BB’s policy worsening banking ecosystem

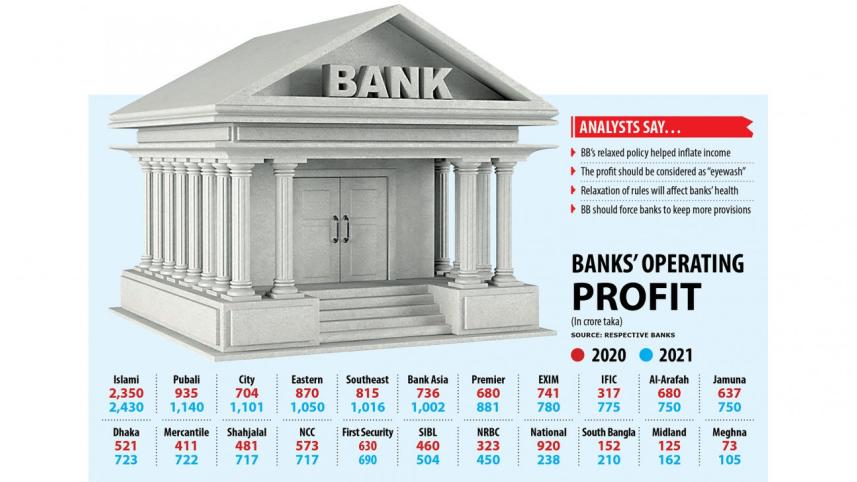

We are greatly disturbed by the Bangladesh Bank's decision to let banks count unrealised instalments of loans as income. As per the central bank's so-called "relaxed policy," banks were not allowed to treat borrowers as defaulters if they repaid only 15 percent of their total instalments payable, and were permitted to transfer the unrealised interests on the 85 percent of the loan instalments to their income—although the sums were not paid. In reality, there is no way that the entire amount of the unrealised interests will be paid to the banks. Therefore, by doing this, banks are painting an unrealistically positive picture, which is illusory.

Additionally, by showing the unrealised instalments of loans as income, banks are inflating their profits, thereby, increasing the dividends payable to its owners and shareholders. This will drain banks' assets on the one hand and could likely increase their share prices on the other—even though there are no tangible reasons for these to occur. So, the entire banking ecosystem is being spoiled as a result of the BB's decision. In the short run, this decision may seem like it is giving banks a victory, but that victory will be extremely short-lived, as banks are showing increased incomes by cooking the books—and not through any actual profit.

Last year, we saw the entire global banking sector struggle because of Covid-related shutdowns. Whereas we see central banks around the world working extra hard to increase the provisions held by banks in their countries, we are seeing the opposite happen here. Because of the Bangladesh Bank's policies, the provisions being held by banks could go down, making the sector even more vulnerable in the long run—while on paper, making it look like everything is all well and good.

When it is the job of the regulators to ensure that the banking sector is following strict accounting methods to give borrowers, depositors, investors and shareholders an accurate picture of how the sector is doing, we fail to understand why the Bangladesh Bank is doing the exact opposite, what it expects to achieve through such policies in the long run, and whether this is a result of external actors once again influencing the central bank, like they have done so often in the past.

Over the years, we have seen the central bank's independence deteriorate, it break its own rules and regulations as a result of that, discipline in the sector worsen, and the sector's stability become increasingly questionable. This latest policy adopted by the Bangladesh Bank does nothing but add to such instability. We cannot help but condemn such policies by the central bank, and urge it to make an immediate course correction for the long-term future of the sector—and the economy in general.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments