Political parties agree to continue financial reforms

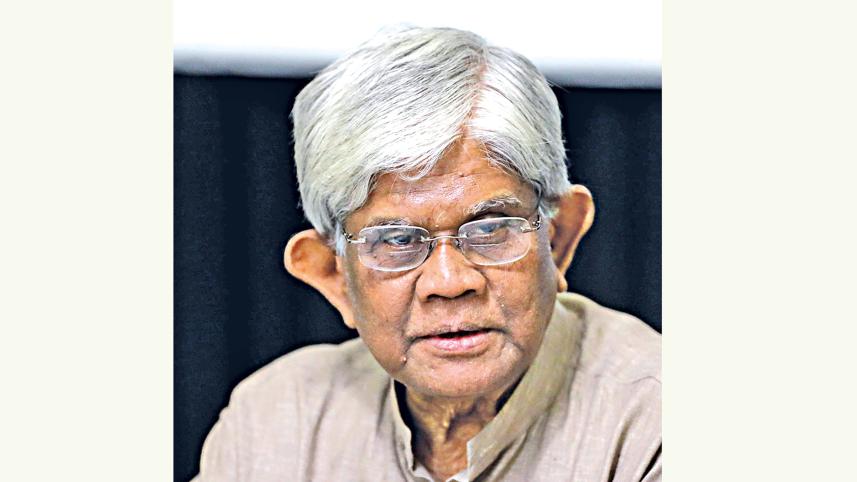

Finance Adviser Salehuddin Ahmed said they have engaged with political parties about reforms in the banking and financial sectors, and the parties have broadly agreed to support and carry forward these initiatives.

The interim government wants to complete short-term reforms by February next year, while mid and long-term reforms will be carried out by the next elected government, he said.

"We are in contact with them. They will continue the good work; they cannot simply set these aside. If that does not happen, you [journalists] will be there to hold them accountable," he told journalists at the Secretariat yesterday.

On banking sector reforms, Ahmed said no one would be able to completely disrupt the system because strong checks and balances are in place.

"If anyone tries to take over a bank like during the previous regime, it will not be possible. Depositors themselves will speak up and refuse to keep their money in that bank," he added.

Asked about the number of banks to be merged, he said details would not be disclosed yet to avoid harming those banks. "Some banks will be merged in a rational manner."

The Bangladesh Bank (BB) has been conducting an asset quality review of 17 banks. The interim government plans to merge around five of them, with the rest to be merged under the elected government.

The World Bank and Asian Development Bank have offered more than $2 billion in support, but they seek assurance that the next government will continue the interim government's initiatives.

In response to a question about recovering laundered money, he said some efforts have begun, but results may take time, as those involved are very cunning.

He added that 11 sensitive cases have been identified, and most of the funds have been traced. Mutual Legal Assistance requests have now been made to recover the money.

"The most important message of our initiatives is that beyond recovering the money, a clear warning has been sent for the future, that if such corruption occurs under the next government, strict action will be taken against the perpetrators," he said.

He said that when they took office, the country's financial situation was on the brink of collapse, almost in the ICU.

"There was high inflation, low reserves, and rampant plundering of banks. Banks were looted like never before in the world. In one bank, 95 percent of loans had defaulted, and the chairman, along with his associate,s had taken away the funds," said the finance adviser.

According to him, recovery has slowly begun since then. However, many challenges remain.

"There is light at the end of the tunnel. I believe we have begun moving in the right direction, and it would be better if progress happens faster. But I am optimistic that better days lie ahead."

On BB's autonomy, he said autonomy does not mean giving complete control.

"Many countries have it; in some places, full autonomy exists. But here, autonomy means operational autonomy. They need to have autonomy in day-to-day operations because whichever government comes, it will have its own political guidance. There has to be a connection between the two and a system for accountability."

Regarding the draft law on the BB's autonomy, he said they have agreed in principle but need to analyse it in detail.

Anisuzzaman Chowdhury, special assistant to the chief adviser on financial affairs, said that after similar uprisings in other countries, economic and GDP growth usually remain low.

However, in Bangladesh, no such negative indicators persist, which he described as exceptional.

Finance Division Secretary Md Khairuzzaman Mozumder said the country's macroeconomy is now stable.

He noted that there has been no volatility in the foreign exchange rate since the introduction of the market-based rate. "On one hand, inflation has decreased, and on the other, wage rates have increased."

Abdur Rahman Khan, chairman of the National Board of Revenue (NBR), said no blanket measures were taken against officials involved in the movement opposing the separation of tax policy and implementation.

"Actions were taken against those who broke the limits only," Khan said.

Nazma Mobarek, secretary of the Financial Institutions Division, said people's confidence in banks has grown as deposits have increased.

She said deposits in the weak state-owned Janata Bank increased by Tk 15,000 crore, while BASIC Bank saw a Tk 12,000 crore rise.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.