proficient board of directors in terms of firm commitment and positive attitude for maintaining corporate governance in all tiers of the bank," Chowdhury said.

The board has provided full freedom to the management, allowing it to run the bank smoothly and playing a pivotal role in expanding its footprint.

The bank has clocked 20 per cent growth for the last 10 years. Loans, import and export facilitation, remittance conveyance and profit figures -- all point to a continual increase.

For instance, loan disbursement posted a 19.36 per cent increase and deposits grew 7.76 per cent in 2021 compared to that in the previous year.

Export financing logged a growth of 45.58 per cent while import financing surged 70.35 per cent.

"Despite the achievements, we are not complacent. We are not going to stop our journey here. Rather, we plan to go big based on digital means," said Chowdhury, who started his career as a probationary senior officer at the bank in 1983.

He has been serving the bank for the last 39 years. In April last year, he was promoted to the post of managing director from additional managing director.

Although the bank has a strong physical presence for serving rural people, it has already put in place various digital means to extend its operations to tech-savvy youths.

It has 490 branches, 39 sub-branches and 17 Islamic banking windows in remote and urban areas of Bangladesh.

"The future of banking will be different. That's why we are rapidly embracing digital technologies and solutions to capture it as early as possible," Chowdhury said.

The 21st century is referred to as the digital age. Besides, the coronavirus pandemic has impacted people's lifestyles and organisational behaviour. The change in the situation has driven customers to rely more on digital channels to access financial services.

The new normal has also turbocharged the bank's efforts to speed up the digital transformation.

Pubali Bank already has a real-time centralised online banking network making use of in-house banking software. It is providing internet banking, mobile banking and card services (debit and credit).

The bank launched an app-based banking product named "PI Banking" in August 2020. In addition, e-KYC (electronic know your customer) and an instant e-KYC-based account opening system have already been rolled out.

Pubali Bank is now working to develop software for QR code-based payment systems.

The intra-bank online banking is totally charge-free, irrespective of the amount and frequency, another relief for clients.

"The bank has no hidden charge for maintaining accounts, offering loans or keeping deposits," said Chowdhury, who attained a postgraduate degree from the University of Dhaka.

"We have a dedicated workforce to materialise the bank's goals."

"We address grievance management, gender equality, timely promotion and pay scale. There exists a congenial environment in ensuring job satisfaction and competency development," Chowdhury said.

The bank has also set up a retired employees' welfare fund so that they can get support from the lender when any of them faces critical situations.

Pubali Bank sets aside Tk 50 lakh from its net profit per year to expand the fund, which has now reached Tk 6 crore.

The bank has also put in efforts to implement the government's National Financial Inclusion Strategy to bring the unbanked people under the formal financial sector.

Most of the banks are not interested in opening branches in rural areas as it is costly and takes a long time to break even.

Although the far-off areas of Bangladesh have a robust presence of mobile financial services and agent banking, all financial services cannot be provided through the two windows, Chowdhury said.

"So, the policy of setting up a sub-branch is undoubtedly a good initiative taken by the central bank. This is cost-effective and client-friendly."

Pubali Bank has decided to set up more than 215 sub-branches within two years.

The veteran banker also touched upon some important issues facing the economy.

"There will be further domestic inflationary pressure this year," he said, adding that remittance flow may also slow down.

The country also faces excessive pressure from foreign exchanges due to higher imports. But the stimulus packages declared by the government have already started to offset the crises efficiently.

And the ending of the moratorium facility will have little impact on the default loans, according to Chowdhury.

"However, further policy support, if extended, will be helpful for banks."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments