Competition choking small cement makers

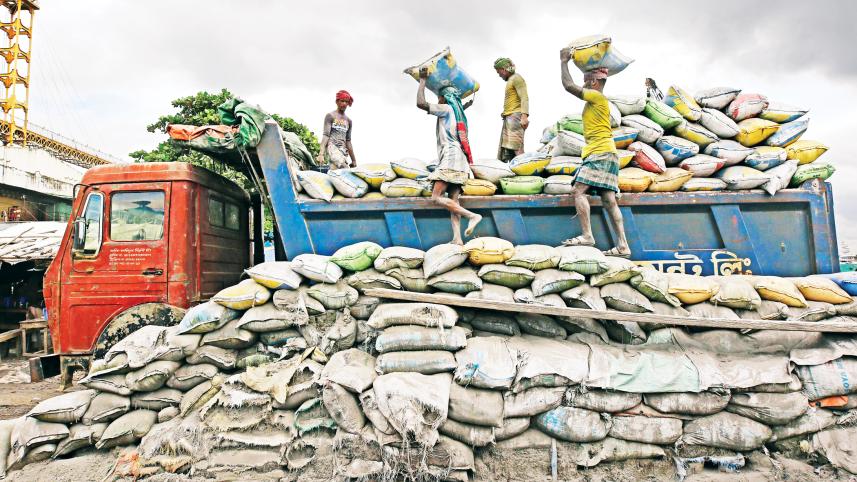

Rising freight rates globally for demand recovery and supply disruptions as well as an increase in transport costs locally owing to a hike in diesel prices have made it difficult for small-scale cement manufacturers to compete in Bangladesh.

"Small-scale cement makers are facing acute competition from their more established counterparts as there is over-manufacturing in the industry," said Syed Kamruzzaman, company secretary of Aramit Cement.

The company currently has a low production capacity and so its main market is restricted to Chattogram and its adjoining districts.

"If we expand our market, it would not be commercially viable," he said.

Regarding the recent market scenario, Kamruzzaman said sales fell slightly in the last quarter due to a lower number of orders.

With this backdrop, he alleged that the Bangladesh Cement Manufacturers Association (BCMA) is a practically non-effective organisation as it does not play its due role in favour of cement makers.

"The shipping cost was $17 per tonne just a month ago and it has since increased to $24 per tonne," Md Alamgir Kabir, president of the BCMA, said on February 15.

This has had factories doling out more money for production, the BCMA said in a statement, adding that it would not be possible for cement makers to sustain losses for a long time.

A senior official of Royal Cement, on condition of anonymity, said since large manufacturers want to grab the market, small manufacturers are struggling to survive.

He alleged that the BCMA decides to adjust prices to ensure their survival but large manufacturers do not follow the decision as they are capable of running their business at a minimum profit margin. However, the same is not possible for small manufacturers.

Nine large companies -- Shah Cement, Bashundhara Cement, Fresh Cement, Premier Cement, Seven Rings Cement, Crown Cement, LafargeHolcim Bangladesh, HeidelbergCement Bangladesh, and Akij Cement Company -- collectively control 85 per cent of the domestic market.

The remaining 15 per cent is catered to by other manufacturers, said the official. Mohammed Amirul Haque, managing director of Premier Cement, said manufacturers will have to make commercial adjustments as shipping costs are increasing.

Regarding the sufferings of small-scale manufacturers, he suggested improving their business strategy and reducing production costs.

However, he does an issue with the struggles of small-scale operations as they entered the sector to do business but have seemingly done so without conducting any research beforehand.

Haque sees a good future for the cement sector as consumption will increase in rural areas along with rising urbanisation and economic development.

Md Shahidullah, managing director of Metrocem Cement, said small manufacturers are facing difficulties to keep their businesses afloat due to high competition in the industry.

If small manufacturers intend to continue operations, they will have to increase their capacities through investment or mergers with other manufacturers.

"My business is an example as it is at the point where we would need to merge to survive. However, I will not merge. Instead, I will try to run it at any cost," he added.

Despite the industry's growth, Bangladesh is still one of the lowest consumers of cement products in the world with per capita cement use standing at 200 kilogrammes.

There are 37 active cement factories in Bangladesh with a combined annual production capacity of 58 million tonnes against the local demand of 33 million tonnes.

Annual consumption stood at about 33.4 million tonnes in the fiscal year of 2020-21 and is forecast to increase by high single digits in the current fiscal year.

According to the annual report of LafargeHolcim Bangladesh, construction activities have returned to normalcy across the country with most projects and the individual housebuilder segment picking up pace.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments