Political, energy crises stifle investment

Persisting political uncertainty and energy crisis are holding back investment growth in Bangladesh, business leaders and policy experts said yesterday.

Investment has remained largely stagnant or declined slightly in the last fiscal year, they also said, calling for structural reform to address the existing bottlenecks.

The slowdown in investment raises concerns over the country's growth trajectory and job creation prospects, the Policy Research Institute (PRI) said during a presentation at the institute's Monthly Macroeconomic Insights event in Dhaka.

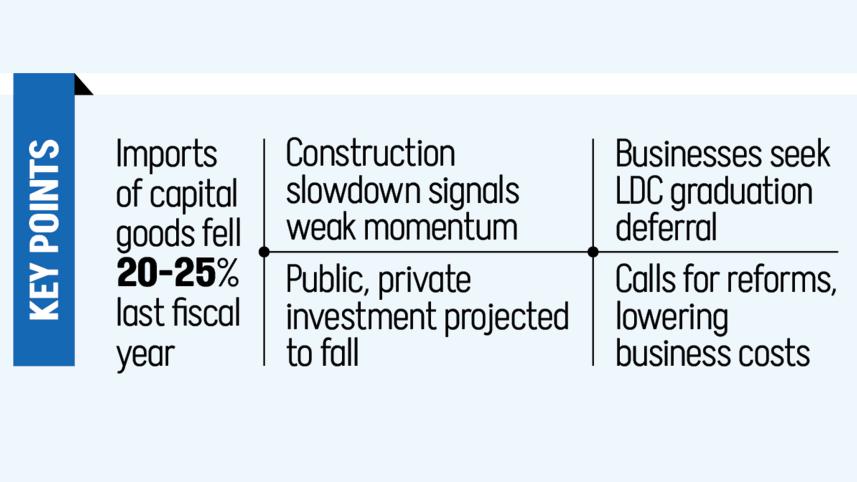

PRI pointed to a 20–25 percent fall in capital goods imports in the last fiscal year and a sharp slowdown in construction as evidence that investment momentum has stalled.

"The challenging investment climate has been one of the most serious impediments to economic growth in recent years," Ashikur Rahman, principal economist at PRI, said during the keynote presentation.

He said that constraints in energy supply, logistics and political uncertainty require urgent attention to unlock new investment opportunities.

"It is neither accurate nor sufficient to blame slower growth solely on a tight monetary stance," he added.

He stressed that unless structural bottlenecks in the real economy are tackled alongside financial policies, Bangladesh will not be able to stimulate investment and sustain growth.

Also speaking at the event, Anwar-ul Alam Chowdhury Parvez, president of the Bangladesh Chamber of Industries, said, "Political uncertainty is a reason for low investment. Another reason is that the conducive environment for investment is not here, while energy supply is also not up to the mark."

"Yet, the government is not consulting with businessmen regarding the economic issues. So, how will investors decide to pour money?" he added.

"Once the elections are held, investment may rise under a political government," he hoped.

Public investment was projected to decline to 6.4 percent of GDP in fiscal year 2024-25 before recovering slightly to 7 percent in the current fiscal year, PRI said at the event citing International Monetary Fund (IMF) data.

Private investment, meanwhile, was projected to fall to 23.2 percent last fiscal year and is expected to drop further to 22.5 percent in the current FY2025-26.

Official investment data for FY25 is not yet available.

Meanwhile, business leaders reiterated calls to delay Bangladesh's graduation from least developed country (LDC) status, currently scheduled for 2026.

Parvez said the economy's overdependence on garments and lack of tax reforms left the country unprepared.

"We have only one export product, though we have potential in the leather and light engineering sector," he said.

On tariff protection after graduation, he said many sectors are saying they will be out of business if tariff protection is withdrawn. "Do you know how much local industry will be impacted after LDC graduation just for lifting import tariffs?"

Stating that this will lead to a decline in revenue, he said the government is not preparing to broaden the tax net.

Former National Board of Revenue chairman Nasiruddin Ahmed said the cost of doing business in Bangladesh is high and needs to be reduced, with regulatory reforms in tax, VAT and customs.

"However, the tax authority is imposing high taxes and duties to meet its revenue targets, which is costly for businesses and also pushes up prices," he added.

Habibullah N Karim, vice-president of the Metropolitan Chamber of Commerce and Industry, Dhaka, described poverty and unemployment as the most pressing concerns, urging incentives and policy support for labour-intensive sectors such as agro-processing and IT.

He further called for controlling the country's external debt, which has almost doubled in the last five years, mainly due to project cost overruns and weak cost-benefit analyses.

On LDC graduation, he said, "Everybody is calling for deferral, but it will not cause the sky to fall. Of course, things will change, but we will survive. The problem is the government is not addressing the ramifications of the situation."

Bangladesh Bank's Chief Economist Md Akhtar Hossain said the current and financial account balances are improving, helping to rebuild foreign exchange reserves.

The country's real exchange rate, he noted, was overvalued for many years but is now largely aligned with market conditions.

"We need to attract FDI, so we need to work on what policy support they need," he added.

M Abu Eusuf, executive director of Research and Policy Integration for Development, said, "We have missed opportunities in reform."

"Everyone knows what should be done, but action has not been taken. If VAT compliance issues are addressed, revenue collection from VAT could triple," he added, citing a multilateral agency.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments