Uneven recovery in garment industry

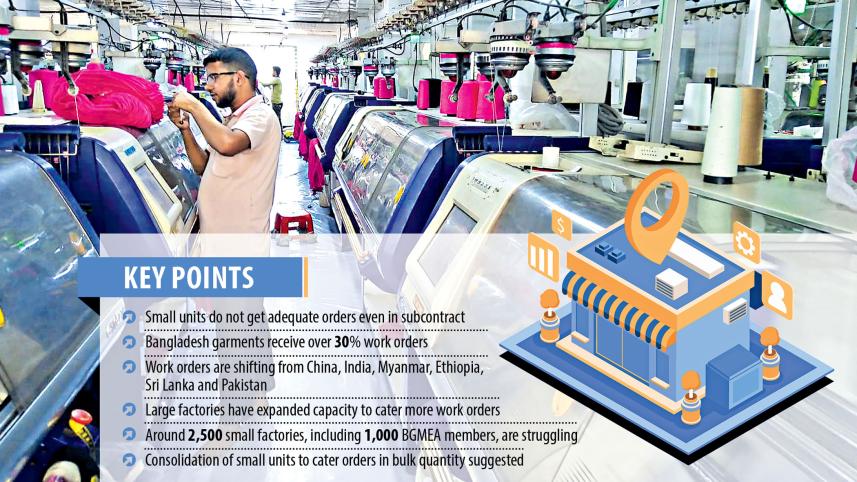

Bangladesh's garment industry might be brimming with export orders from international buyers thanks to the ongoing turnaround of the global apparel supply chain, but it is the larger units that are running in full swing while smaller ones have been pushed into corners.

More than 1,000 small members of the Bangladesh Garment Manufacturers and Exporters Association (BGMEA) and nearly 1,500 non-member factories are not getting enough orders to survive.

What is worse, the small factories that have been fortunate to keep factories up and running are not receiving expected prices.

Amid the slump in business, many small factories are already closed and many are planning to follow suit because of the lower flow of work orders and lower prices.

And this is happening at a time when Bangladesh's garment industry has been receiving a record volume of export orders for several months now.

In keeping with the recovery of the supply chain from the severe fallouts of Covid-19, a lot of work orders are shifting from China, Myanmar, Ethiopia, Vietnam, India and Pakistan to Bangladesh, thanks to competitive price, uninterrupted supply even during covid-19, and globally standard safety and compliance in major big garment units.

But smaller factories have been hamstrung by poor compliance, weaker financial strength, lack of modern machinery, skilled workers and negotiation skills, and their inability to produce value-added high-end garment items. As a result, most of them are involved in sub-contracting and producing basic garments.

For instance, Md Saidur Rahman, managing director of Bakul Apparels Ltd in Savar, closed his factory in July last year as he was not receiving an adequate volume of orders and prices.

His factory was shut due to the shortage of orders at the onset of Covid-19 in March 2020. At that time, he paid Tk 26 lakh every month in salaries to 150 workers. Later, he was forced to sell machines and shut the factory.

Now, he is trying to revive his garment business with three friends.

Rahman used to produce woven trousers and knitted products mainly on a sub-contract basis. "So, the price was low," said the entrepreneur, who made a foray into the business in 2019.

Since it was a small factory, it could not maintain high compliance and the retailers and brands did not place orders directly with it. Moreover, he could not avail of the soft loan from the government-sponsored stimulus fund because of the stringent conditions of banks.

"The small factories need special attention," Rahman said.

Mahbubul Alam Ripon, executive director of A R Knitting at Hemayetpur, also in Savar, says he produces 60,000 pieces of sweaters a month mainly as a subcontractor but the flow of orders is not adequate to make a good profit.

His factory lost Tk 2 lakh a month in salaries for his 30 workers and other operational costs. If orders keep coming regularly, he can make Tk 2 lakh to Tk 3 lakh per month.

In 2019 and 2020, when the business was dull, Ripon sold 12 out of 40 sweater making machines to bear expenses and survive.

"However, the abnormal price hike of raw materials like yarn and needles are affecting the business," he said.

Shamim Ahsan, managing director of Bluetex Knitwear Ltd, a Savar-based small factory, has been able to attract orders as he has improved the compliance. He employs 250 workers.

"But the price is not up to the mark," he said.

Ahsan also faced a lot of challenges but he is hopeful that he will be able to come back as he is getting orders now.

The entrepreneur ships garment items worth $2.50 lakh per month.

"About 1,000 small member factories are in trouble as they are not getting an adequate amount of work orders. We are providing them technical supports and have reduced the service charge at the BGMEA so that they can get a small relief," said Faruque Hassan, president of the BGMEA.

Khondaker Golam Moazzem, research director of the Centre for Policy Dialogue, suggested the consolidation of some small factories so that they can cater bulk orders with a view to growing bigger.

"With the increased flow of orders, the bigger units have expanded their capacity, so they are not placing many orders with subcontractors."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments