State banks not keen on Padma’s merger request

Managements of the state-owned banks are in a state of discomfort after being informed about the Padma Bank's wish to get merged with a state lender.

If Padma Bank is merged with any state bank, the financial health of the lender will worsen more in the days ahead, said managing directors and senior officials of the lenders.

Padma Bank, the erstwhile Farmers Bank, in a letter to the finance ministry on August 8, said it intends to merge with any state lender in order to avoid a "potential catastrophe".

The beleaguered lender requested the government for allowing it to be merged with any state bank – Sonali Bank, Janata Bank, Agrani Bank, Rupali Bank and Bangladesh Development Bank.

Default loans in the five banks stood at Tk 35,850 crore as of June this year, which is 18.12 per cent of their total outstanding loans, according to data from the central bank.

Md Abdus Salam Azad, managing director of Janata Bank, said his bank was already facing different types of problems.

"The financial indicator of the state bank will worsen if Padma is merged with the lender," he said.

Janata Bank will have to take over all loans of Padma Bank if it merges with the latter, he said.

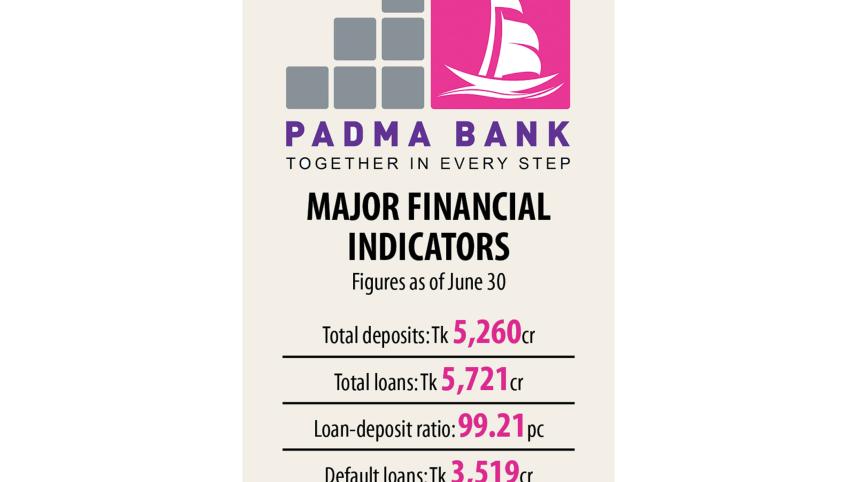

As of June this year, non-performing loans in Padma Bank stood at Tk 3,519 crore, or 61.65 per cent of its outstanding loans.

"Such a large amount of default loans of Padma will put an adverse impact on Janata," he said.

Mohammad Shams-Ul Islam, managing director of Agrani Bank, said he was not aware of the merger proposal.

"I am a director of the Padma Bank board but I did not get to know anything about the merger process. The proposal has not even got approval from the Padma's board," he said.

As per a government decision, the Investment Corporation of Bangladesh (ICB), Sonali, Janata, Agrani and Rupali together injected Tk 715 crore in the form of capital in 2018 into Padma in order to bolster its financial health.

Managing directors of the four lenders and the ICB have been serving as board members of the Padma since then.

Islam, however, said his bank would take a decision to this end as per government instructions.

The Daily Star talked to a good number of high officials of the rest of the state lenders regarding the issue.

All of them expressed dissatisfaction over the proposal as merging with Padma Bank would not bring any good for them.

The finance ministry yesterday forwarded the letter to Bangladesh Bank, requesting it to take a decision.

Md Serajul Islam, spokesperson and an executive director of the central bank, said there was no scope to make any comment immediately as he had not yet read the letter.

Another central bank official, however, said Padma Bank had not given any specific proposal in its letter on how it could be merged with any other bank.

It is not the central bank's task to identify a suitable lender for completion of the merger on behalf of Padma Bank, he said.

If Padma Bank gets into any agreement with a state lender, the central bank may take a decision on the issue, according to the guidelines for merger and amalgamation.

Established in 2013 as Farmers Bank, the lending agency had fallen prey to scamsters.

A Bangladesh Bank investigation found that more than Tk 3,500 crore was siphoned off between 2013 and 2017.

The bank fell in deep trouble after depositors, which included government agencies, started pulling out their money as allegations of corruption arose against Muhiuddin Khan Alamgir and Md Mahabubul Haque Chisty, the then board chairman and chairman of the audit committee respectively.

In the letter sent last month to the ministry, Padma Bank said it faced a lot of constraints after the start of its new journey, including a severe shortfall of liquidity.

The bank said the Covid-19 pandemic affected credit growth as well as realisation of non-performing loans, causing losses to rise. "As such, our capital is declining noticeably," read the letter signed by Managing Director Md Ehsan Khasru.

The Covid-19-induced challenges led to operating losses of Tk 120 crore in the first half of 2021. As a result, shareholders' equity declined to Tk 221 crore, down from Tk 332 crore at the end of last year.

If the current trend continues, equity will decline to Tk 100 crore by the end of this year, it said, adding that it could maintain Tk 173 crore as provision against a requirement of Tk 1,645 crore.

Padma Bank said its capital shortfall would amount to Tk 2,100 crore as of June this year.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments