Penalising bank account holders?

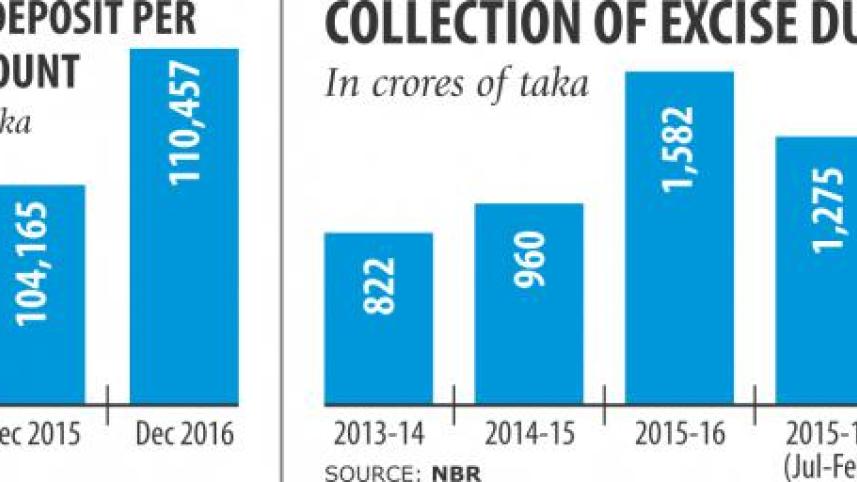

In an effort to boost revenue, the government is considering doubling excise duty on both debit and credit balances of bank account holders. Accounts having Tk 1 lakh-Tk 10 lakh will have to cough up Tk 1,000 excise tax, which is double the amount charged currently. Apparently, the move is being considered given record number of accounts going up as financial inclusion has led to more and more people coming under the banking network, a rise of some 7 percent since 2016 to 8.14 crore. According to the national board of revenue, banks constitute the highest portion of excise duty collected, and hence the reasoning may be to extract even more from this sector.

We however fail to agree with this plan because depositors keep money in banks as a form of savings and investment. This is a highly irrational move although it may help earn the government some extra revenue at the depositors' expense, because the imposition of such 100 percent increase in excise duty will merely squeeze them even more. Instead of looking at better financial management where the government dishes out thousands of crores of Taka each fiscal to prop up loss-making state-owned banks and enterprises, we are now faced with this spectacle whereby the national exchequer is poised to further burden bank depositors. Why? Depositors who are registered taxpayers (having TIN) pay 10 percent advance income tax and those without TIN must pay 15 percent. Despite slashing of interest rates on fixed deposits, depositors still keep their savings in banks because there are no alternative avenues where money can be invested safely. We urge the government to rethink this policy which will prove disastrous for millions of fixed income group earners.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.