The basics of income tax calculation

The tax system of Bangladesh was inherited from the British and Pakistani regimes. Gradually, the system was developed based on the canons of taxation and other criteria to get the most public revenue, which the government can use to maximise the state's social welfare.

Taxes are imposed on various things. One of the main types of taxes is income tax, which plays a pivotal role in Bangladesh's economic development. The Income Tax Act 2023 was newly enforced in June 2023 and explains all provisions, rules, and regulations of income tax and the powers and duties of tax authorities. As citizens of the state taking benefits, we have to give back to the state as taxpayers. Therefore, we must submit tax returns by calculating the liable taxes ourselves.

Firstly, we must determine our income year, assessment year, and residential status. The income year is counted from July 1 to June 30. The assessment year is the next year of income year. The residential status is calculated using the days inhabited in the country. This will help us determine the taxable income for the year and the tax rate to be used for our income.

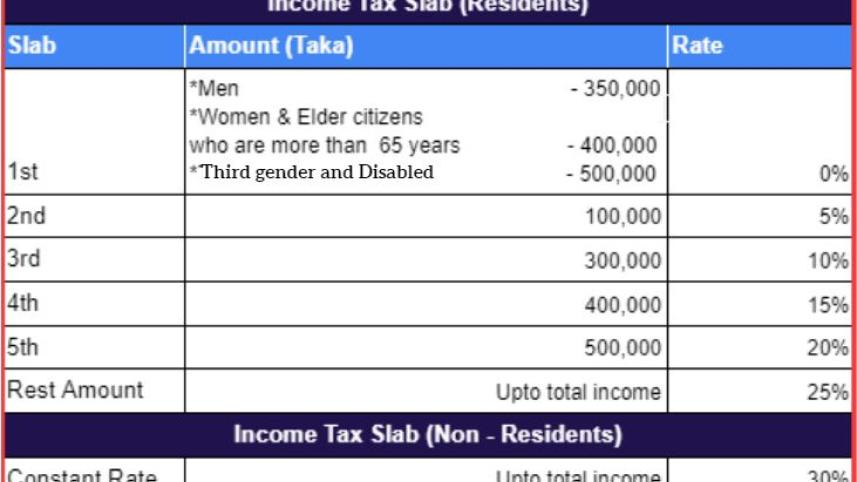

Secondly, calculate the gross tax liability following the table below:

As specified in government paripatra 2023-24, the first slab limit for men is BDT 350,000, for women and elder citizens who are more than 65 years is BDT 400,000, for third gender and disabled is BDT 500,000, and lastly for parents or legal guardians of disabled, handicapped, or dependent children will be BDT 50,000 more for each child. The rest of the slab for everyone else is the same. For non-residents, the tax rate is 30 percent.

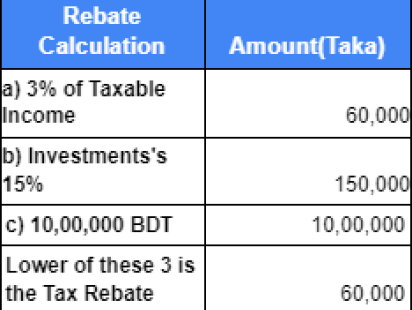

Thirdly, we must deduct any rebates from gross tax liability to get net tax liability. Rebate is only eligible for resident and non-resident Bangladeshis. The rebate can only be the lower value of 3 percent of taxable income, 15 percent of investments, and simply BDT 10,00,000. For example, if your taxable income for the current income year is BDT 20,00,000 and your investment is BDT10,00,000, 3 percent of BDT 20,00,000 is BDT 60,000. 15 percent of BDT 10,00,000 is BDT 150,000. Of the three, 3 percent of taxable income is the lowest, so that will be the rebate.

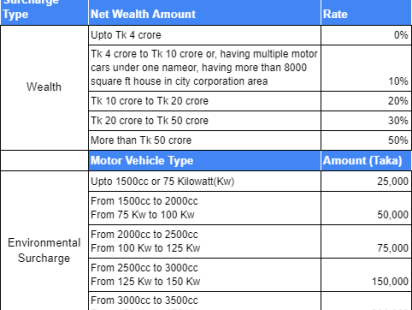

Fourthly, the surcharge has to be calculated and added to net tax liability. Surcharge are of three types. Surcharge for net wealth above BDT 4 Crore. 2.5 percent surcharge for any income from the tobacco manufacturing business. Environmental protection surcharge for owning more than one motor vehicle. Between two or more cars environmental surcharge is imposed on the car with a higher cc or kilowatt. The rate and amounts used are according to the chart.

Lastly, in computing income tax, we deduct advance tax, tax deducted at source (TDS), or withholding tax and tax refund claim.

The general deadline to submit tax returns is 30th November unless the government extends the deadline. The last date to pay tax liability is June 30th after submitting the tax return.

The writer is a student at the Department of Accounting and Information Systems, Bangladesh University of Professionals.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments