Bangladesh Bank (BB)

Rules relaxed for hiring ex-bankers as directors

Bangladesh Bank (BB) yesterday relaxed rules for banks regarding appointment of former bankers as directors of the lenders, according to a circular.

3 September 2023, 18:00 PM

Don’t fall for quick fixes in bank sector

Relaxing loan repayment is unlikely to work if habitual defaulters continue to be tolerated

21 June 2023, 12:10 PM

Bangladesh’s Monetary Policies: A poor dose of the right medicine

Bangladesh Bank has missed the train by caving in to the pressure of the finance ministry, which dictates policymaking at the central bank being driven by short-term political interests.

17 January 2023, 16:00 PM

Feeble monetary policy against challenges

Bangladesh Bank yesterday unveiled a wishy-washy monetary policy for the next six months that will prove to be ineffective in tackling the headwinds passing through the economy.

16 January 2023, 01:00 AM

Lanka gets 6 more months to repay BB’s $200m

Bangladesh Bank yesterday granted Sri Lanka’s request to be given six more months to repay a $200 million loan due to the prolonging of its economic crisis.

13 January 2023, 03:00 AM

Islami Bank takes emergency Tk 8,000cr from BB

Islami Bank has started to avail a central bank facility that is only summoned during extraordinary circumstances, as the Shariah-based lender looked to dress up its balance sheet ahead of the year’s end.

2 January 2023, 01:30 AM

The never-ending crisis in our banking sector

Bangladesh Bank, which is supposed to oversee the governance of the country’s financial institutions, has rather supported these irregular activities through its policies and actions.

12 December 2022, 15:00 PM

Hold the elite to account

Investigation into financial irregularities the first step forward

6 December 2022, 17:05 PM

Big budget, bigger corruption

Lack of accountability and the culture of impunity destroyed governance from within.

1 December 2022, 17:00 PM

Will the government touch the ‘untouchables’?

The default-loan narrative has smeared our otherwise powerful story of graduation from the Least Developed Country (LDC) status.

17 November 2022, 17:36 PM

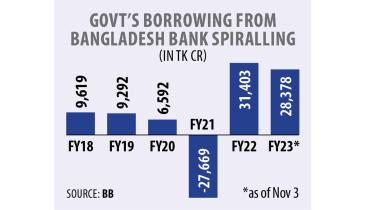

Govt borrowing from Bangladesh Bank stokes inflation fears

In a time of elevated inflation, the government has started to borrow heavily from the Bangladesh Bank to meet the budget deficit, in a move that is set to push up the consumer price level further.

11 November 2022, 02:00 AM

Study in China: BB allows paying tuition fees

The Bangladesh Bank has allowed banks to help students who are studying in China pay their tuition fees.

9 November 2022, 07:08 AM

Rules relaxed for financing coal-based power plants

Bangladesh Bank (BB) today relaxed its rule to facilitate lending for establishment of coal-based power plants and buy the dirty fuel to generate electricity.

8 November 2022, 13:09 PM

We must prioritise food security

PM’s call in this regard is a welcome one

7 November 2022, 21:05 PM

PM steps in to ensure smooth food supply

Prime Minister Sheikh Hasina yesterday instructed Bangladesh Bank to intervene if any bank faced a dollar shortage while opening letters of credit for importing food, fertiliser and other agricultural inputs to ensure uninterrupted food supply.

7 November 2022, 02:00 AM

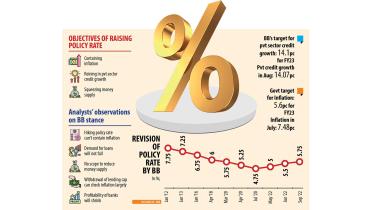

BB hikes key interest rate by 25 basis points

The Bangladesh Bank yesterday raised its benchmark interest rate by 25 basis points to 5.75 per cent as it stepped up its fight against inflation, which is running at a multi-year high.

30 September 2022, 02:10 AM

Economic growth momentum at risk for global volatility: BB

The economy faces multidimensional challenges as the volatile global scenario threatens to create an adverse situation for the growth momentum of Bangladesh, the central bank warned yesterday.

29 September 2022, 02:10 AM

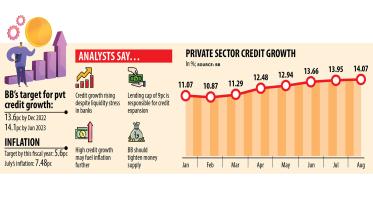

Private credit growth surges, nears Bangladesh Bank target

Bangladesh’s private sector credit growth surged to 14.07 per cent in August, almost touching the central bank’s target for the entire fiscal year, an ominous sign for the economy since it may stoke inflationary pressures.

28 September 2022, 02:10 AM

Bangladesh’s currency conundrum: What role can interest rates play?

Bangladesh Bank can better fix the currency turmoil by freeing both interest rate and exchange rate to adjust over time.

24 September 2022, 14:00 PM

Bangladesh Bank platform eases local trade in foreign currency

A new digital platform rolled out by the Bangladesh Bank has opened a new horizon for local businesses to do trade with foreign currencies on a real-time basis.

23 September 2022, 02:20 AM