Liquidity stress major concern for banks

The ongoing liquidity stress has become a major concern for Bangladesh's banking sector as people hardly park funds with lenders due to higher consumer prices, which have turned the return on deposits negative, said a top banker.

"The deposit growth has declined in recent times as the common people are now struggling to cope with the escalating inflation," said Syed Mahbubur Rahman, managing director of Mutual Trust Bank (MTB), in an interview with The Daily Star last week.

Bangladesh Bank data showed the deposit growth fell to 9.35 per cent in June this year from 13.80 per cent in the same month in 2021.

Inflation sat at a multi-year high of 9.10 per cent in September, owing to escalated commodity prices in the global markets, a surge in import bills, and a depletion of foreign currency reserves.

In turn, the interest rate on bank deposits is 6 to 7 per cent, making the return negative.

Amid dollar shortages, the central bank has injected more than $4.50 billion into the market so far this fiscal year to help businesses clear import bills, which have worsened the liquidity base at banks, Rahman said.

Banks have to buy the greenback in exchange for the local currency.

Rahman hopes that the ongoing stress in the foreign exchange market may ease in the next couple of months if remittance inflow and export earnings receive a boost.

The opening of letters of credit, known as import orders, is already slowing down, he said. "This is a good sign for the economy."

LCs amounted to $12.4 billion were opened between July and August, the first two months of the ongoing fiscal year, in contrast to $12.3 billion a year earlier.

The noted banker praised the central bank for taking time-befitting measures to rein in imports, which hit a record high of $82.49 billion in the last fiscal year, which ended in June.

"We should, however, continue the imports of capital machinery and industrial raw materials. Otherwise, the productive sector will face a setback, which will impact export earnings adversely," he said.

"If the manufacturing sector suffers any setback, borrowers may turn into defaulters. Under such a situation, the unemployment rate may increase, which may stoke social disturbance."

The war in Ukraine has altered global patterns of trade, production, and consumption of commodities in ways that will keep prices at high levels through the end of 2024 exacerbating food insecurity and inflation, the World Bank has warned.

"So, policymakers should address the issues with the utmost importance and take appropriate measures to resolve the downside risks," Rahman said.

He recommended banks lay emphasis on fortifying their capital base so that they can absorb shocks emanating from any credit or other risks.

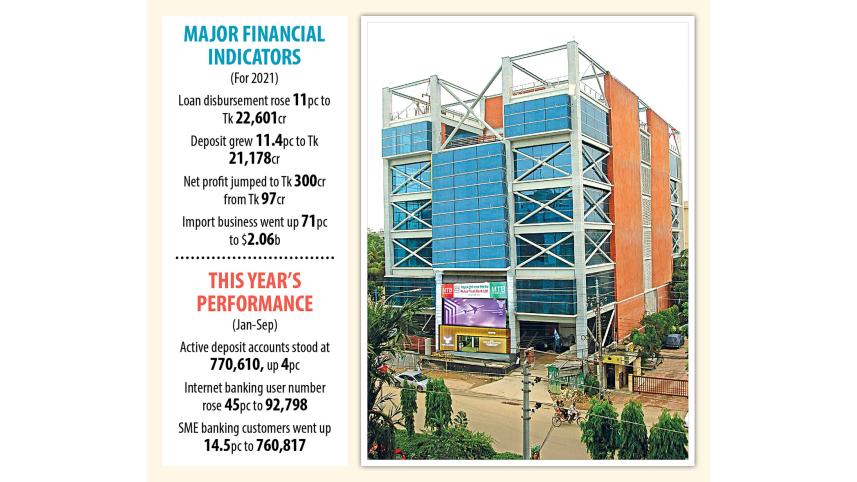

Rahman's interview comes as MTB, one of the strong banks in Bangladesh, celebrates its 23rd founding anniversary today.

Default loans at the bank accounted for 5.54 per cent of its outstanding credits of Tk 24,065 crore in June, much lower than the industry average of 9 per cent.

Loan disbursement stood at Tk 22,601 crore as of December, up 11 per cent from a year ago. Deposits grew 11.4 per cent to Tk 21,178 crore.

Rahman, who joined the bank in December 2019, praised the board of directors for not intervening in the day-to-day operations, thus allowing the management to run it while maintaining efficiency.

Considering the ongoing challenges in the banking sector, MTB, which began its journey in 1999, is running operation in a cautious manner and has thus geared up its efforts to keep the quality of its assets in good shape.

"We have given all-out efforts to bring down stressed assets," he said.

The ideal relationship between the management and the board has helped the bank win a number of awards, at home and abroad.

For example, the BB recognised MTB as one of the top 10 sustainable banks in 2020. It also received a letter of appreciation from the central bank last year for hitting the central bank target on loan disbursement under the Covid-19 CMSME stimulus package.

On top of that, Global Finance, a North American financial publication, named MTB as the World's Best Consumer Digital Bank" in Asia-Pacific in 2022.

"But we are not complacent. We have already set a roadmap to widen our banking services through the implementation of various digital programmes," Rahman said.

In order to make the remittance transfer process smooth, MTB has incorporated automation, enhancing the service, disbursement and reconciliation process.

"We have inked deals with some global financial technology companies to bring in remittances and such partnerships are helping us become a strong player in the field of remittance," he said.

MTB has also started giving out SME loans through the platform of a local fintech, which furnishes the bank with information about potential borrowers.

After scrutinising the credit application submitted by borrowers, the bank now offers small-scale loans to entrepreneurs, said Rahman, who attained an MBA from the Institute of Business Administration at the University of Dhaka.

"We will distribute the majority of SME loans through the digital platform in the coming years."

MTB has also decided not to set up branches aggressively as it looks to use technologies to offer banking services to a population increasingly embracing digital banking.

Under the traditional branch-led banking model, banks have to spend a hefty amount to offer services. But such expenditure is not needed to provide services through digital banking, Rahman said.

The number of internet banking users of the bank increased from 64,112 in December 2021 to 92,798 in September this year. Currently, MTB has 119 branches and 36 sub-branches.

Its banking app – MTB Smart Banking – has gained popularity among clients. The app allows people to open accounts and customers to access account statements, do mobile top-ups, transfer funds, pay utility bills, merchant bills and pay credit card bills, and transfer funds to accounts of mobile financial services.

Recently, the private commercial bank launched MTB Virtual Prepaid Card for account-holders.

Through the app, customers can create their own card and transfer funds from accounts to the card and use them during shopping, explained Rahman, who started his banking career in 1988.

"As a result, customers will not have to carry any physical cards."

The bank has also introduced a business credit card, the first of its kind in Bangladesh. Under the facility, the same credit card can be used by several members of a corporate employer.

"We are giving efforts to strengthen our workforce to reach our goals. We will put more focus on digital banking since it is the future."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments