Unruly dollar aggravates market stress

A uniform exchange rate has remained a far cry in Bangladesh despite banks moving to embrace a single rate of the US dollar amid a deepening shortage of the American greenback.

As a result, clients are opening letters of credit (LCs) on the condition of deferred payments.

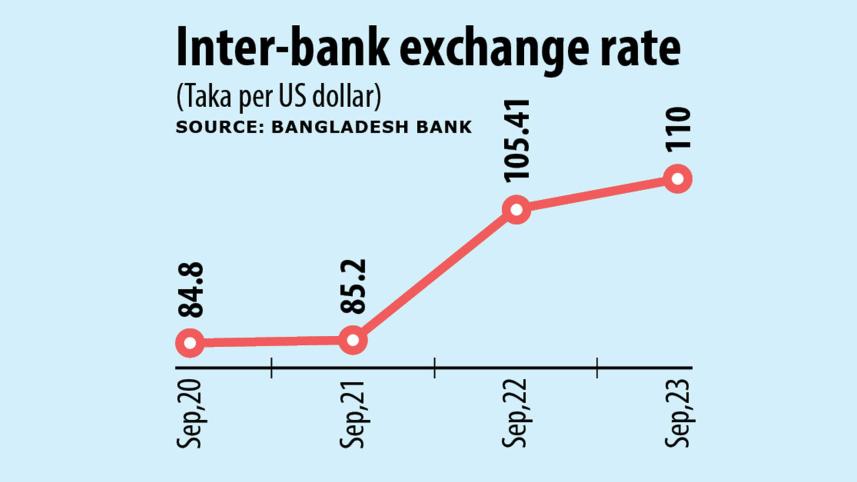

It comes after the Bangladesh Foreign Exchange Dealers Association (BAFEDA) and the Association of Bankers, Bangladesh (ABB) on August 31 fixed the single exchange rate.

They had decided to buy the US dollar at Tk 109.50 and sell them at Tk 110 from the first working day of this month.

But the chief executives of four private commercial banks yesterday said the fixed rate is not market-based, so it has not been implemented yet.

The foreign exchange market has become volatile due to the "policing" of the central bank, they said.

Seeking anonymity, they said they are not able to open LCs at Tk 110 per dollar due to the dollar crunch.

Banks are facing the crisis due to the higher demand of the currency against a lower supply caused by the decline in remittance earnings and slower-than-expected export receipts.

In August, migrant workers sent home $1.59 billion, down 21.5 percent year-on-year, the sharpest drop since April 2020. Export earnings registered a 3.8 percent growth, down from 36 percent in the identical month last year.

One CEO said that his bank is opening LCs on the condition of deferred payments requested by clients.

When importers agreed to open LCs on the condition of deferred payments, banks charged Tk 5 to Tk 10 per USD on top of the fixed rate, he said.

Another CEO said his bank is not getting US dollars at the fixed buying rate of Tk 109.50.

Banks are selling US dollars at as high as Tk 117 and quoting Tk 114 to Tk 115 while buying the currency from exporters.

"Now there is a huge mismanagement in the forex market due mainly to the central bank's inappropriate decision aimed at introducing a fixed exchange rate. If it continues, the economy will face a disaster."

The four CEOs urged the central bank to let the exchange rate of the US dollar reflect the market realities, saying a fixed exchange rate does not bring any positive impact in an open economy.

"The dollar supply will increase if a floating exchange rate is allowed," said one of them.

An official of National Polymer Group said it has opened LCs at the rate of Tk 110 in recent times, but it has had to pay an additional Tk 3 per dollar unofficially.

The additional payment has to be made in cash or cheque, he said.

"We are helpless since we have to open LCs to run our business and ensure timely shipments," the official said.

"We know that it is a violation of the central bank's order, but we have no other alternative."

However, Fazle Rabbi, head of marketing at Partex Star Group, said it has opened LCs at Tk 110 recently.

"The dollar rate also depends on clients' relations with banks and the amount of transaction."

Mohammad Hatem, executive president of the Bangladesh Knitwear Manufacturers and Exporters Association, said exporters are getting Tk 109.5 a dollar.

"The problem exists in the case of imports."

"In paper, the cost of the greenback is Tk 110. In reality, businesses have to pay more to import," said Hatem, adding that they have to pay up to Tk 5 for a dollar in cash to banks unofficially.

He said the latest central bank directive aimed at ensuring a market-based exchange rate has created the scope for banks to cash in on the foreign exchange shortage.

Citing a major knitwear exporter, Hatem said exporters could earlier sell the greenback to another business if they maintained accounts with the same bank.

"Now, they cannot do this. This curb has created the scope for banks to make additional profits."

A top official of a commodity importer and processor said in the case of small-scale imports valued $1,000 to $100,000, banks impose a fixed rate. The rate moves up if import bills go beyond the range.

Contacted, ABB Chairman Selim RF Hussain said: "We met with the Bangladesh Bank but there is no news to share."

Md Mezbaul Haque, an executive director and spokesperson of the central bank, described the meeting on the forex market as a regular one.

Replying to a question, Haque said if a bank quotes a higher rate than the BAFEDA-ABB fixed rate, the central bank will take action against them.

The central bank recently sought explanations from 13 private commercial banks for allegedly violating the fixed exchange rate.

Speaking to The Daily Star recently, Centre for Policy Dialogue Executive Director Fahmida Khatun said the forex market mechanism can't work when the exchange rate is fixed.

"It is not a sustainable solution when the exchange rate is fixed artificially. We badly need a market-based exchange rate."

Bangladesh has been witnessing volatility in the forex market for the past one year and a half owing to the sharp depletion of the forex reserves.

The gross international reserves came down to $21.70 billion on September 13.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments