Inflation drops to 3-year low, but food costs remain high

Consumer prices eased in August, reaching their lowest point in more than three years. Yet households faced higher food bills compared with July, at a time when shrinking purchasing power and declining jobs are squeezing many households.

Headline inflation stood at 8.29 percent in August, down from 8.55 percent in the previous month, according to the latest data released by the Bangladesh Bureau of Statistics (BBS) yesterday.

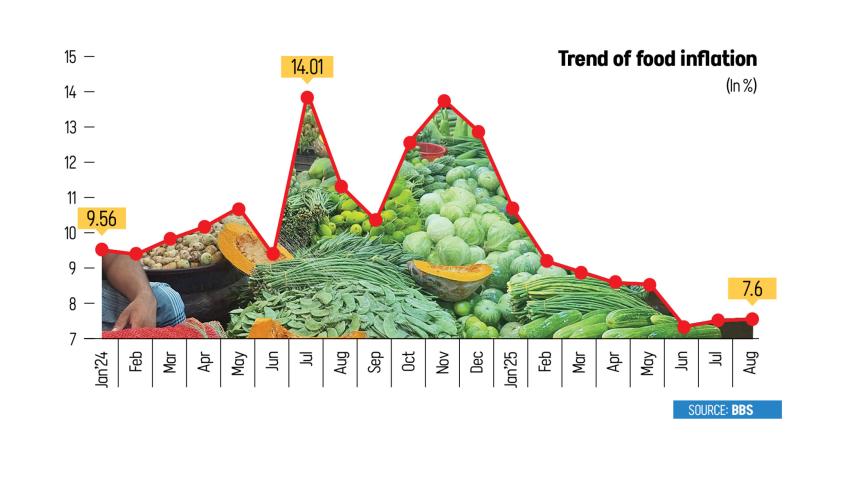

Food inflation, a lingering concern for low-income households, edged up to 7.60 percent from 7.56 percent in July.

In August, vegetable prices rose for the second month in a row, pushing food costs higher.

But falling prices of non-food items pulled overall inflation down. Non-food inflation slipped to 8.90 percent in August, from 9.38 percent the month before.

With this, the annual average inflation rate eased to 9.58 percent in August, compared with 9.95 percent in the same month a year earlier.

SM Nazer Hossain, vice-president of the Consumers Association of Bangladesh, a non-profit organisation for the protection and promotion of consumers' rights, said rising prices of rice, vegetables and other essentials are driving up food inflation.

"These escalating costs are placing a significant burden on consumers," he said.

The absence of timely government intervention, combined with fewer job opportunities and eroding household incomes, has made matters worse, Hossain told The Daily Star.

Bangladesh had recorded monthly inflation above 9 percent for over two years until May this year. Prices then began to cool in the following months.

Even so, annual average inflation rose to 10.03 percent in June from 9.73 percent a year earlier, squeezing the living standards of poor and low-income families.

A study by independent non-profit Power and Participation Research Centre (PPRC) published last month found that poverty levels have risen sharply.

Nearly 28 percent of the population is now classed as poor, up from 18.7 percent in 2022.

Extreme poverty has also climbed, with 9.35 percent of people now living in this category, compared with 5.6 percent three years ago.

In other words, one in four people live below the poverty line, while one in ten is trapped in extreme poverty.

The study also showed that 18 percent of the population fall into the "vulnerable non-poor" group, who could slip into poverty at any time.

Hossain Zillur Rahman, executive chairman of the PPRC, said that while inflation fell from 8.5 to 8.29 percent, incomes remained stagnant or were even falling in some cases.

"We have to assess inflation, particularly in relation to incomes. For fixed-income households, which make up about 85 percent of the population, this is a serious problem," he said.

He added that wage trends needed to be closely monitored, as they signal where the economy is heading.

"This is just a decimal-level movement. These marginal, short-term changes cannot really be called a 'decline'. The real concern is the persistent 12-month strain we are seeing. The balance between income and expenditure is the most important factor for people's welfare, and that is where the problem lies."

Rahman said the latest easing in prices is not enough to provide comfort.

"These are essentially short-term trends, and they do not give us much reason to be satisfied," he commented.

"Overall inflation declined slightly last month, but these are minimal changes, reversible rather than sustainable. That is why we must keep a close watch on inflation trends. There is still a long way to go before we can bring inflation down to a tolerable level," said the economist.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments