The financier with a difference

Mutual Trust Bank has one feature that sets it apart from the crowd: its board that consists of the country's most successful business leaders.

However, the influential board members do not interfere in the managerial affairs -- the reason behind the bank's meteoric rise.

Indeed, MTB's top management, headed by the managing director, enjoys the broadest power in the industry. This is evident from the fact that the chief executive has several times higher credit approval authority than any of his peers in the local banking industry.

“The bank's strength is in its board, and the excellent teamwork between the board and the management benefits us,” said Rashed A Chowdhury, chairman of the bank.

From their experiences in running local business entities such as Square, ACI, and Apex, the directors know very well that the management teams work better with little intervention from the board.

“The management teams have decision-making power, and they don't have to wait for board meetings in order to get approvals for sanctioning all loans,” said Chowdhury.

“The board has empowered the management with the maximum possible power to run the bank effectively but with proper accountability and reporting,” said Anis A Khan, managing director and CEO of the bank.

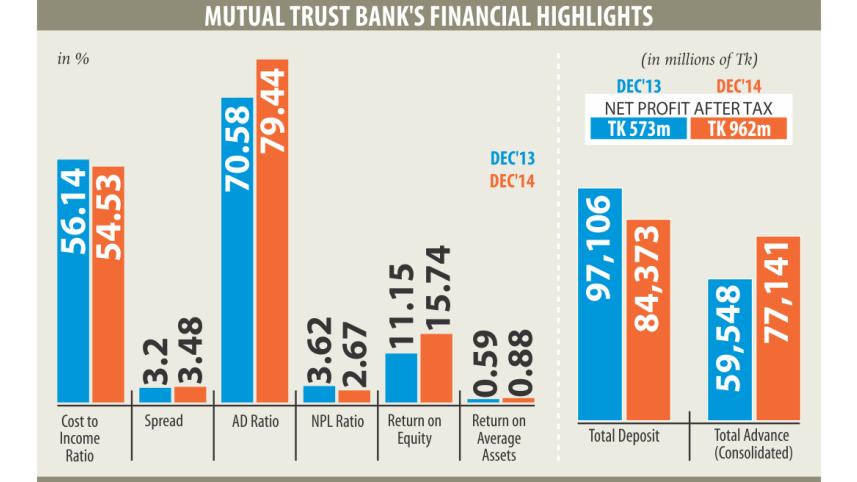

The strategy worked well at a time when the banking industry has been struggling to make much business in the last two years. The bank paid 20 percent dividends for its shareholders for 2014 -- higher than the industry average of 10-15 percent.

Its operating income rose nearly 24 percent year-on-year to more than Tk 572 crore in 2014.

Net profits recorded a whopping 68 percent growth and earnings per share almost doubled to Tk 3.12. Its capital adequacy ratio stood at 10.77 percent, higher than the Bangladesh Bank's mandated 10 percent.

What is more impressive is its nonperforming loans (NPL), which came down by around 1 percentage point to just 2.67 percent last year. The banking sector's NPL was over 10 percent.

Its return on average equity was nearly 16 percent in 2014, one of the highest in the industry with over 29 percent growth in loans and advances, helping the bank raise its total assets by 15 percent.

Its advance-deposit ratio, which indicates the use of a bank's liquidity for business purposes, was also well above the industry standard, at 77 percent.

The lender is also at the forefront of social causes, be it green banking or corporate social responsibility activities.

The incumbent CEO also played role in transforming the bank into the dynamic and promising lender that it is today.

When Khan joined the bank in 2009, it had no automated teller machines, point of sales terminals (POS), credit cards, or internet banking.

The bank now has 103 branches, over 200 ATMs, 2,200 POS, credit cards, and SMS and internet banking.

“The bank is now well structured and continually introducing new and superior products, to meet growing customer demands,” said Khan. The transformation has helped the bank post phenomenal growth in the balance sheet and profitability and deposits and advances, while the NPL came down significantly.

MTB has also introduced pension schemes for retirees, particularly for the private sector, and savings schemes for the small and poor savers who can deposit Tk 5 or Tk 10 a month, said Khan.

He said this journey would not have been possible without the proactive support of the board. He also gave credit to the workforce whom he terms brilliant.

The lender recruits the best possible human resource through rigorous screening. Officials at mid and entry level positions get the highest remuneration in the industry, said Khan.

A senior official at MTB gets a salary of Tk 65,000 a month, which is around Tk 45,000 in most other banks. A management trainee can become junior assistant vice president soon after his or her job is confirmed, whereas it takes several years in other banks.

“MTB will be the factory for making future leaders for the banking sector, similar to what it was like with Standard Chartered Bangladesh in the 1990s and 2000s.”

This amazing performance has made the board optimistic and confident.

“We want to be a regional bank, if not an international one in the next one decade,” said Chowdhury.

However, the board and the CEO are well aware of the task at hand in order to take the bank to a new height.

Financing small and medium enterprises would be a major task for the bank in the years to come, said Khan.

“The thrust will be on the SMEs as the corporate sector is saturated. More loans have to be extended to the SMEs if Bangladesh wants to be a middle income country,” he said.

The banking sector's loan to the SMEs stands at around 10 percent of the total loan portfolio at present.

Reducing the cost of funds and addressing the deficiency in capital are other major challenges for MTB, which has focused more on current and savings accounts rather than other accounts to reduce the cost of funds, Khan added. MTB's annual report shows the paid-up capital of the bank was Tk 307.8 crore at the end of 2014, up from nearly Tk 280 crore a year ago.

Chowdhury said poor infrastructure is a bigger problem than political uncertainty.

“Lack of infrastructure is hampering business. It is unacceptable if it takes seven hours to cover a distance of 100 kilometres,” he said, citing recent experiences.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments