Foreign exchange reserves pulled towards riptide

The country's foreign exchange reserve will face trouble in the days ahead as both the export earnings and remittance are now maintaining a declining trend due to the ongoing economic fallout from the global coronavirus pandemic.

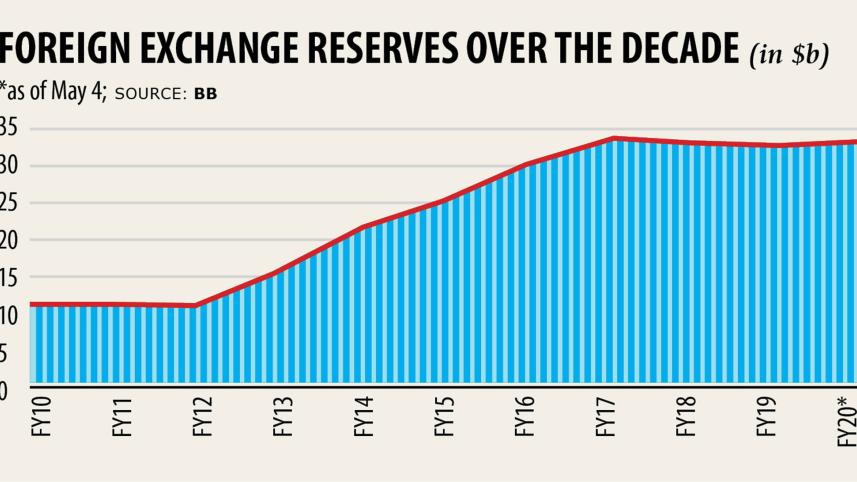

Foreign exchange reserves yesterday stood at $33.09 billion, enough to settle import payments for nearly seven months, according to data from the central bank.

But the reserve is not good enough given the impending rainy days, experts said.

Although the import bills have shrunk in size as well in recent months, this will not bring any respite to the reserves as both remittances and exports, the two major sources of foreign currency, have drastically declined.

In April, remittance hit a 34-month low of $1.08 billion, down 25 per cent from a year earlier.

April's inflows take fiscal 2019-20's tally to $14.86 billion, up 11.77 per cent year-on-year.

The country earlier expected that remittance would surpass the $19-billion mark this fiscal year on the back of the 2 per cent cash incentive introduced by Finance Minister AHM Mustafa Kamal in his maiden budget to encourage migrant workers to send home money through the official channels.

But now the target looks unlikely to be fulfilled, which will be a big blow to the reserves.

Export earnings in March declined 18.29 per cent year-on-year to $2.73 billion due to a slump in shipments of apparel products, the country's main export item, according to data from the Export Promotion Bureau.

March's receipts take the export earnings from the first nine months of the fiscal year to $28.97 billion, missing the periodic target by 14.52 per cent.

Although the EPB has yet to release the export figure for April, earnings seem to have declined drastically due to the ongoing shutdown in the majority of the export destinations.

Both the export and remittance will maintain the ongoing negative trend in the next few months, so this is a crucial period for the central bank to handle its foreign exchange reserves, said Zahid Hussain, former lead economist of the World Bank's Dhaka office.

"Reserve is the last resort for any economy to tackle the economic meltdown. Considering this, the central bank should cut back on its foreign currency sales to banks."

Countries in North America, Europe and the Middle East will take a good while to restructure their economies. If those economies do not rebound, Bangladesh's exports and remittance will not bounce back.

Besides, thousands of Bangladeshi workers are waiting to come home, which will have a further adverse impact on the rural economy.

The lower import is not much of a comfort for the reserves, Hussain added.

The settlement of letters of credit, generally known as actual import, in terms of value, fell nearly 9 per cent year-on-year to $4.54 billion in January.

Import in the first seven months of fiscal 2019-20 stood at $32 billion, down 4.43 per cent year-on-year.

The central bank has not prepared the import figures after January due to the ongoing disruption in economic activities all over the world.

A good number of central bankers predicted that the import payments might decline significantly during the period.

The oil price in the global market has declined rapidly in the wake of the pandemic, giving a breathing space to the country's balance of payments, Hussain said.

"But this will not help keep stable the reserve. So, banks will have to stop the import of luxurious products immediately."

Besides, the government should try to manage soft loans and grants from multilateral donor agencies to boost the reserves, Hussain said.

The declining export and remittance in May and June will create a severe strain on the reserves, said Mustafizur Rahman, distinguished fellow of the Centre for Policy Dialogue.

Salehuddin Ahmed, a former governor of the central bank, echoed the same.

He suggested banks stop the import of capital machinery to tackle the shortage of foreign currency.

"There is no need to expand investment in the industrial sector right now. Rather, we have to protect the existing industrial plants and factories from the recession," Ahmed said.

The central bank yesterday paid ACU $650 million to settle payments for imports, which will bring down the reserves to less than $32.50 billion within a day or two.

The ACU is an arrangement by which the participants settle payments for intra-regional transactions among the participating central banks on a net multilateral basis.

Bangladesh, Bhutan, India, Iran, the Maldives, Myanmar, Nepal, Pakistan and Sri Lanka are members of the Tehran-headquartered ACU.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments