Regulator scraps licence of Standard Insurance

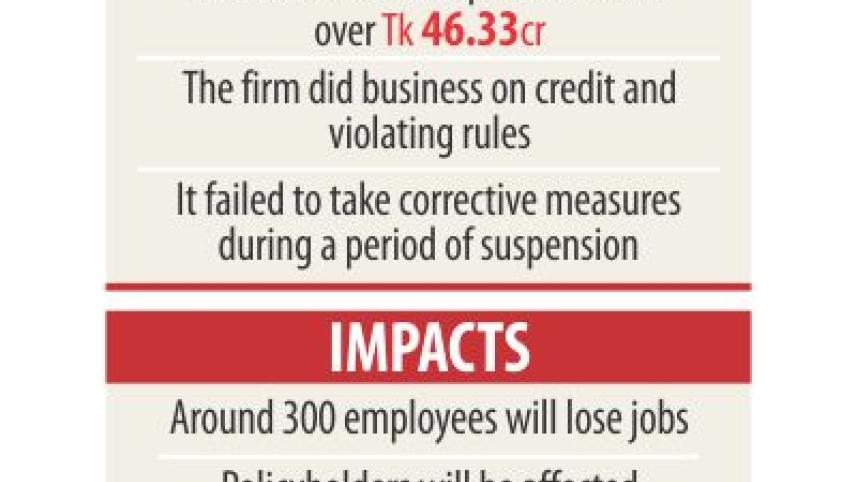

In a rare move in Bangladesh, the insurance regulator has revoked the licence of Standard Insurance on charges of violating the rules of mandatory reinsurance amounting to about Tk 46.5 crore.

The Insurance Development and Regulatory Authority (IDRA) took the decision on Wednesday; the cancellation of the licence came into effect on Sunday.

“Standard Insurance has been violating the law constantly. The insurer was given five months to correct itself, but it did not do anything visible,” the IDRA said in a notice.

One of the allegations that prompted IDRA to revoke the licence is the insurer's failure to reinsure its three big policies.

Reinsurance, which is legally mandatory, refers to the act of an insurer buying insurance cover for its policies from one or more companies to share the risks.

After detecting the breach of rules, the regulator in June suspended its operating licence for three months, which was later extended by another two months. The regulator had also asked the company to explain within 30 days why its licence should not be revoked, but the company failed to satisfy IDRA with a response.

During this period of suspension, IDRA instructed the private insurer not to issue cover notes or insurance certificates. The company was also banned from new business activity.

“However, the insurer did business during the period of suspension, violating the regulatory authority's order,” IDRA said.

Contacted, Amar Krishna Saha, chief executive of Standard Insurance, said he was disappointed with IDRA's decision.

“We're thinking about appealing against the decision,” Saha told The Daily Star yesterday.

The insurer can appeal to the government (ministry of finance) within 90 days of licence cancellation, according to the Insurance Act 2010. The insurer can also apply to IDRA for a review of the decision in 45 days.

Standard Insurance was incorporated as a general insurance company in November 1999 under the Companies Act 1994, and obtained registration from the Controller of Insurance in December 1999 under the Insurance Act 1938.

The insurer has 25 branches across the country and employs 300 people, excluding marketing executives who get benefits based on the business they can make for the company. These 300 employees will lose their jobs with the licence cancellation.

“If the company doesn't exist, how will we employ people and pay their salaries,” said Saha, in response to a query made by The Daily Star.

According to IDRA, Kazipur Fashions, a garment company, bought fire insurance worth Tk 49 crore from Standard Insurance in August 2013.

The coverage was later enhanced by Tk 11 crore. The garment company is owned by HTM Quader Newaz, current chairman of Standard Insurance.

The regulator found that the insurer did not reinsure the additional Tk 11 crore coverage, putting policyholders at risk.

Similarly, Standard Insurance failed to reinsure Tk 34.5 crore for International Trading Services and nearly Tk 1 crore for Tulgaon Fashions in 2013.

In Bangladesh, all insurance companies have to reinsure half of their policies with the state-owned Shadharan Bima Corporation and the other half can be insured with any local or international company.

“Standard Insurance has totally failed to comply with the mandatory reinsurance regulation for some of its big policies, which is a clear violation of the law,” Shefaque Ahmed, chairman of IDRA told The Daily Star.

Standard Insurance is listed on the Dhaka and Chittagong stock exchanges and its shares traded at Tk 13.2 in Dhaka yesterday. The decision will affect the investors as well, but IDRA officials believe the move would improve governance in the overall insurance industry.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments