Universal Pension Scheme: 6,100 sign up within 6 hours of launch

At least 6,100 people signed up for the universal pension scheme as of 5:00pm yesterday, the first day.

At least 463 people also deposited their first instalment.

The much-anticipated scheme was launched yesterday by Prime Minister Sheikh Hasina virtually from the Gono Bhaban.

Many people from Gopalganj, Bagerhat and Rangpur as well as the Bangladesh embassy in Saudi Arabia joined the inaugural ceremony virtually.

"We are receiving good response already -- hopefully it will increase further in the coming days," Golam Mostofa, member (additional charge) of the National Pension Authority, told The Daily Star.

Citizens above the age of 18 can register for the scheme at the dedicated portal www.upension.gov.bd.

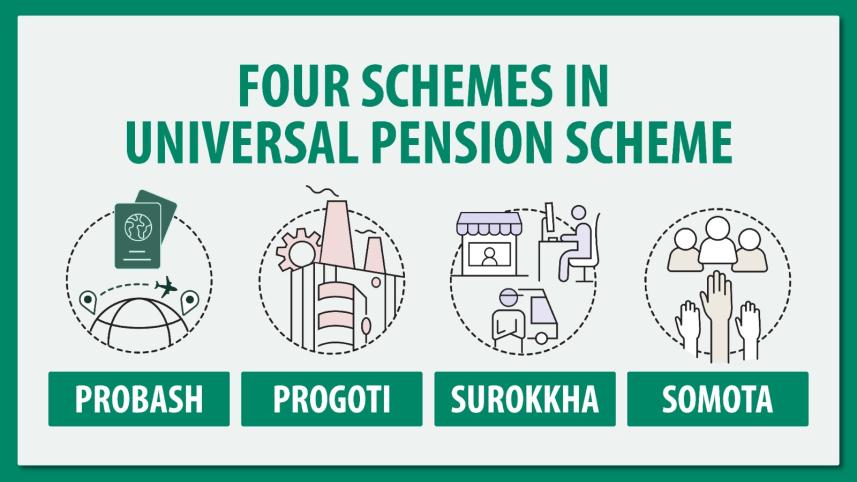

While the PM yesterday inaugurated four packages, she said there will be a total of six packages under the scheme.

However, details about the two other schemes were not disclosed at the ceremony.

A finance ministry official said the other two schemes would be designed for the public servants and officials of state-owned enterprises.

The official said the government has a plan to reform to the existing pension system for public servants.

At present, save for government and semi-government organisation officials, anyone aged 18 and above can enrol in one of the four packages under the universal pension scheme: Progoti, Shurukkha, Samata and Probash.

They will have to submit an application through the online portal of the pension authority.

The individual has to provide various details such as parents' names, mobile phone number, email, national identity (NID) card number, date of birth, bank account number, and details of a nominee.

Later, the beneficiary will receive a unique identification number through SMS or email. This completes the registration.

Upon successful registration, the beneficiaries will be able to pay instalments at a bank branch or through the mobile financial service platform, online bank transfer or a bank card.

The pension authority will confirm the beneficiary regarding instalment payment through SMS.

Using the unique number and password, the beneficiary will be able to know about how much deposit they have made in total.

Housewives, students and unemployed persons can register for the Shurokkha package, which is designed for the self-employed and the informal sector workers like farmers, rickshaw pullers and day labourers.

They can put in Tk 1,000, Tk 2,000, Tk 3,000 or Tk 5,000 a month.

If the students and unemployed persons enter into government services, they will have to withdraw from the Shurokkha scheme.

The Samata package is designed for the ultra-poor, with the monthly instalment being Tk 1,000. The government will pay Tk 500 and the other Tk 500 will be paid by the beneficiary.

The Probash scheme is for expatriate Bangladeshis, with the monthly instalment options being Tk 5,000, Tk 7,500 and Tk 10,000. They will have to furnish the instalment in foreign currency.

Upon their return home, they can continue the scheme by paying in taka or switch to another package. But they will get their pension in taka.

Private sector employees can apply for the Progoti scheme, whose monthly instalment options are Tk 2,000, Tk 3,000 and Tk 5,000.

While it is not mandatory for private sector companies to sign their employees up to the government's pension scheme, if they do so, they would have to contribute to half of the monthly instalment.

If the company does not want to sign up for the scheme, the employees can still sign up on their own.

The beneficiary will start receiving pension benefit after 60 years of age and this benefit will continue until their death. If a beneficiary dies, their nominee will get pension benefits until the pension-holder's age reaches 75.

The pension-holder will be able to withdraw cash in their pension benefits through mobile financing service or bank account.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments