Restore discipline in the banking sector

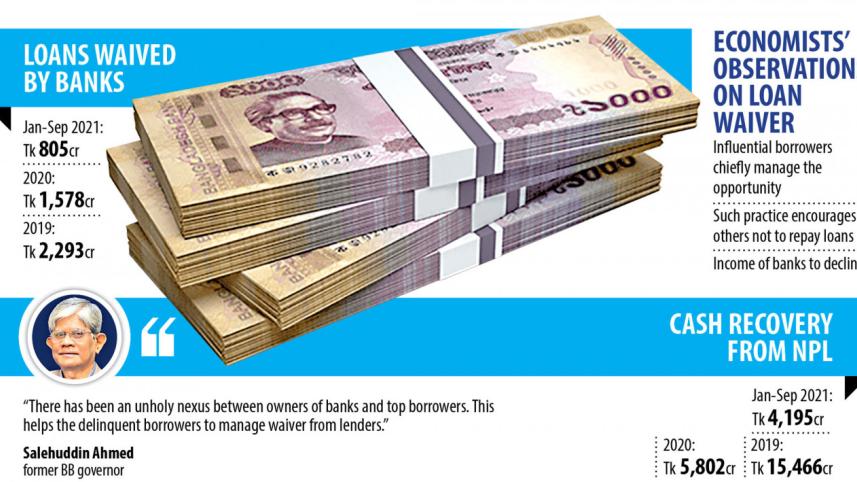

Throughout the pandemic, banks have been generously waiving loans despite their poor record of recouping funds from defaulters. Between January 2020 and September 2021, they waived a total of Tk 2,383 crore. And this seems to have become a ritual—according to Bangladesh Bank data, banks waived loans amounting to Tk 2,293 crore in 2019 and Tk 1,194 crore in 2018.

As the media has been reporting for years now, it is mainly influential and delinquent borrowers who manage such facilities, creating a moral hazard for good borrowers. Recently, this daily has reported how more and more borrowers are now refusing to pay back their loans, despite recording profits and, thereby, having the means to repay their borrowings. What this has done is lower the amount banks have been recouping year-on-year—banks recouped Tk 5,802 crore from their combined non-performing loans (NPLs) in 2020, in contrast to Tk 15,466 crore the year before—while delinquent loans have continued rising at the same old rate. This has been affecting their cash flow and income, pushing the sector deeper into trouble.

The banking sector has been a major concern for years now. Experts have continually warned that the sector is in danger of facing a massive crisis. And by the looks of it, things have only been getting worse, which is extremely disconcerting. One of the major problems that we have seen in the sector is a nexus between the owners of banks and delinquent borrowers—and also among the owners themselves. This has led to the concerned banks approving one questionable loan after another. And this, quite frankly, has been permitted by the inaction of the regulators, who have ignored their own rules and let these banks violate banking regulations time after time.

As the concerned actors dig a deeper and deeper hole for the banking sector, what we cannot help but wonder is: how long before it all blows up? And will the authorities and other concerned stakeholders realise the folly of not turning back, before we hit that point?

The only way the banking sector will be saved from a major calamity is if the regulators get their act together and actually start doing their job. A part of that is to ensure that banks do not lend to habitual defaulters, nor continue to reschedule their debts ad infinitum. Moreover, the regulators, along with the banks, must pursue all legal channels to recoup the remaining debt, which is massive at this point. The nexus behind the ill-discipline in the sector should also be identified, and punished according to law.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments