Govt moves to train insurance risk analysts

- Government drafts ordinance to establish actuarial institute

- Severe actuary shortage hampers insurance industry

- Idra seeks feedback on proposed legislation

- New council to regulate professional standards

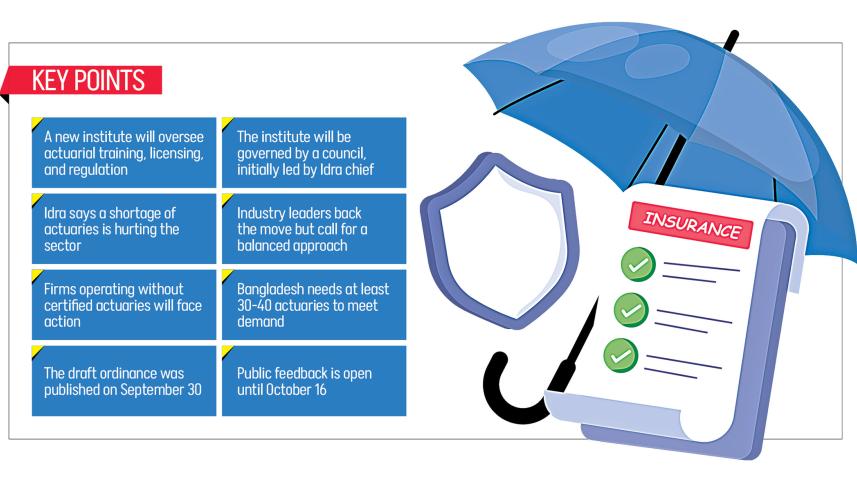

The government is considering setting up an institute to provide education, training and examinations for professional financial risk analysts in the local insurance sector, while also overseeing their professional conduct.

A draft ordinance to this effect has been prepared and made public in September.

The Insurance Development and Regulatory Authority (Idra) has invited feedback from stakeholders, experts and the public on the Bangladesh Actuary Ordinance 2025 until October 16.

Professionally, such financial risk analysts are known as actuaries. Their work combines the skills of a data scientist, economist and forecaster.

Within insurance companies, actuaries quantify financial risks to ensure stability and profitability.

They use mathematics and statistics to design products and set premiums that are both competitive and sufficient to cover future claims.

They also determine the reserves a company must maintain to guarantee payment of all policyholder claims. Besides, actuaries model catastrophic risks and advise management on strategies to protect the firm from insolvency and ensure its long-term financial health.

Despite having more than 80 insurance companies, the country currently has only three or four actuaries, some of them based abroad, according to a senior figure in the Bangladesh Insurance Association.

"We need 30 to 40 actuaries to work well. With that number, the industry can be managed well by sharing resources," said Adeeba Rahman, first vice-president of the Bangladesh Insurance Association and sponsor director of Delta Life Insurance.

Saifunnahar Sumi, consultant for media and communication at Idra, also said there is a pressing need to enact comprehensive actuarial legislation.

She said every life insurance company is required to appoint a professional actuary under the Actuarial Qualification and Responsibility Regulations 2023. However, most firms have failed to comply because of a shortage of qualified actuaries in Bangladesh.

Sumi said such a law would establish a legal framework for the profession, nurture qualified actuaries, regulate and raise professional standards, and eventually promote transparency and accountability across the insurance industry.

According to the draft, the ordinance will come into force through a government notification in the official gazette, as there is currently no parliament. It will formally establish the proposed institute.

The Actuarial Society of Bangladesh, now the sole professional body for actuaries, will be dissolved once the new institution is formed.

A council will be created to manage and administer the institute. The Idra chairman will be the president for the first three terms by virtue of office.

Council members will elect a vice-president, general secretary and treasurer from among themselves, and seven fellows or associates of the institute will be nominated as council members.

The draft also outlines acts of professional misconduct.

For example, an actuary will be considered guilty if they pay or authorise payment of any portion of professional fees, commissions or remuneration to anyone who is not a member. Allowing a non-member or an unqualified member to sign valuation reports or financial statements on their behalf will also be treated as misconduct.

An actuary will be deemed to have acted improperly if they engage in any business or occupation not approved by the council and unrelated to the actuarial profession.

The council will have the authority to remove a member from the register if they are found guilty of misconduct, fail to pay membership fees for up to three years, or in the event of death, according to the draft.

Only members holding a valid certificate of practice from the council will be authorised to work as actuaries in Bangladesh. Every member, except student members, may use the title "Actuary".

The draft further mentions that any company, local or foreign, carrying out actuarial work without registered members will commit an offence under the ordinance. Similarly, no one other than a registered member may sign professional documents on behalf of the institute.

No case under the ordinance may be filed except by the government, a relevant authority, the institute, the council or an authorised representative.

Mohammad Sohrab Uddin, an actuary and former deputy governor of the Bangladesh Bank, welcomed the move, saying the number of qualified actuaries in Bangladesh is far below what the industry requires.

"The initiative to set up an actuarial institute is undoubtedly a timely step," he said, adding that while many countries around the world have their own actuarial institutes, Bangladesh still does not have one.

"If the government succeeds in setting up such an institute, it will greatly contribute to enhancing transparency in the insurance sector as well as other related financial industries," said Uddin, also a former chairman of Sadharan Bima Corporation.

Bangladesh currently has 82 insurance companies, including 36 life insurers and 46 non-life insurers.

Meanwhile, the chief executive of a leading insurance company expressed concern about the inclusion of government officials and agency executives in the new council.

"This is unusual for a professional body. Over time, it might effectively become just a department of the Idra," he said, requesting anonymity.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments