Govt guarantee for state enterprises’ loans on the rise

The government guarantee given to state enterprises against their loans edged up further this fiscal year as demand from agencies seeking support security to generate power, and provide food and fertilisers at subsidised prices has increased.

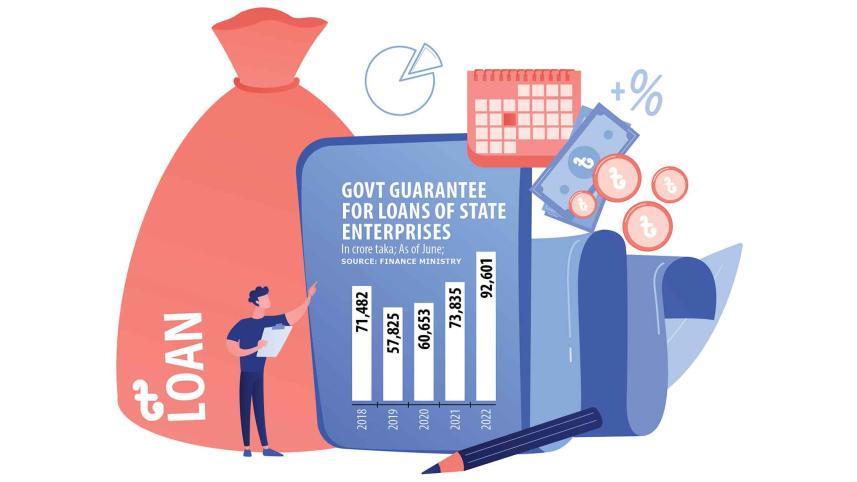

The state's guarantee given to publicly owned enterprises is going to rise 25 per cent to Tk 92,601 crore in the next fiscal year from Tk 73,835 crore in the outgoing fiscal year, according to budget documents released by the finance ministry.

This is the third consecutive year the government guarantee against loans negotiated by various state-owned financial institutions and non-financial enterprises has spiked.

If the state agencies fail to pay back their loans in time, the guarantees are invoked and liabilities for payment are passed on to the government, the finance ministry said in a budget brief for the fiscal year starting on June 30.

This may have future fiscal implications, it added.

Economists said the government should be cautious of the burden of guarantee as contingent liabilities of the government are increasing. In case of failure on behalf of the enterprises, the state will have to pay back the loan to the lenders.

Analysts recommend the government should consider the viability of the enterprises and examine whether the security that would be given to the organisation is worthwhile, he added.

At the end of the fiscal year ending in June 2019, the government guarantee given against loans to state agencies was Tk 57,825 crore. The amount grew later.

As of this June, the government guarantee given to the Trading Corporation of Bangladesh for buying various essential commodities such as soybean oil, lentil, sugar and onion increased to Tk 1,652 crore from around Tk 500 crore a year ago.

Its guarantee for fertiliser imports by the Bangladesh Agricultural Development Corporation (BADC) more than doubled to Tk 10,281 crore as of June 2022 from Tk 4,559 crore.

The security given against loans taken by state-run power companies increased to Tk 49,515 crore this year from Tk 41,692 crore a year ago, according to the finance ministry.

The finance ministry said the guarantee will be valid beyond June 30 this year.

Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh, said the government has to take the liability of the loans in case the state enterprises fail to pay back the money.

"Ultimately, the loan taken by Biman has to be borne by the government," he added.

Mansur went on to say the burden of public debt and publicly guaranteed debt falls on the government and the guarantee given by the government as of June 30 this year is a sizable amount.

"The government should be careful about loans, whether the fund borrowed by a state enterprise is worthwhile," he said. "At the same time, the government takes the total debt, including loans borrowed by the private sector from abroad, because it will have to bear the burden in case of their failure to pay."

Khondaker Golam Moazzem, research director of the Centre for Policy Dialogue (CPD), said the government guarantee is supposed to increase as the flow of grants declined.

"We are going for more commercial loans," he said.

He said the government should be alert regarding giving guarantees.

"It should consider the viability of the organisation," Moazzem added.

Debapriya Bhattacharya, distinguished fellow of the CPD, said estimates of contingent liabilities are not fully transparent and figures are not usually accessible.

"This is one of the critical problems of our fiscal accounting," he added.

Second, the contingent liabilities are not included through overall public debt assessment, which leads to deceptively lower figures of debt stock and debt servicing.

"This then remains as an off-budget financing."

Third, he said, prudential fiscal management would demand certain limits on incurring contingent liabilities.

"All three violations put Bangladesh's fiscal management under risk. Finally, such fiscal accounting practices do not allow us to objectively assess the economic viability of the beneficiary state-owned enterprises."

In his book, called "Bangladeshe Budget: Orthoniti O Rajniti" (Budget of Bangladesh: Economics and Politics) published in March 2021, Akbar Ali Khan, former finance secretary and adviser to the caretaker government, said the government does not allocate funds against the guarantees it gives.

He suggested the government determines the actual amount of contingent liabilities and allocates possible annual amounts in the budget for the sake of transparency.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments