Muhith ponders over fuel price cut

The finance ministry has sought the energy ministry's opinion after oil prices hit rock-bottom in the international market, which has intensified the pressure on the government to lower domestic fuel prices.

“We have to do something with the fuel price,” said Finance Minister AMA Muhith in a letter to Tawfiq-e-Elahi Chowdhury, energy adviser to the prime minister, and Nasrul Hamid, state minister for power, energy and mineral resources, on January 6.

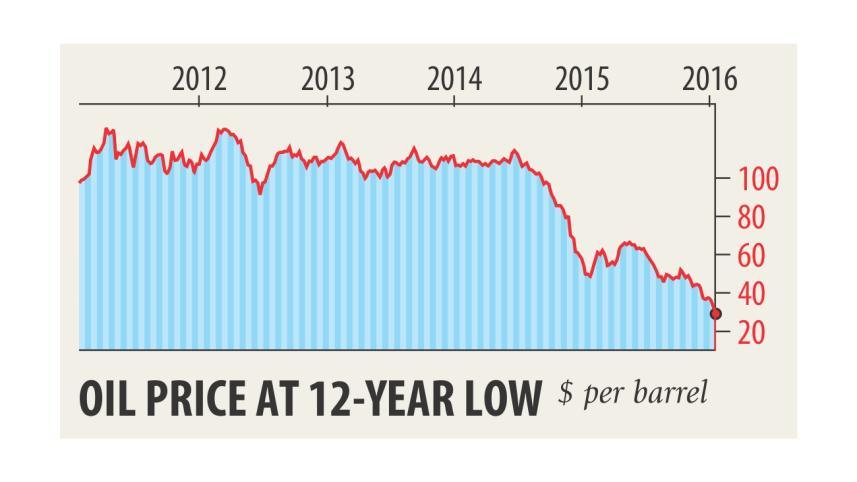

The oil price slide began in mid-2014 but the government has been defiant against adjusting the local price to allow Bangladesh Petroleum Corporation to recoup the losses it had incurred between fiscal 1999-2000 and 2014-15 and repay its loans.

Now that the state-run BPC itself has admitted that all its bank loans have been repaid and that it is counting profits, the pressure is mounting on the government to reduce the fuel price.

In the letter, Muhith said: “First, we have to think about whether we will reduce the price of petroleum products.”

He also said there is a government decision to keep the fuel price within 10 percent, more or less, of the international price.

“If we follow the formula we will have to reduce the price of the petroleum products significantly.”

Muhith however suggested the energy minister discuss the issue with the prime minister, who is also the minister for power, energy and mineral resources.

The move from the government came after Brent crude, a major international benchmark price for purchases of oil, dropped to $27.65 a barrel yesterday, the lowest since 2003, as investors fret over a crude glut and slowing demand due to economic weakness, especially in China.

The new low came after international sanctions on Iran were lifted, which paved the way for increased supply amid a global glut.

And with Iran back as a full player in world oil markets, a further drop is likely.

Earlier this month, emerging-markets lender Standard Chartered said it was “not impossible” that the price of oil could fall to $10 a barrel.

Meanwhile, a number of economists told The Daily Star that the historically low oil prices can be both a boon and a bane for Bangladesh. It is allowing the country to cut back on huge energy subsidies and recoup losses but is also putting pressure on foreign currency reserves.

On the positive side, the low price of oil will allow the BPC to cut down deficits and open up more opportunities for the government to review its fuel prices, said Mustafizur Rahman, executive director of the Centre for Policy Dialogue.

Although Bangladesh has not adjusted the fuel prices in line with the downward trend, the country is already benefiting from the low rates by way of imports of goods and commodities that rely on energy for production.

At the same time, Rahman also mentioned the risks Bangladesh might face.

Because of the decline, the oil-exporting nations have come under fiscal pressure and are cutting back on development spending. “As a result, the number of Bangladeshi workers going to these countries may decline, meaning we will have less remittance income,” he added.

Hossain Zillur Rahman, executive chairman of the Power and Participation Research Centre, a think-tank, said the benefit of low oil price has not been passed on to consumers in Bangladesh. “It is understandable that the government is not cutting the fuel price for allowing the BPC to recoup the huge fiscal backlog created over decades.”

At the same time, time is up for the government to take a policy decision on the price adjustment in the local market.

If the fuel price is adjusted, the government has to ensure that the benefits reach the end consumers.

He also said the government needs to review the terms at which it buys oil from the international markets.

Bangladesh procures crude oil from Saudi Arabia and the United Arab Emirates in a government-to-government mechanism at a fixed price in order to avoid any upward price shock.

Since the price is very low now the government can reconsider the current arrangement, said Rahman, a former caretaker government adviser.

In its latest monetary policy for January-June, the Bangladesh Bank said the falling fuel and commodity prices have globally created a low-inflation environment, paving the way for a considerable reduction in policy rates.

Although expectations owing to the global fuel price might have played a positive role in dampening inflationary concerns, the food component, which occupies almost 60 percent of the consumption basket, played the major role in pulling the general inflation downwards.

The central bank also sees a slowdown in the growth rate of foreign exchange reserves in the near future partly because of the slow growth in remittances from the Middle Eastern countries, which are suffering enormous revenue losses for the fuel price decline.

Remittance income makes a large portion of the country's foreign currency reserves -- and a significant portion of it comes from workers living in oil-producing countries.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments