Stimulus package for CMSMEs must be given out by Oct

The central bank yesterday instructed banks and non-bank financial institutions (NBFIs) to disburse loans under the stimulus package for the cottage, micro and small enterprises within October.

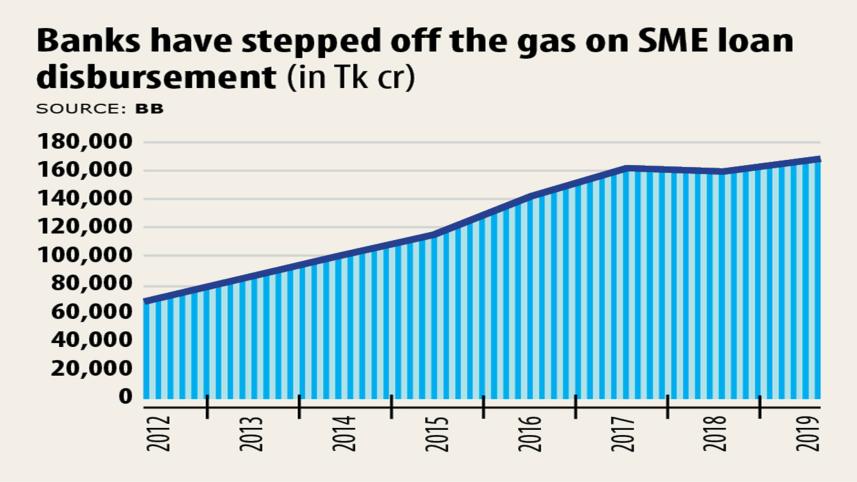

The Bangladesh Bank came up with the decision at a virtual meeting with managing directors of 16 banks and 4 NBFIs in the wake of the slower loan disbursement for the cottage, micro, small and medium enterprises (CMSME).

Banks and NBFIs whose loan disbursement ceilings are Tk 50 crore and above were summoned to the meeting presided over by BB Governor Fazle Kabir.

So far, banks have disbursed about Tk 1,550 crore under the stimulus package worth Tk 20,000 crore.

The central bank, however, has approved banks and NBFIs for disbursement of loans worth Tk 2,731 crore.

On 2 July, the BB governor had met another 23 banks whose loan disbursement ceilings are Tk 300 crore and above asking them to accelerate their loan distribution process.

"The central bank has asked us to speed up," said Mominul Islam, managing director of IPDC Finance, who participated in the meeting yesterday.

Banks and NBFIs had earlier asked to disburse loans under the stimulus packages within August.

"We have requested the central bank to extend the deadline for the stimulus package of the CMSME sector until December. But we were given two more months."

Both banks and NBFIs have also committed to implementing the stimulus package for the CMSME sector within the stipulated period to revive the economy from the ongoing fallout brought on by the coronavirus pandemic, Islam added.

Under the package, funds will be given at 9 per cent interest rate to borrowers. Of the interest rate, 4 per cent will be borne by the borrowers and 5 per cent by the government in subsidies.

Also, the central bank will provide half the Tk 20,000 crore stimulus package to cash-strapped banks so that they could give out the loans smoothly. As much as 48 banks and 20 NBFIs have signed participant agreements with BB to give the funds under the package.

But the package is failing to take off.

As per the terms of the stimulus package, banks can disburse credit equivalent to 30 per cent of the CMSME's existing working capital, which is much too small any amount for the lenders to bother with, said an official of a bank wishing to be named as he is not authorised to speak with media.

Besides, BB asked banks to disburse 50 per cent of the loans under the stimulus package to the manufacturing sector, 30 per cent to the service sector and just 20 per cent to the trading sector, which traditionally accounts for the bulk of the SME loans.

Nearly 65 per cent of the SME loans typically go to the trading sector as the segment is the major part of the economy. This has discouraged banks to use the stimulus package despite the central bank instruction to implement all credit packages, which have been formed to mitigate the recession, by August.

The central bank should address the issues immediately as SMEs account for 20 per cent of the GDP, the bank official added. The sector accounts for 80 per cent of the total industrial employment and 25 per cent of the country's labour forces.

Besides, the central bank also reviewed the stimulus package for the marginal farmers and businesses at the meeting.

On 2 April, the central bank introduced the package worth Tk 3,000 crore.

The central bank has so far approved 33.44 per cent of the package to banks.

The trend of loan disbursement under the package is satisfactory, said a central bank official.

He went on to express a hope that the funds from the stimulus package may be completed in the quickest possible time.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments