Default loan in Bangladesh

Defaulted loans may double next year

The defaulted loan figure is set to double as the Bangladesh Bank is set to tighten the classification rules for all types of loans by March next year to meet the International Monetary Fund’s loan conditions.

19 November 2024, 18:00 PM

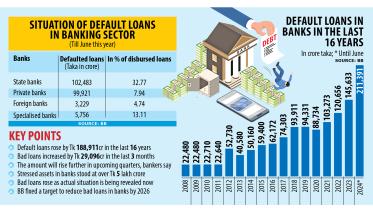

Bad loans hit alarming record

Awami League-affiliated businesses had already put the country’s banking sector in trouble with huge bad debts, but the loans disbursed through irregularities to these companies turned sour even at a more alarming pace after the party’s ouster.

17 November 2024, 18:40 PM

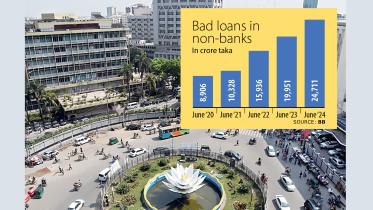

Non-banks’ default loans hit record high

Non-bank financial institutions (NBFIs) in the past fiscal year saw their defaulted loans reach a record 33.15 percent of all disbursed loans, according to the central bank, indicating a fragile situation in the sector thanks to widespread loan irregularities and scams.

6 October 2024, 18:00 PM

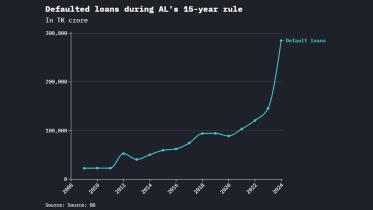

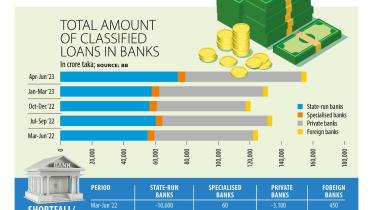

Default loans surpass Tk 200,000cr for first time

Default loans in the banking system surpassed Tk 200,000 crore for the first time, underlining the fragile condition of the sector that fell prey to rampant scams and irregularities under the tenure of the Awami League government over the past 16 years.

3 September 2024, 18:00 PM

Public institutions must perform better

Govt should overhaul ailing sectors, ensure accountability

16 August 2024, 04:00 AM

Urgent bank reforms are crucial

Recover bad loans, punish those who exploited the sector

12 August 2024, 09:30 AM

Time to bring back smuggled money

Those who were involved in stealing funds from the country must be held accountable.

8 August 2024, 05:00 AM

Bad loans hit historic high

Default loans in the banking sector of Bangladesh hit an all-time high of Tk 182,295 crore, but no reform programme to reduce it has been announced in the budget for the upcoming fiscal year.

6 June 2024, 18:00 PM

Default loans hit historic high of Tk 1,82,295 crore

Bad loans rose by Tk 36,367 crore in just three months

6 June 2024, 10:51 AM

Unearth real data of bad loans

At the end of December 2023, Bangladesh's banking sector had NPLs worth Tk 145,600 crore, around 9 percent of total outstanding loans, central bank data showed.

22 April 2024, 00:47 AM

State banks' default loan surges

Default loans in the banking sector shot to a historic high at the end of June this year owing to rising non-performing loans (NPLs) at state-owned commercial banks, said Bangladesh Bank (BB) yesterday. The amount of NPLs at the state banks stood at Tk 74,450 crore, up 28.45 percent from

4 October 2023, 18:15 PM

What makes Bangladesh the 'champion' of default loans?

The news of Bangladesh occupying the second-highest position in South Asia in terms of a bad loan ratio is no surprise.

20 May 2023, 18:00 PM

Why delay probing money launderers?

Investigators sitting on information about Dubai real estate purchase despite HC order

18 March 2023, 11:50 AM

Is dual citizenship to blame for money laundering?

“Is Bangladesh a place of looters?” – this question was raised by the High Court last month.

8 March 2023, 17:00 PM

Default loans rises nearly 17%

Habitual defaulters' reluctance to repay the funds fuelled the amount to reach Tk 120,656 crore

19 February 2023, 11:29 AM

Weak banking sector, Achilles’ heel of economy

The International Monetary Fund has identified the problems in the banking system, including the high volume of defaulted loans, as one of the three domestic risks that derail the economy in the short- to medium-term.

5 February 2023, 01:00 AM

2023 will be the year of inflation and financial turpitude

While the government is distracted by elections, the financial economy will suffer

1 January 2023, 02:00 AM

The rise and fall of Islami Bank

There are rumours in the market that a highly politically powerful business group is going to take over the ownership of the bank from S Alam Group.

6 December 2022, 15:00 PM

Loan defaulters are putting the banking sector at risk

Despite economic progress over time, Bangladesh’s financial sector continues to be dominated by banks that stand on shaky ground.

20 November 2022, 13:00 PM

Will the government touch the ‘untouchables’?

The default-loan narrative has smeared our otherwise powerful story of graduation from the Least Developed Country (LDC) status.

17 November 2022, 17:36 PM