Auditors recovered Tk 5,834cr in 2014-15

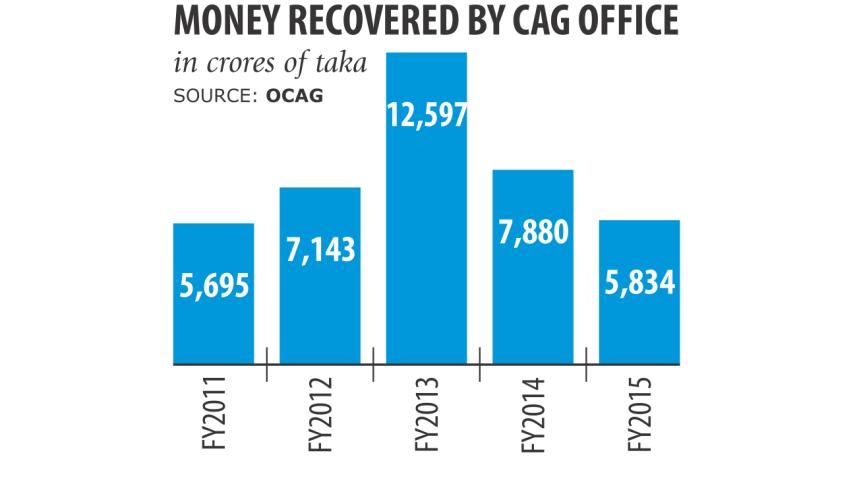

Government auditors recovered Tk 5,834 crore in fiscal 2014-15, down 25 percent from the previous year thanks to slow settlement of audit observations.

The auditors recovered and adjusted financial irregularities worth Tk 7,880 crore in fiscal 2013-14, according to the Office of the Comptroller and Auditor General or OCAG.

In fiscal 2012-13, Tk 12,597 crore was recovered or adjusted, according to the documents of the OCAG.

CAG Masud Ahmed, however, told The Daily Star that the drop in recovery means the secretaries of the ministries are recovering or adjusting money through internal control.

“We have recommended strengthening internal control and taking departmental steps so that the irregularities go down. I think our recommendation has started to take root.”

The government revenue went up 17 times and expenditure 20 times since fiscal 1982-83, according to the OCAG. As a result, audit observations and OCAG's audit-related activities have increased significantly.

But slow settlement of audit observations has contributed to huge numbers of unsettled audit observations, inflicting adverse impact on the country's overall public financial management.

The number of outstanding audit observations stood at 39,883 at the end of fiscal 2014-15 with a total value of Tk 193,486 crore, according to the OCAG.

In the same fiscal year, 17,205 audit objections involving Tk 30,353 crore were settled, while the OCAG recovered or adjusted Tk 40 for every taka it spent.

The OCAG disclosed a strategy paper at a programme in Dhaka on Tuesday, in which it said there is a dire need for restructuring audit department to cope with a huge increase in both revenue and expenditure of the government.

Audit coverage along with effective audit of the OCAG is being hampered as one-third of the sanctioned posts remain vacant. Overall, the OCAG has 34 percent shortage of manpower against sanctioned post of 3,419.

Since 1971, the OCAG has submitted 1,207 reports to parliament. Of them, 800 are annual reports, 151 special audit reports, 26 performance audit reports, 18 issue-based reports, 168 appropriation accounts and 44 finance accounts.

The eighth parliament discussed 332 reports, and the ninth parliament 590. The current parliament, which has been in action for more than two years, has discussed 48 audit reports until June this year.

The OCAG has submitted 15 reports in 2015 and 23 reports in 2016 to the president but they have not been submitted to the parliament, according to the OCAG strategy paper.

The strategy paper also shed light on the nature of irregularities.

They include misappropriation of public money, non-compliance of rules, regulations and executive order, embezzlement, theft, irregular payment, non-realisation of VAT or tax, failure in collecting other revenue and non-deposition of collected revenue.

In the strategy paper, Ahmed said audit observations are piling up day by day in the audit directorates and the pace of settlement of audit observations is relatively very slow.

It said annual settlement rate of pending audit observations ranges from 1 percent to 21 percent and averages 2.3 percent.

The paper said weak documentation, lack of officials trained on public financial management, unwillingness, negligence and ignorance to timely response to audit observations, are adding to the poor rate of settlement of audit observations.

The absence or ineffective international audit mechanism, lack of computerised database of pending audit observations and huge work load are not helping matters either.

The main obstacles in the settlement of audit observations are a lack of experienced workforce, weakness in audit documentation, lack of communication with audit departments and line ministry, unwillingness of officials concerned to respond to inherited audit observations of other colleagues.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments