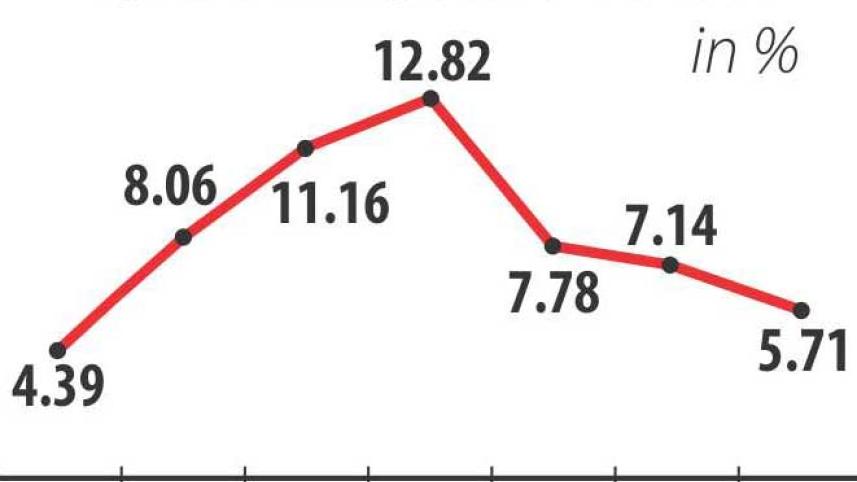

Call money rate slumps to six-year low

The call money rate, which is the rate at which banks lend overnight money to each other, slumped to a six-year low of 5.71 percent in September, indicating the market is flush with liquidity but does not have much demand for credit.

The rate dropped further in October and went below the 5 percent-mark yesterday, bankers said.

The last time the weighted average call money rate fell below this level was in 2009, when it went down to 4.39 percent.

“The call money rate reflects the economy at the moment,” said Biru Paksha Paul, chief economist of Bangladesh Bank.

Bankers said a combination of factors such as sluggish demand for credit and the option of foreign currency loans by local companies have contributed to this down trend.

“We are not getting good loan proposals. It has become difficult to invest our surplus funds,” said Shafiqul Alam, managing director of Jamuna Bank.

Bank credit expanded 11.62 percent year-on-year in August, nearly 5 percentage points lower than the target set by the BB for the July-December period.

The central bank set the private sector credit growth target of 15.5 percent for the second half of the year.

Four years ago, private sector credit grew by over 26 percent.

When there is surplus liquidity in the system, the call money rate tends to move closer to the fixed reverse repo rate.

Now, the reverse repo rate, which tends to be somewhat conservative in Bangladesh, yields more than the overnight money market.

The interest rate on reverse repo has remained unchanged at 5.25 percent since February 2013.

Reverse repo is the rate at which banks park their excess funds with the BB -- the last option when no other avenues are available for investing the excess money.

The BB bought Tk 12,442.5 crore on October 21 and Tk 16,956 crore a day earlier through reverse repo auction.

“Now, the BB looks reluctant to buy money from us at reverse repo rate,” said the head of a treasury department of a local bank.

On Sunday, banks have offered Tk 19,248 crore to the BB, but it took up Tk 12,127 crore, according to the central bank's reverse repo auction data.

Shrinking imports and rising foreign exchange reserve also indicate weak economic activities in Bangladesh.

The opening of letters of credit for imports stood at $3.01 billion in July, down 17.62 percent year-on-year. In August, LCs of $3.44 billion were opened.

Declining imports and piling up of foreign reserves are not good signs for an economy like Bangladesh, said a managing director of a bank requesting not to be named.

Bangladesh's foreign currency reserves stood at $26.88 billion yesterday.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments