Private credit growth inches up in Dec

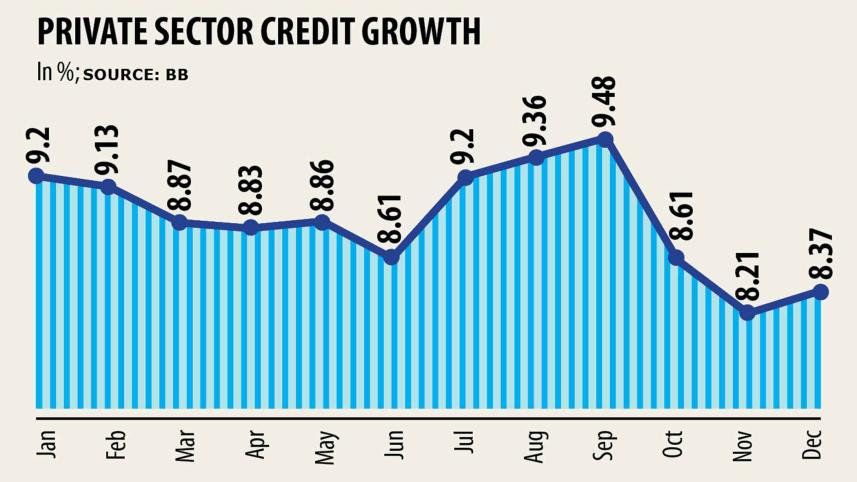

Despite demand for loans being suppressed by the ongoing business slowdown, private sector credit growth crept up in December after undergoing a steep descent in the previous two months.

The year-on-year credit growth stood at 8.37 per cent in December, up from 8.21 per cent a month earlier, showed data from Bangladesh Bank.

In its monetary policy statement for fiscal 2020-21, the central bank set a private sector credit growth target of 11.5 per cent by December last year and 14.8 per cent by June this year.

But till date, this has turned out to be far from reality because of the financial meltdown brought on by the coronavirus pandemic.

Banks add accrued interest to the principal amount of loans in the final month of every quarter, which usually pushes up credit growth temporarily, said bankers.

For this reason, the credit growth inched up last month, which is why the increase in growth should not be termed an extraordinary phenomenon, they said.

In accounting, accrued interest refers to the amount of interest that has been incurred, as of a specific date, on a loan but has not yet been paid out.

Accrued interest can be in the form of accrued interest revenue for banks.

Credit growth has been subdued in the last two years but it started undergoing a tailspin soon after the government declared the lockdown in March last year to keep the deadly flu at bay.

The growth commenced to increase since July last year riding on the implementation of stimulus packages by both the government and the central bank.

But the increasing trend lasted till September and the growth started to nosedive again from October.

The banking sector is also facing a burden of excess liquidity due to the feeble credit demand from businesses and commoners in tandem.

Excess liquidity in banks escalated 95 per cent year-on-year to Tk 204,700 crore in December last year.

There had been no extraordinary reason for the increase in credit growth in December as banks had not experienced any robust loan demand from borrowers, said Emranul Huq, managing director of Dhaka Bank.

Adding accrued interest to the principal loans amount pushed the credit growth for the time being, he said.

Borrowers had enjoyed a loan moratorium throughout last year, meaning that a majority of clients did not pay the interest associated with loans they availed.

So, banks were forced to add the accrued interest to the principal loan amount of borrowers, Huq said.

In addition, banks also tried to give out loans in the concluding month of last year as part of efforts to widen their balance sheets, giving a push to credit growth to some extent, he said.

"Businesses are still taking the cautious path for expansion of their industrial units given the ongoing business slowdown. So, the increased credit growth in a true sense did not bring any optimism at this moment," he said.

Md Arfan Ali, managing director of Bank Asia, echoed him.

But he went on to express hope that the credit growth would get a boost within the next two to three months because of the optimism brought about with the arrival of vaccines and hopes of an economic recovery from the second half of this year.

Several global think tanks have recently forecasted that the global economy will rebound strongly from the second half of this year.

Such optimism has already led to a hike in prices of commodities in the global market such as food grains, soyabean, steel, cotton and so on, Ali said.

This will widen import financing of banks within the next few months, which will subsequently increase export earnings as well, he said

"The country will enjoy the economic recovery at a faster pace than what the nations of the Eurozone and North America will experience in the coming days," he said.

In recent months, the health complications stemming from the coronavirus are fading away from Bangladesh, creating strong hopes of a recovery in the quickest possible time, he said.

Syed Mahbubur Rahman, managing director of Mutual Trust Bank, said it would take at least the first quarter to enable predictions on whether the credit growth would witness a sustainable rise.

The economic recovery largely depends on the effectiveness of vaccination process across the globe, he said.

"We may get a respite from the ongoing uncertainty within this quarter as the vaccination process will enjoy a momentum during this period," Rahman said.

People will also get to know about the payoffs from the vaccine, he said.

The outstanding loans in the private sector stood at Tk 11,41,342 crore as of December in contrast to Tk 11,20,902 crore the previous month.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments