BB's large loan rescheduling facility gets no response

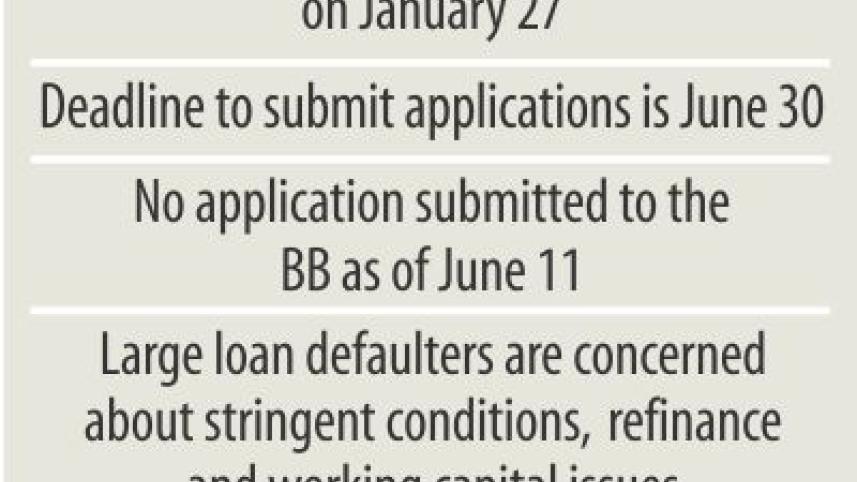

Bangladesh Bank's much talked-about special package to allow large loan defaulters to reschedule their loans has received no response from borrowers in the last four and a half months.

The central bank, in a major move on January 27, issued a notice allowing defaulters of large loans -- Tk 500 crore or more -- to reschedule their debts on the ground that they were affected by 'various external and domestic factors beyond their control'.

BB set a deadline of June 30 to receive applications from interested parties but none has been received yet.

“We are not sure whether we will be able to get working capital after rescheduling the loan. The shortage of working capital will force us to default again,” said Zahir Ahammed Ratan, chairman of Nurjahan Group.

The company, which has around Tk 1,000 crore in defaulted loans, is trying to reschedule its loans out of the BB's large loan restructuring policy.

Similarly, Mostafa Group that has around Tk 1,500 crore in defaulted loans, is also trying to reschedule its loans out of the special offer.

“We've applied to the banks to regularise our loans out of the BB's special rescheduling policy,” said Jahir Uddin, managing director of Mostafa Group.

Even Beximco Group, which is one of the biggest defaulters with over Tk 5,000 crore of loans, is yet to apply for rescheduling.

The central bank's move to give large loan defaulters a chance to reschedule their loans came after the Beximco Group's application to the BB to rescue the business group from a cash crunch.

“This is a complex issue and many banks are involved in a single case. Every bank has to take their board's approval before submitting the application to the BB,” said Mohammad Naushad Ali Chowdhury, executive director of BB.

Moreover, there are issues of collateral, security and working capital that have to be resolved between the borrowers and the banks, Chowdhury said.

For restructuring, a large borrower will have to pay a minimum of 1 percent as down payment if the loan figure exceeds Tk 1,000 crore.

In case of loans between Tk 500 crore and Tk 1,000 crore, the borrower has to pay 2 percent as down payment.

After getting the restructuring facility, the large borrowers will enjoy 50 percent term loan facility against their last credit limit from the banks and 60 percent for their working capital.

The restructured loan shall have a maximum tenure of 12 years for term loan and six years for demand and/or continuous loan. The interest rate, to be charged against the outstanding balance of the restructured loan, may be at a discount from the prevailing declared rate of the bank.

In any case, it shall not be less than the cost of fund plus 1 percent. The banks will have to keep the restructured loans under special mention accounts and they must keep 2 percent provision against such type of loans.

The banks will have to withdraw the restructuring facility if any borrower fails to repay instalment for two consecutive quarters.

The Daily Star spoke to the managing directors of two banks, both of whom said the conditions for rescheduling large loans under the policy are very tough for the borrowers.

“There is hardly any chance to get refinance after rescheduling a large loan. Defaulted loans will be rescheduled only,” said another managing director of a private commercial bank.

Syed Abu Naser Bukhtear Ahmed, a former banker and currently a financial consultant, pointed out BB's biased policy to extend the rescheduling facility to only the big and rich borrowers. “Why would the borrowers below Tk 500 crore not get the same chance?”

Ahmed said the down payments and other conditions could be different, as the BB has done for the Tk 500-crore and Tk 1,000-crore borrowers.

He also said the conditions and processes needed to take up the rescheduling opportunity are cumbersome and time-consuming.

For instance, there are cases in which as many as 30 banks are involved for a single group's defaulted loans.

Yet, BB is expecting 20 to 30 rescheduling applications from the defaulted borrowers by the June 30 deadline, according to Chowdhury.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments