Taka slide brings a little cheer for major exporters

A falling local currency usually translates into higher earnings for exporters since their products become more competitive in the global markets.

From that sense, Bangladeshi exporters, who fetched a record $52.08 billion in the just-concluded fiscal year, should be over the moon since the taka has fallen more than 11 per cent against the US dollar in the past one year as the central bank loosened control over the exchange rate to rein in the depletion of foreign currency reserves.

But local exporters have not been able to cash in on the steep fall of the currency because of a surge in import costs of raw materials, unprecedented hike in shipping charges and runaway inflation, fuelled by the dragging coronavirus pandemic and the Russian war in Ukraine.

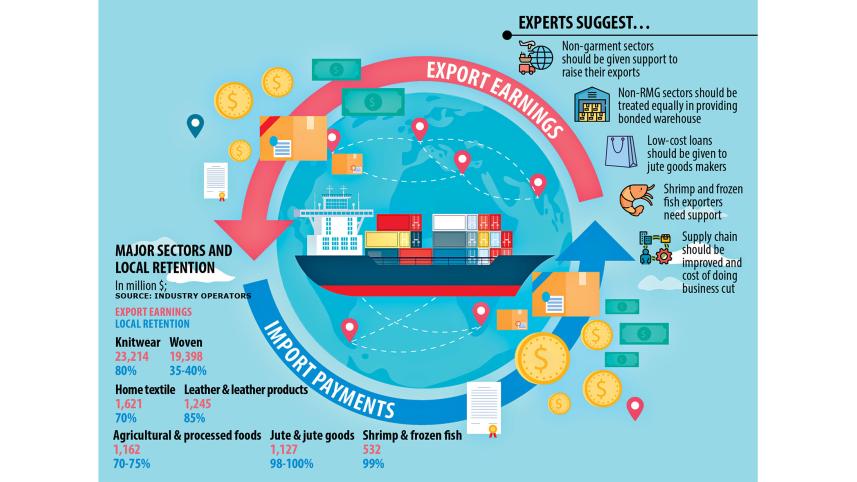

And it is the higher value-addition and lower dependence on imports that are making all the difference.

This means sectors such as jute, ceramics, leather, leather goods, agro-processing, vegetables, fish and fruits are benefiting more from the currency depreciation since their value-addition and retention are nearly 100 per cent.

On the other hand, the retention by garment exports, which account for about 85 per cent of the country's earnings from the international markets, is 65 per cent, which translates into lower benefits for the country's biggest foreign currency earner.

The depreciation of the taka had been a long-standing demand from exporters as they looked to gain more from a favourable exchange rate and to be more competitive in international trade.

In January this year, a dollar traded at Tk 86 in the banking channel and it rocketed to Tk 102 this week. The rate is Tk 105 in the kerb market.

But the slide came at a time when the import cost has skyrocketed. As a result, the benefit of the currency depreciation is not helping exporters much since the gain is largely being gobbled up by the higher cost of raw materials purchased from external sources.

Md Fazlul Hoque, managing director of Narayanganj-based Plummy Fashions Ltd, says he hasn't benefitted significantly from the depreciation since he has to import raw materials at higher prices.

"Since international buyers are not raising the prices of goods and the cost of production has gone up, exporters have not been able to reap the maximum benefit from the fall of the taka."

According to Hoque, the gain from the depreciation could be as high as 20 per cent whereas the production cost and the import value of raw materials have almost doubled.

In fact, the gain is almost the same as it was before the start of the currency's slide since Hoque and other exporters were lagging when it comes to competitiveness in the global supply chain due to a stronger taka.

Garment manufacturers in the countries such as China, India and Pakistan that have their own raw materials are well-positioned to benefit more from their currency's slide as the nations need not spend billions of dollars in import bills to make export-oriented finished goods, said the entrepreneur.

Echoing Hoque, Kutubuddin Ahmed, chairman of Envoy Textile, says since the company is importing raw materials at higher costs, it is not gaining much from the currency depreciation.

Kamruzzaman Kamal, marketing director of Pran-RFL, one of the biggest agro-processed food exporters in Bangladesh, says the local value-addition of agro-processed foods would be up to 80 per cent.

"So, we are benefiting from the taka's depreciation."

According to Mohammed Mahbubur Rahman Patwari, a former chairman of the Bangladesh Jute Mills Association, exporters are getting Tk 92-93 for a dollar, up 9 per cent from Tk 85 earlier.

Jute goods exporters can retain as much as 98 per cent of their export earnings as the environmental-friendly jute is grown locally.

"We will do better if we are given low-cost loans to invest in modern machinery to enhance productivity," said Patwari.

Mustafizur Rahman, a distinguished fellow of the Centre for Policy Dialogue, says the level of gain from the currency depreciation is lower than expected because exporters have to buy raw materials at higher costs.

For instance, of the total receipts from garment exports of $42 billion in the last fiscal year, the net retention is $28 billion after excluding the labour and raw materials costs.

The retention is 80 per cent in knitwear exports and 40 per cent in woven garment exports, said Rahman.

Mohammad Hatem, executive president of the Bangladesh Knitwear Manufacturers and Exporters Association, says local banks are paying them Tk 93–Tk 94 per US dollar when they encash their export proceeds.

But when they open letters of credit to import raw materials and capital machinery, banks are charging Tk 103-Tk 104 per USD.

"So, it is the banks that are mainly making money from the currency depreciation, not the exporters," Hatem said.

Selim Raihan, executive director of the South Asian Network on Economic Modeling, said the sectors that are not highly import-dependent are reaping the advantage of the depreciation.

"This is an opportunity for non-garment industries. The exports of non-garment products may rise if the problems faced by the exporters are addressed."

For instance, he said, the tannery industrial estate in Savar is not properly functional, while leather and leather goods makers don't receive equal treatment as garment makers when it comes to using the bonded warehouse facility while importing raw materials duty-free.

The import tariff for the materials used in light engineering and agro-processed products is also not favourable.

"The export by these sectors will increase if these issues are addressed," added Raihan, also a professor of economics at the University of Dhaka.

Amin Ullah, president of the Bangladesh Frozen Foods Exporters Association, said it would be tough for them to augment the shipment of locally grown shrimp and fish unless the taka lost its value.

"But we are not getting higher prices since European buyers are offering lower rates."

In the past, frozen food exporters had to depend on imported cartons and spare parts of machinery. Now, they can source the items locally.

"So, our value-addition is almost 100 per cent and we are retaining the full export earnings," Amin said.

He urged the government to give special attention to raising the exports of products that have a higher portion of local ingredients.

Syed Md Shoaib Hasan, a former vice-president of the Bangladesh Agro-processors Association, demanded the government remove the restriction on aromatic rice export.

If inflation can't be contained, the currency depreciation may not bring much yield, said M A Razzaque, research director of the Policy Research Institute.

Inflation in Bangladesh rocketed to 7.56 per cent in June, the highest in nine years.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments