Bad loans getting out of hand

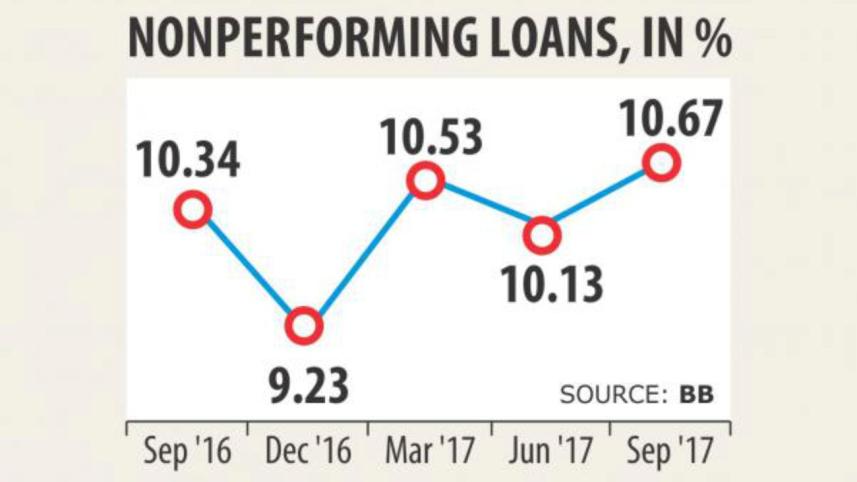

The banking sector's non-performing loan (NPL) ratio was 9.23 percent at the end of last year. This ratio currently stands at 10.67 percent as of September 2017. What is fast emerging as a pattern amongst loan defaulters is the use of courts to file writ petitions against banks as a ploy to not pay back loans taken by them. Banks on the other hand have been found to be sorely lacking in taking tough administrative and legal steps against the big loan defaulters. Volumes have been written on the issue of giving out loans to companies of dubious reputation and yet, year after year, scam after scam, banks have given out thousands of crores of taka with little hope of recovery.

We have in fact, wittingly or unwittingly encouraged the culture of defaulting on bank loans. And in the midst of all this, why is the government bailing out certain banks—that have continued to lose money year after year—without taking any constructive steps to rein in on their cumulative NPLs? Such banks have shown utter disregard in following established banking norms and display no intention to change their management practices.

The banking sector is in a state of disarray. With default loans climbing three times over a nine-year period, precisely what can we expect from Bangladesh Bank which is supposed to regulate and mitigate the anomalies in the sector? It is high time the central bank started playing the role of regulator by putting banks' boards on notice that this sort of behaviour will not be tolerated. Unless the central bank does this, there is little hope of restoring order in the financial sector and that is a very ominous sign for the economy at large.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.