Hike in key interest rate: Case for lifting lending rate cap strengthens

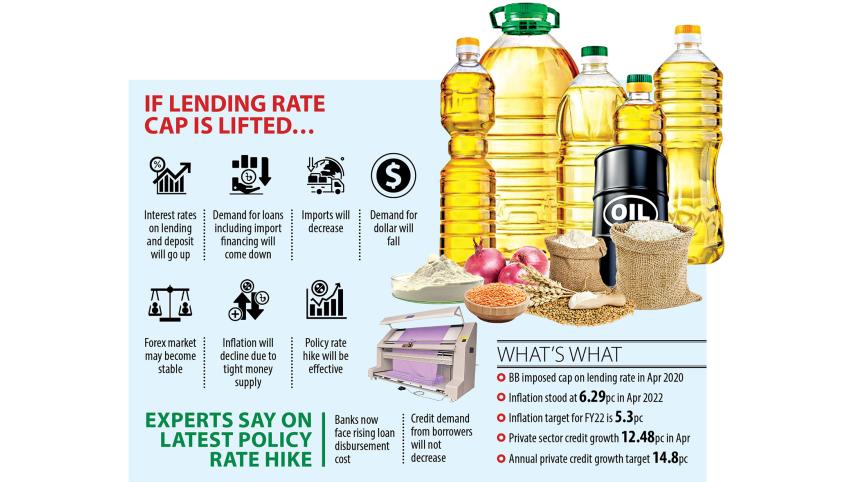

The case for withdrawing the lending rate cap, set in motion more than two years ago, has strengthened after the Bangladesh Bank hiked its key interest rate for the first time in a decade to cool inflationary pressures.

Experts urged the central bank to move away from the ceiling in order to bring back stability to the financial sector, which is facing a crisis owing to depleting foreign currency reserves and the devaluation of the local currency.

They described the hiking of the policy rate by the Bangladesh Bank by 25 basis points on Sunday as time-befitting and called on the BB to abolish the lending rate cap to make it effective.

The central bank imposed the interest rate cap on loans on April 1, 2020, as per the direction of the government. In August last year, it asked lenders not to set the deposit rates on fixed-term deposits below the inflation rate, as higher consumer prices have turned the actual return on such savings negative.

Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh, said that the taka would become dearer if the central bank withdrew the lending cap.

"Hiking the policy rate will not be able to reduce the credit demand unless the interest rate cap on lending is withdrawn."

The increase in the key lending rate of the BB, the repurchase rate at which a central bank lends money to lenders, to 5 per cent means banks will have to pay more to borrow. So, lenders will have to adopt a cautious stance while disbursing loans.

The policy rate hike will not tighten the money supply to a significant level, Mansur said.

But if the interest rates on loans go up, clients will not feel encouraged in borrowing from banks. Similarly, if the deposit rate increases in keeping with the lending rate, it will provide better returns to savers and allow banks to woo funds.

"This will make keeping the taka at banks attractive," said Mansur.

The withdrawal of the lending rate cap is also expected to bring back stability to the foreign exchange market.

Mansur also explained that the cost of funds for import financing would go up when the lending cap is withdrawn.

Banks are allowed to charge a maximum of 9 per cent for post-import financing.

"Importers will take a cautious stance when the interest rate on post-import financing moves higher," said Mansur, also a former official of the International Monetary Fund.

This will rein in import payments, which have gone up exponentially in recent months owing to the higher commodity prices in the global markets and the weakening of the local currency at home.

Bangladesh's import payments stood at $61.52 billion between July and March, up 44 per cent year-on-year, while exports grew 33 per cent to $36.61 billion.

The large import payments created a record trade deficit of $24.90 billion in the first nine months of the current fiscal year ending in June. This has compelled the central bank to inject more than $5.83 billion into the market, sending foreign exchange reserves low.

The reserves stood at $42.29 billion on May 25 in contrast to $46.15 billion on December 31.

The surge in imports, which are needed to feed the economy rebounding from the pandemic-induced slowdown, has also created tremendous pressure on the taka, compelling the central bank to depreciate the local currency seven times this year alone.

The latest devaluation came on Sunday when the taka was allowed to lose value by 1.25 per cent to Tk 89.

A BB official said that import financing was one of the main reasons behind the recent upward trend of credit growth in the private sector. The credit growth stood at 12.48 per cent in April, albeit slower than the BB's target of 14.8 per cent for the current fiscal year.

The curb in imports may lead to a decline in domestic demand, which will ultimately go on to help the government tame inflation, which rose to an 18-month high in April.

Salehuddin Ahmed, a former governor of the central bank, says that the central bank should withdraw the interest rate cap on lending as it will help ease the inflationary pressure.

He also suggested the central bank not impose any ceiling on the exchange rate of the taka against the US dollar.

Mustafizur Rahman, a distinguished fellow of the Centre for Policy Dialogue, urged the government to revisit the rates on loans and deposits.

Senior bankers also voiced concerns that lenders would face difficulties in running banking operations unless the lending rate ceiling is removed.

Profitability in banks will decrease because they have to borrow at a higher rate from the BB and lend to clients at 9 per cent.

Mashrur Arefin, managing director of City Bank, says Bangladesh has increased the policy rate like in most other countries.

"This is now the highest repo rate in recent years. It indicates that the call money rate will go up soon. The liquidity condition is already under pressure. If the lending rate cap isn't lifted, I hope the central bank will bring some flexibility."

Syed Mahbubur Rahman, managing director of Mutual Trust Bank, also urged the central bank to reconsider the lending cap.

Md Habibur Rahman, chief economist of the central bank, said: "We are not thinking about the lending rate cap at the moment. We are now observing the market."

"We will take measures to this effect if required."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments